Litecoin (LTC) has seen its market capitalization grow by 15% in the past week, adding $1 billion as its price reached a two-year high of $119.64.

This surge has led long-term holders (LTH) to sell their coins to secure profits. However, the LTC price rally shows signs of continuing momentum.

Litecoin Long-Term Holders Book Gains

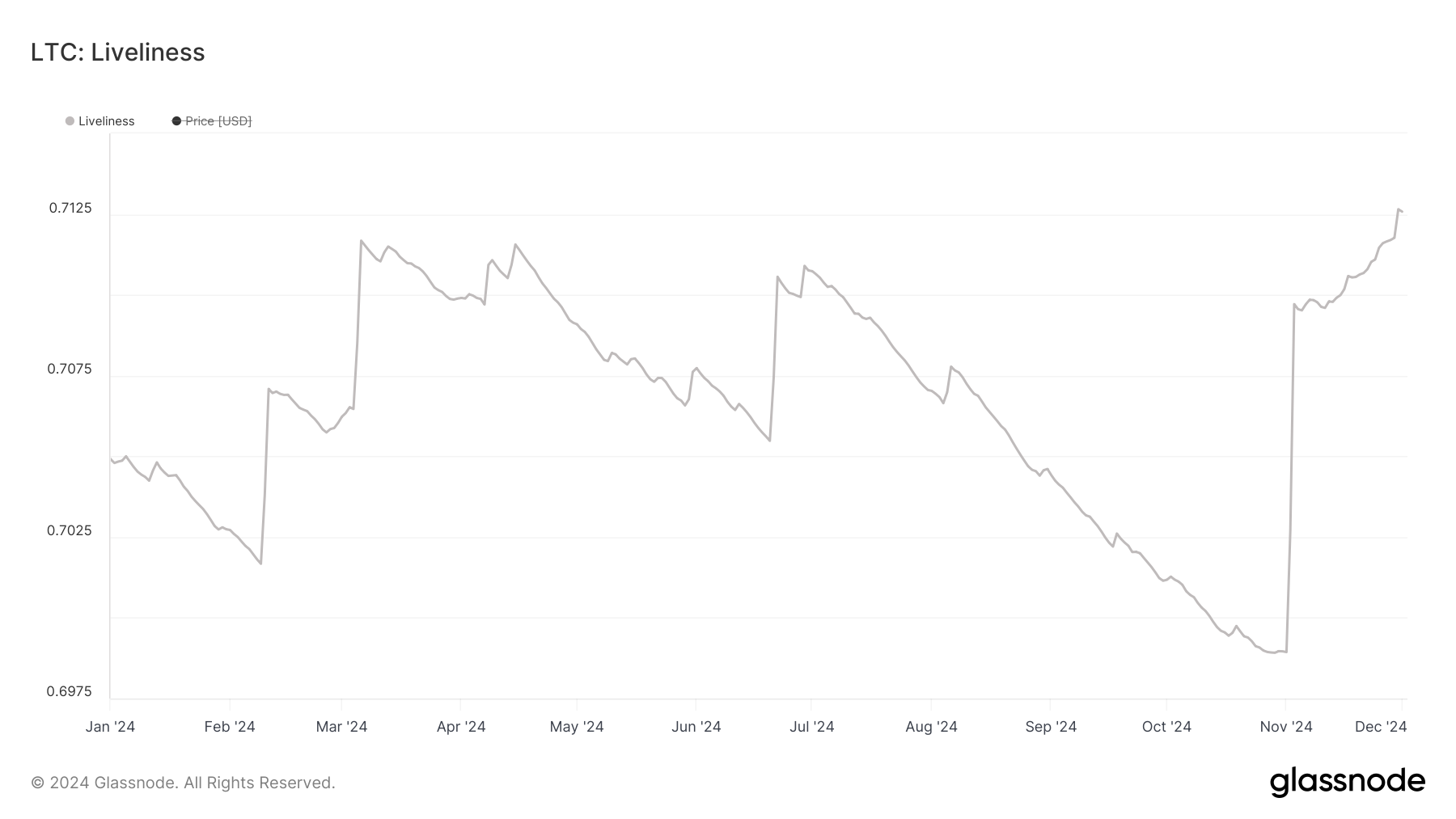

BeInCrypto’s on-chain assessment of LTC’s Liveliness metric has revealed a surge in the number of recently moved or spent coins. Per Glassnode, this currently sits at a year-to-date high of 0.71. For context, as of November 1, LTC’s Liveliness had plummeted to a year-to-date low of 0.69.

An asset’s Liveliness provides insights into the spending behavior of its LTHs. It measures the proportion of coins that have been recently moved or spent. When it spikes, it indicates that many long-term holders are liquidating their positions.

