The MakerDAO community voted to retain the USDC stablecoin as a reserve for DAI. USDC became depegged during the downfall of Silicon Valley Bank but has since returned back to $1, appearing to have survived the crisis.

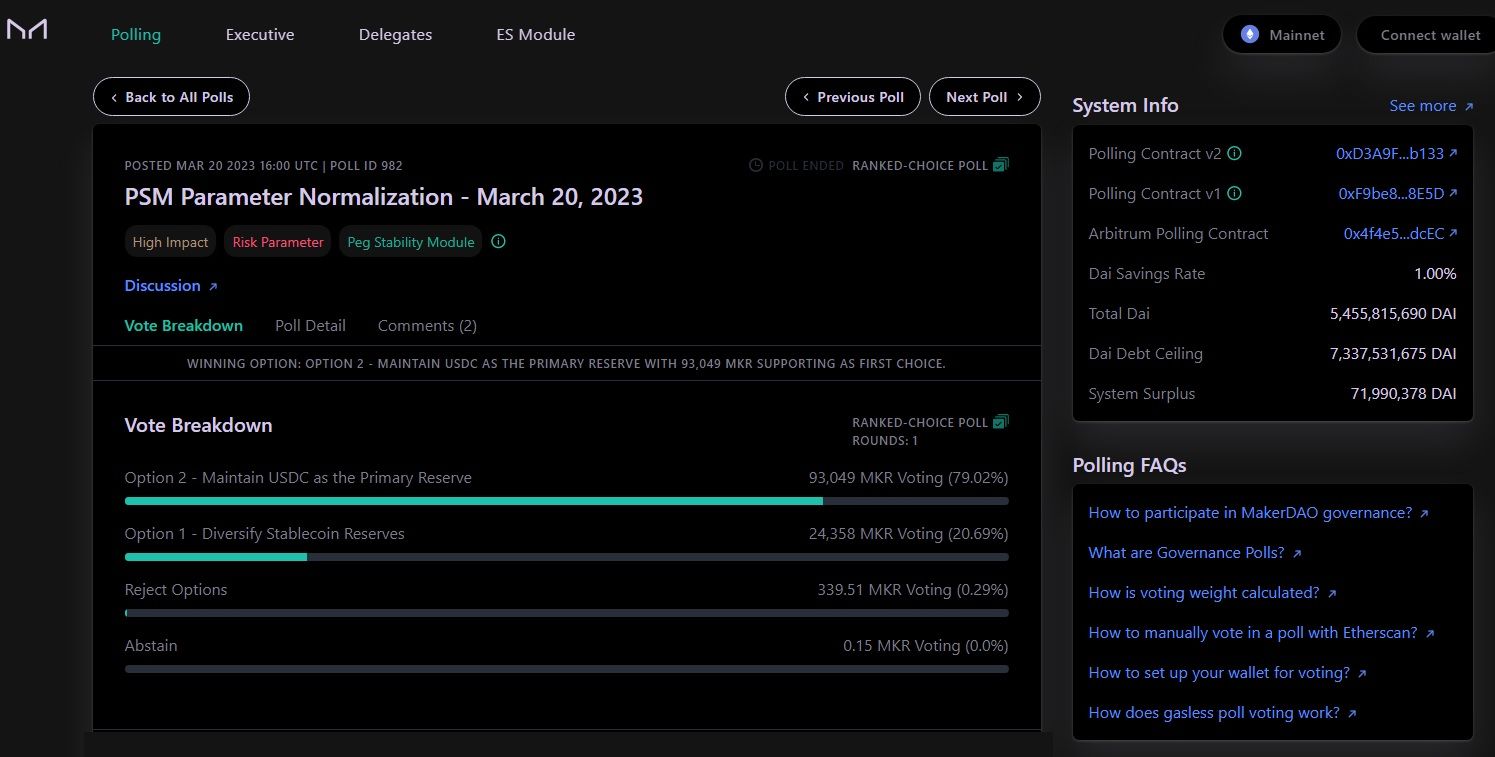

The MakerDAO community has voted in favor of retaining the USDC stablecoin as a key reserve for the DAI token. 79% of the voters supported maintaining USDC as a reserve, while 20% voted to diversify stablecoin reserves.

The poll comes amid the crisis of Silicon Valley Bank, in which USDC-issuer Circle had funds. This led to heavy speculation on what would happen in the market and concerns about USDC’s strength in the market.

In the poll discussion, the nature of the market due to bank losses is described as follows,

“…there are still some outstanding risks and possibility of further bank failures and losses to uninsured bank deposits. The government has not explicitly guaranteed they will backstop all deposits for other institutions beyond SVB and Signature. Stablecoin issuers have taken a more risk averse position since the weekend, with the bulk of bank deposits across each issuer now held at “too big to fail” institutions, which improves risk positioning.”

USDC Depegs But Regains Strength

There’s no doubt that risk aversion is a key point to keep in mind now. USDC depegged about two weeks ago, leading to much speculation about what the after-effects would be. Circle had a $3.3 billion exposure to Silicon Valley Bank, leading to the stablecoin’s market cap dropping by $6 billion once news broke out.

The token depegged to as low as $0.91 before regaining 7% to return closer to its $1 peg. One report also stated that Coinbase offered Circle $3.3 billion to restore USDC. In any case, while it is hurt, it seems that the USDC stablecoin survived the SVB bank’s collapse.

MarkerDAO Has Been Busy

Maker itself has been in the news for several reasons this year. The token has seen massive price growth since the start of the year, thanks to these developments.

Among them is the fact that it announced a competitor to Aave called Spark Protocol. This will “amplify the features of MakerDAO by enabling a liquidity market for supplying and borrowing scalable crypto assets with variable and fixed rates.” It is also working on its treasury bond investments, mulling the expansion of the figure to $1.25 billion.