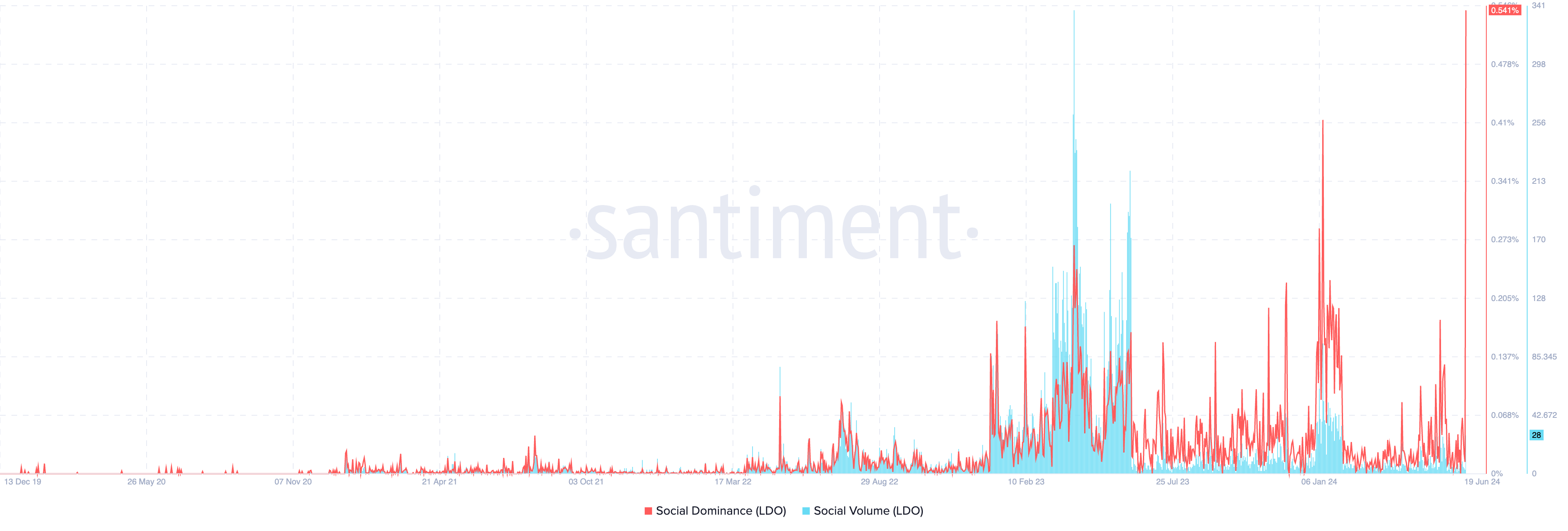

The social dominance of LDO, the token that powers Ethereum’s (ETH) largest liquid staking protocol, Lido Finance, has spiked to an all-time high.

As of this writing, the metric’s value is 0.54%, having risen by over 5,000% in the past 24 hours.

Lido Enjoys High Discussion Rate on Social Media

An asset’s social dominance measures its share of online discussions that specifically mention it compared to the total discussions around the top 100 cryptocurrencies by market capitalization.

When it surges like this, it means that discussions about the asset in question are suddenly a much more significant part of the overall conversations happening in the crypto market compared to before.

In LDO’s case, the uptick in its social activity is due to the announcement that the U.S. Securities and Exchange Commission (SEC) has closed its inquiry into Ethereum’s classification as a security.

This is good news for Lido because it removes the confusion that trailed Ether staking when the SEC began its inquiries.

As a result of the uptick in its social activity, LDO’s value has risen by double digits in the past 24 hours. At press time, the altcoin trades at $2.35, logging a 16% price growth during that period.

