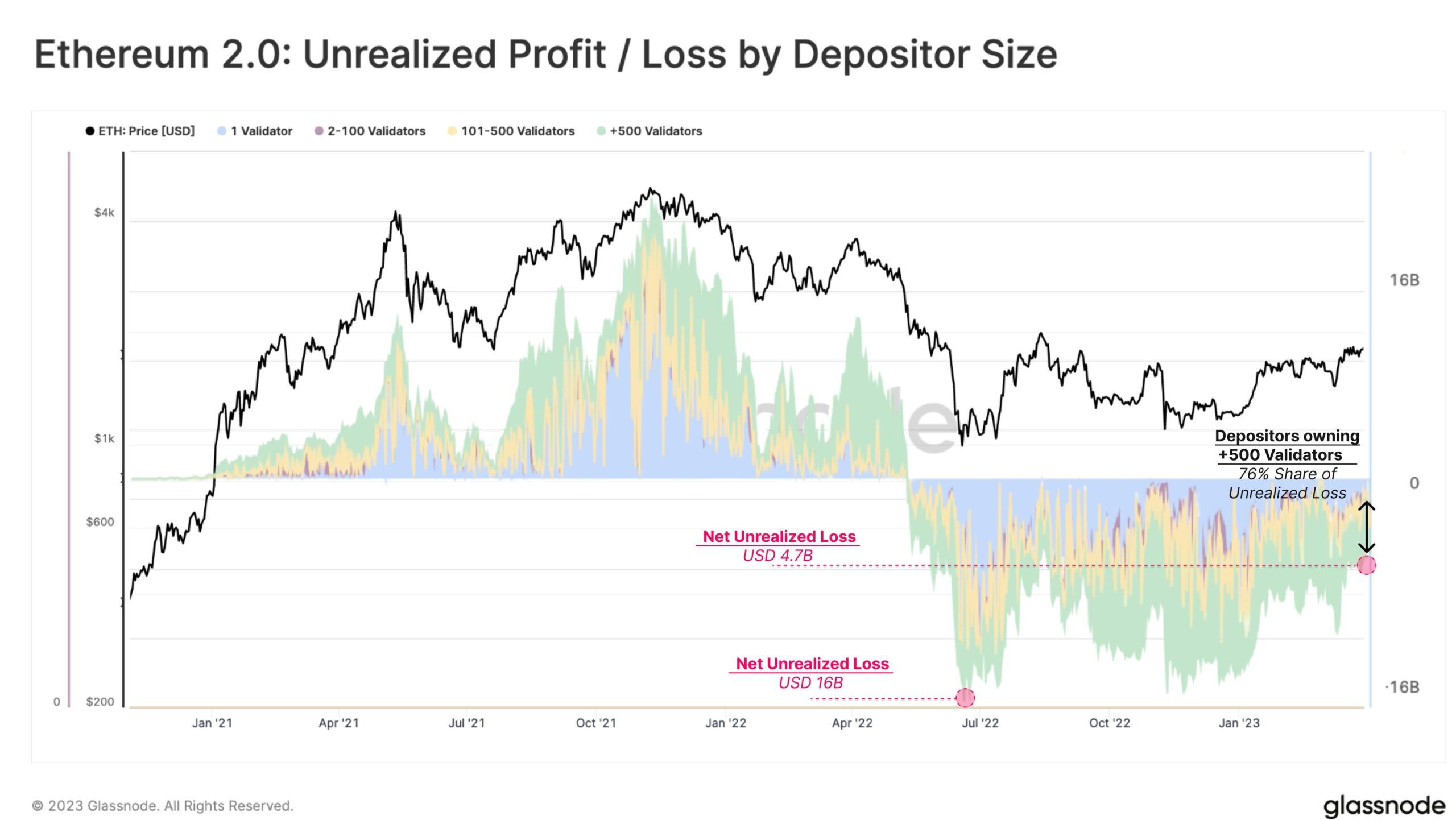

The value of staked Ethereum with unrealized losses has fallen. However, those with the greatest losses are some of the biggest stakers.

On April 11, on-chain analytics provider Glassnode reported on the current state of profit and losses for staked Ethereum.

It noted that the net unrealized loss on the Ethereum Beacon Chain amounts to $4.7 billion. However, this has fallen by 70% from the peak of $16 billion following the Terra Luna collapse.

This was when Ethereum prices tanked to $1,000 in July 2022. They have almost doubled since then as the asset knocks on the door of $2,000.

Glassnode also reported that the “largest of depositors are experiencing the highest degree of financial pain, holding 70% of the unrealized losses.”

Ethereum Staking Dynamics

Nevertheless, long-term investors will not be perturbed by things such as “unrealized losses.” Buying ETH at any price and staking it for more ETH is a good strategy for many if they have no intention of selling or playing the markets.

