Update Oct. 25, 12:30 UTC: MakerDAO Endgame, proposed by Rune, has passed the MakerDAO governance vote. 122 people voted, but only one matters, as Rune represents 63% of the turnover and 74% when accounting for his influence.

Leading DeFi lending platform MakerDAO has proposed an ‘Endgame Plan’ to make the protocol more resilient, but it could severely impact its stablecoin and liquidity pools.

In late August, MakerDAO co-founder Rune Christensen proposed what he termed an ‘Endgame Plan’ to make the network more resilient to regulatory pressure.

The move was largely in response to the U.S. Treasury Department’s move to sanction Ethereum mixing service Tornado Cash. There have emerged two primary paths for the future of crypto networks, according to Christensen: the path of compliance or the path of decentralization.

He wants to take MakerDAO down the path of resilience and decentralization, but it could have a major impact on the DAI stablecoin and DeFi protocols that are heavily reliant on it, such as Curve Finance.

Three MakerDAO Endgame strategies

The Endgame Plan proposes making DAI a free-floating asset, initially collateralized by real-world assets (RWA). There will be a three-year period when DAI remains pegged to the dollar, during which the protocol doubles down on RWA to accumulate as much ETH as possible. This increases the ratio of decentralized collateral.

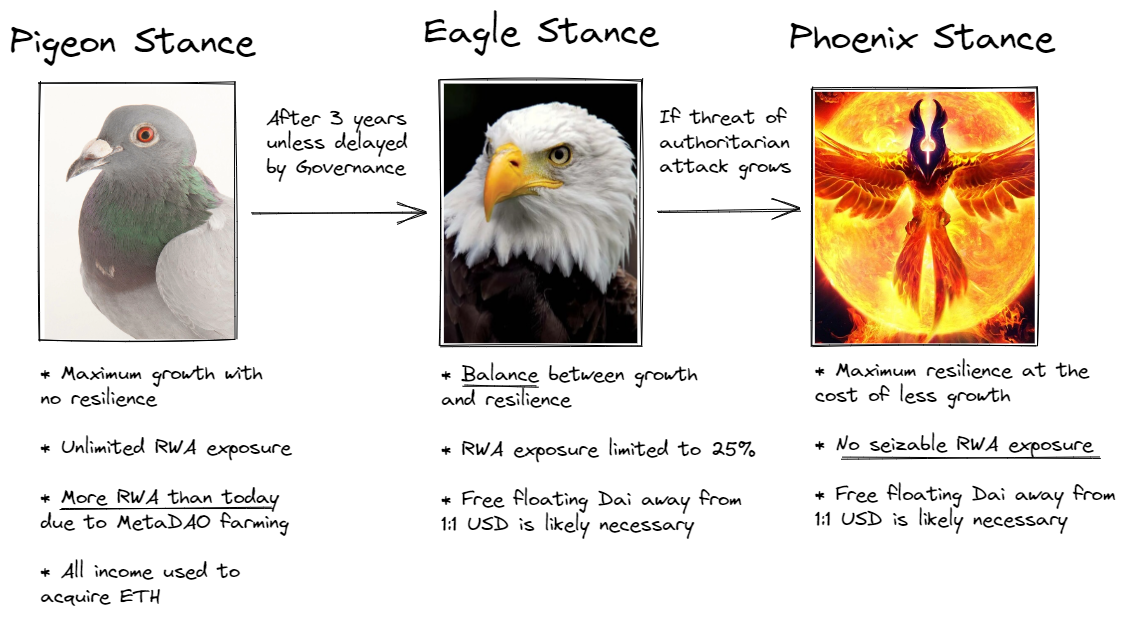

The plan proposes three different collateral strategies called Stances. These range from high exposure to RWA to zero exposure. More exposure enables faster growth but at the expense of resilience, and the Phoenix Stance, which is the endgame, has no RWA exposure, is highly resilient, and sees DAI moving away from its USD peg to become free floating.

The protocol would be put into the Pigeon Stance initially to accumulate ETH to make DAI resilient to authoritarian threats against the RWA collateral. It will then move into a transition phase called the Eagle Stance after it reaches 75% decentralized collateral from ETH accumulation. Finally is the Phoenix Stage with no seizable RWA collateral.

Essentially, Christensen wants to move the protocol away from being collateralized by centralized assets such as USDC and to a more decentralized model which is resilient to third-party threats. It is a tricky balance, and the evolution of DAI could have some other impacts elsewhere in the industry.

The Curve effect

Curve Finance uses DAI and other stablecoins to generate DeFi yield opportunities. One of its most popular farms is 3pool which is a high liquidity pool for efficient stablecoin trading and arbitrage. It would be heavily impacted by a free-floating DAI.

On Oct. 3, Crypto Risk Assessments reported that a drop in DAI price could result in traders using 3pool to exit DAI positions resulting in a buildup of the asset in the pool. Arbitrage bots could also take advantage of the situation between the three stablecoins in the pool (USDT, USDC, and DAI), draining the former two so the third accumulates.

The Curve 3pool may need to be restructured if DAI eventually becomes free-floating. There is currently $861 million in the pool split evenly between the three stablecoins. It has just over $40 million in daily volume.