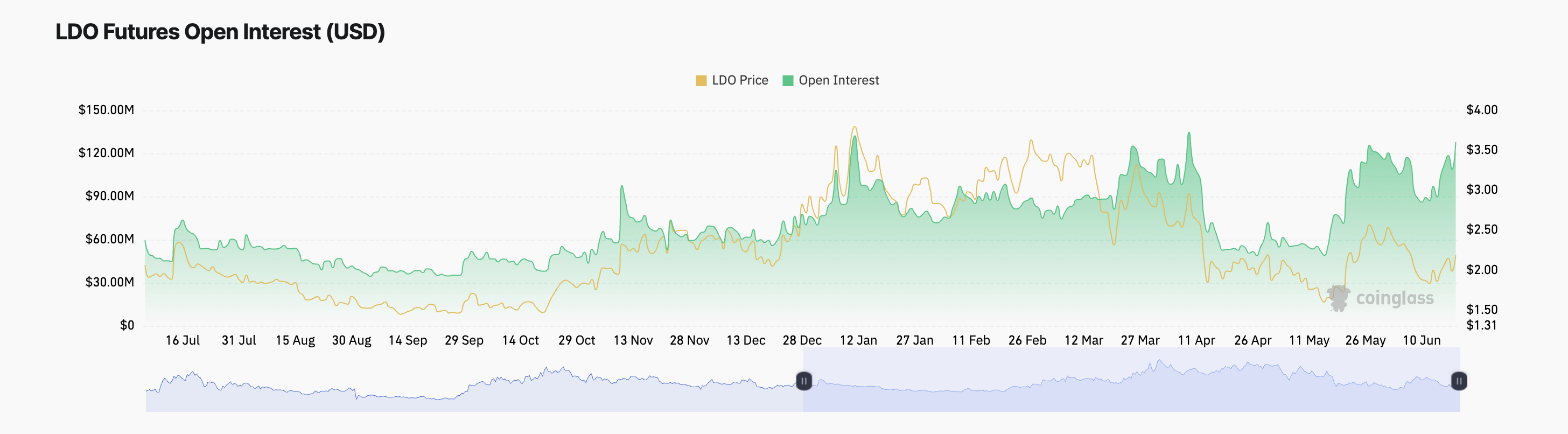

Trading activity has also increased in its derivatives market. In the past 23 hours, trading volume has climbed by 37%, and open interest has also increased by 35%.

Read more: 11 Best DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

The growth in LDO’s open interest signals a rally in the number of new participants who have entered the market to open new positions in the past 24 hours.

LDO Price Prediction: The Bulls Can Send Price Higher

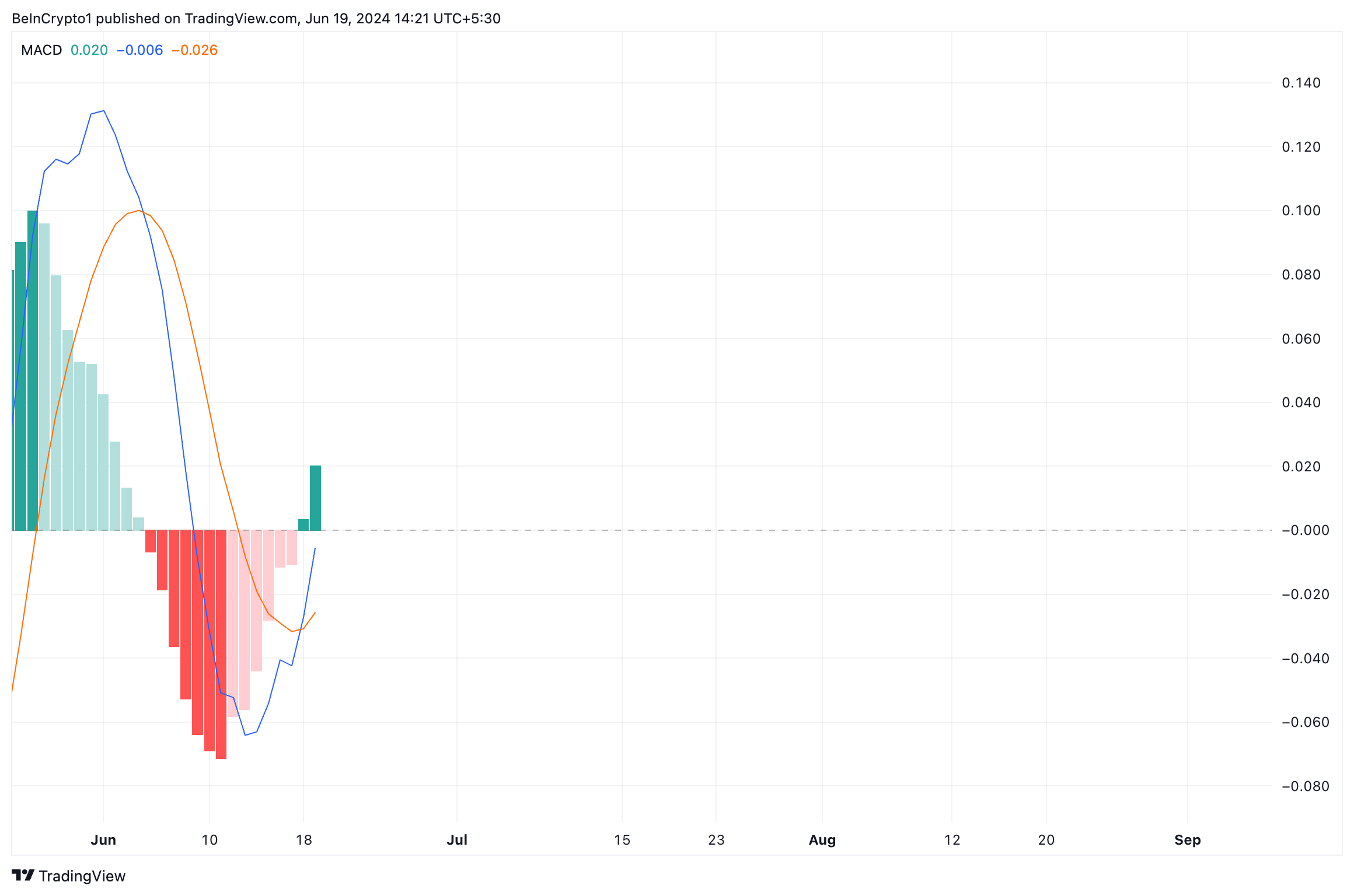

Readings from LDO’s movements on a daily chart confirmed the uptick in the coin’s demand in the past 24 hours. For example, the altcoin’s Moving average convergence/divergence (MACD) showed its MACD line (orange) poised to cross above the zero line.