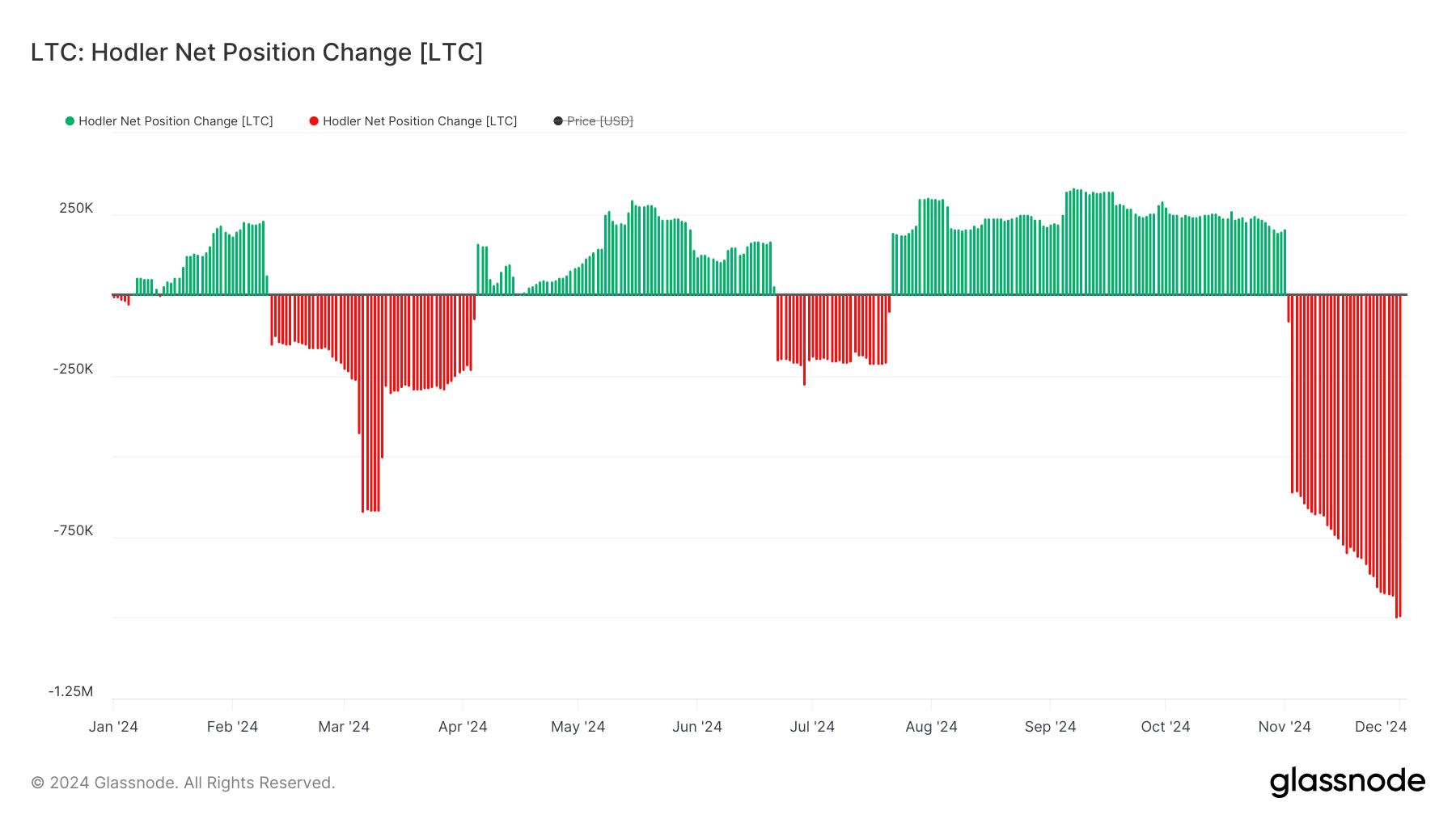

Notably, the negative readings from LTC’s Hodler Net Position Change confirm this distribution trend among its LTHs. This metric, which also tracks the behavior of LTHs, has returned only negative values since November 2. In fact, on December 1, it closed at a year-to-date low of -993,199.

When the Hodler Net Position Change is negative, long-term holders (HODLers) are selling more of their holdings than they are accumulating, indicating profit-taking.

LTC Price Prediction: The Bulls Remain in Control

Despite the selling activity by the coin’s LTHs, the bullish bias toward the LTC remains significant. At press time, LTC trades above its Ichimoku Cloud, confirming the positive momentum in the market.

This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset’s price rests above the Ichimoku Cloud, it indicates a bullish trend, indicating that the asset is in an upward momentum with the potential for further gains.

If this holds true, the LTC price rally may continue toward $143.41, a level it last traded at in January 2022. Conversely, LTC’s price may drop to $107.58 if this bullish momentum wanes.