August has begun on a tricky footing for the crypto market, especially for ‘made in USA’ coins. Trading activity has fallen as investors rush to lock in profits from July’s strong rally. Over the past week, the global crypto market capitalization has slipped by 5%, signaling a drop in demand and a broader market cooldown.

Yet amid this lull, a few ‘Made in USA’ tokens are drawing attention for their potential to buck the trend. Here are three altcoins investors should keep on their radar this month.

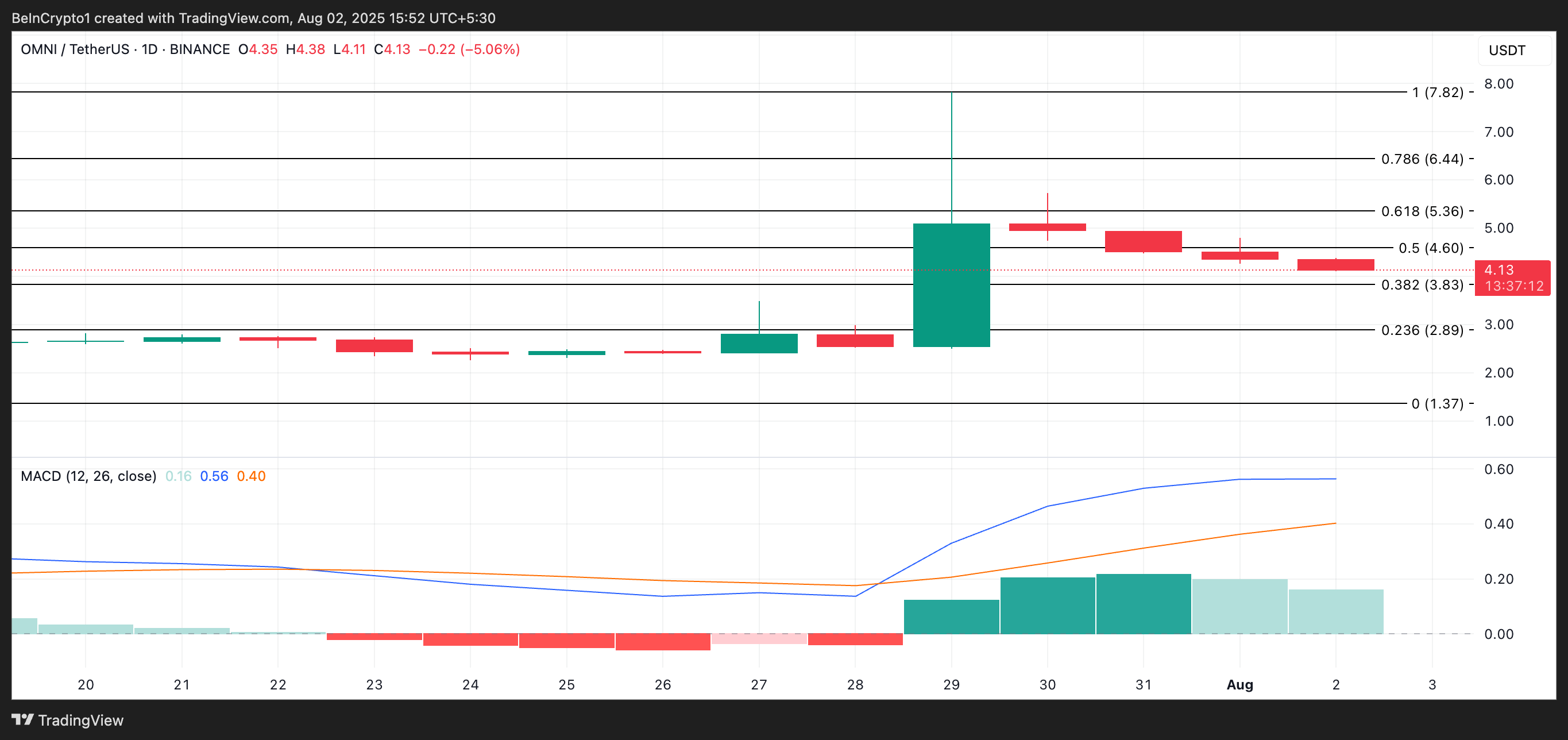

Omni Network (OMNI)

OMNI is up 72% over the past week. It has bucked the broader market decline recorded in the past seven days to record gains. This makes it one of the made-in-USA coins to watch as the first trading week of August runs its course.

The setup of the token’s Moving Average Convergence Divergence (MACD) indicator on the daily chart confirms the bullish bias toward the altcoin. At press time, OMNI’s MACD line (blue) rests above the signal line (orange).

The MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As with OMNI, when the MACD line rests atop the signal line, it indicates bullish momentum. Traders see this setup as a buy signal.

If accumulation persists, the token could break above $4.60.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the other hand, if demand falls, the token’s price could drop to $3.83.

Story (IP)

Currently priced at $5.71, IP has climbed 24% over the past three weeks — positioning it as another made-in-USA coin to watch in early August.

Readings from the IP/USD one-day chart reveal that the altcoin has been trading within an ascending parallel channel since July 11. This chart pattern, formed by drawing two upward-sloping trendlines connecting the asset’s higher highs and higher lows, indicates a sustained bullish trend.

At press time, IP hovers near the lower line of the ascending channel. If this support level holds and accumulation increases, the altcoin could rally, potentially reaching $6.46 in the short term.

IP Price Analysis. Source: TradingView

However, a decisive break below the channel’s support line may invalidate the bullish setup. This could trigger a steeper decline toward the $4.92 zone.

Zebec Network (ZBCN)

ZBCN is up nearly 30% in the past seven days, making it one of the altcoins to watch in the first week of August.

On the daily chart, the token’s Smart Money Index has seen a steady uptick, highlighting the sustained backing of key token holders. At the time of writing, it is at 1.

An asset’s SMI tracks the activity of experienced or institutional investors by analyzing market behavior during the first and last hours of trading. When it drops, it suggests selling activity from these holders, pointing to expectations of price declines.

Conversely, as with ZBCN, when the indicator rises, it indicates increased buying activity. If demand continues to increase, the token’s price could break above $0.0053.

On the other hand, if buying pressure flattens, the token’s price could drop toward $0.0047.