It only intersected the signal line (blue) two days ago, signaling the re-emergence of LDO bulls. When an asset’s MACD line crosses below its signal and zero lines, it suggests that the trend is bullish and that buyers are gaining control over the market sentiment.

Traders often interpret this as a signal to enter or hold a long position in the asset.

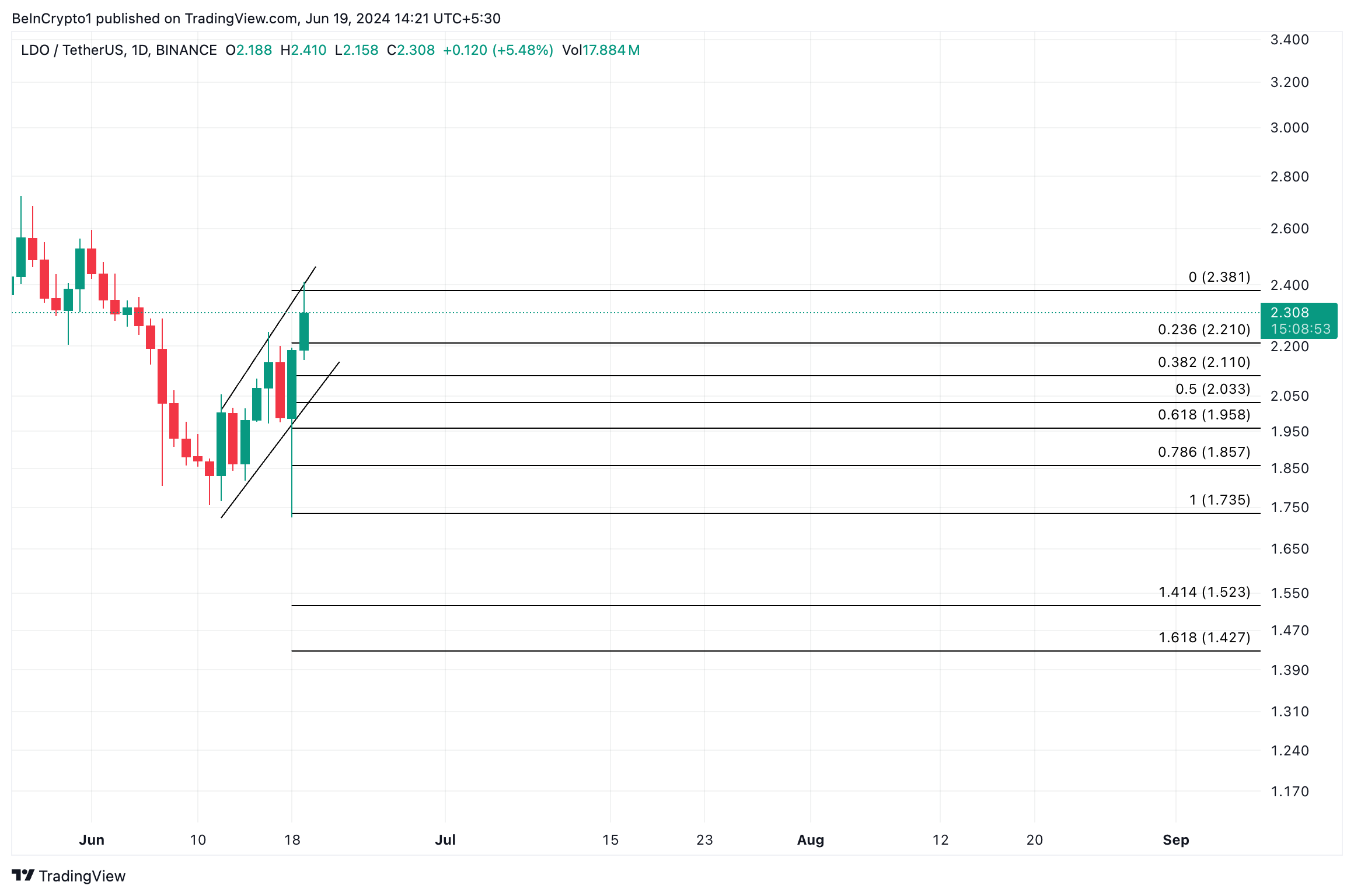

If this trend continues and LDO enjoys a significant bullish bias, its price may rally toward $2.38.

Read more: The Ultimate Guide to Lido Staked ETH (stETH)

However, if profit-taking commences, putting pressure on its price, LDO’s value may drop to $2.21.