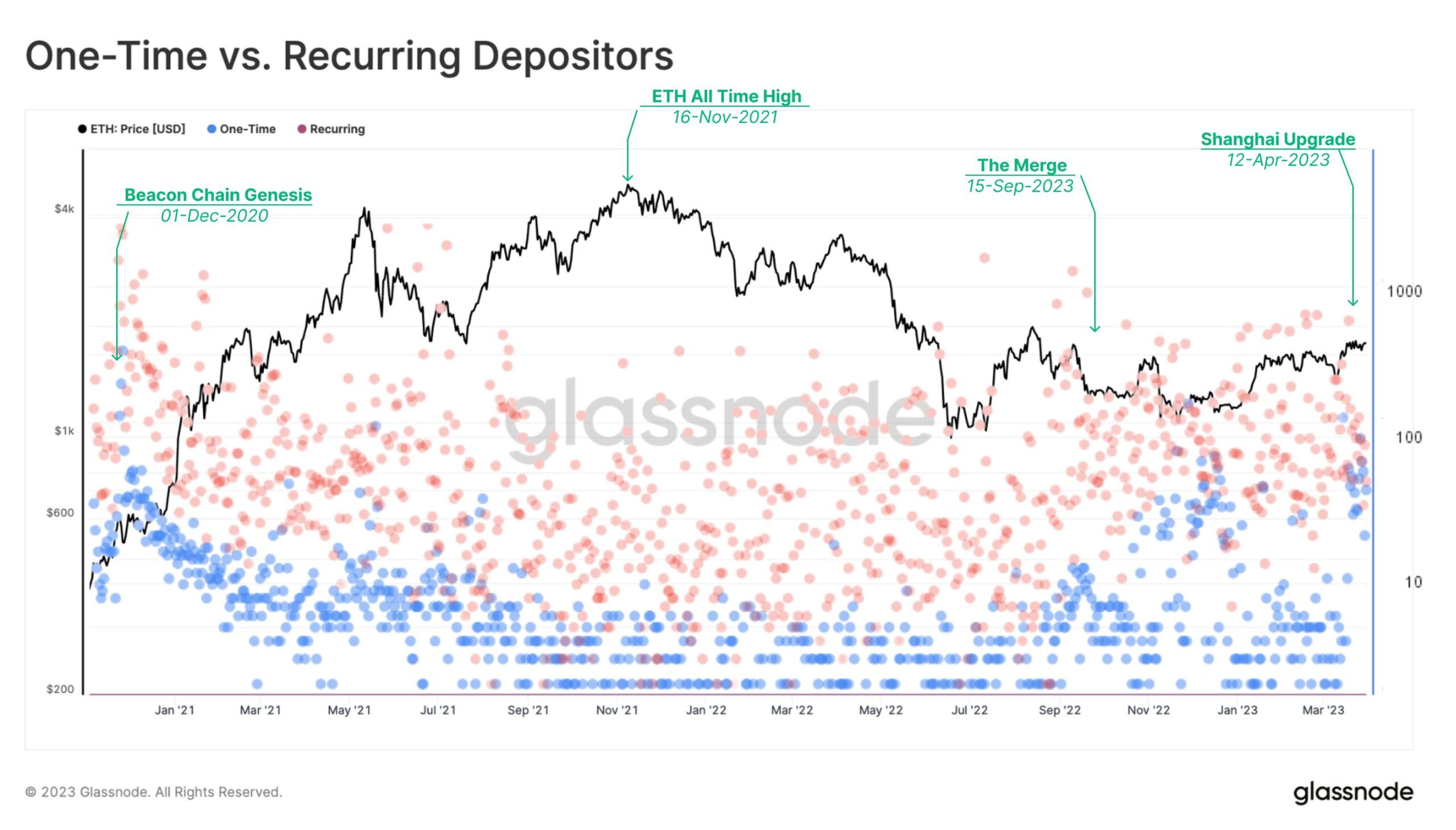

Glassnode also observed the nature of the Ethereum staking pool. It noted that they are “mainly composed of recurring depositors owning multiple validators.” These have been making up to a thousand deposits per day, it added.

“However, major events such as the Beacon Chain genesis, the Merge, and the upcoming Shanghai upgrade have seen a surge in one-time depositors.”

Furthermore, it noted that staking deposit activities are currently low “due to regulatory pressure and the Shanghai upgrade.”

America’s war on crypto has included a crackdown on staking services. SEC chair Gary Gensler has also repeatedly claimed that ETH is a security. In reality, it has yet to be officially classified as such by U.S. Congress.

However, the big question among Ethereum traders is: will there be a big selloff after the Shapella upgrade this week?

Shapella Selloff?

April 12 marks the day that the network undergoes its long-awaited Shapella (Shanghai) hard fork.

As a result, staked ETH will be available for withdrawals, but it is not as simple as that. The 18 million ETH staked will not all be released at once to preserve network security and stability.

Validators and stakers will need to go through a queue and withdrawal period, which could take months. Therefore, it is highly unlikely that a massive chunk of ETH will be sold to markets this week.

ETH prices are currently trading at an eight-month high of $1,923 following a 3.3 % gain on the day.