Selling Bitcoin (BTC) can be straightforward once you understand the right platforms and methods to use. Whether you are looking to cash out your investment or exchange BTC for another cryptocurrency, understanding the process can help you make better financial decisions. This guide will walk you through how to sell Bitcoin, outline different selling methods, and answer common questions to ensure a smooth experience.

KEY TAKEAWAYS

➤ You can use a cryptocurrency exchange or P2P platform to sell Bitcoin securely for cash or other assets.

➤ You can cash out by withdrawing funds to a linked bank account or trade BTC for other cryptocurrencies.

➤ Buying and selling of BTC is legal through licensed platforms. Refer to local regulations to double check.

How to sell Bitcoin in easy steps

Before we get into the details, let’s quickly walk you through a general overview of the process:

- Transfer BTC to your exchange wallet

- Select BTC as your asset

- Choose your sell order type

- Enter amount and confirm

- Withdraw cash

Now, before answering the question of how to sell Bitcoin, it’s vital to understand where you can do so. The easiest way to sell Bitcoin is via a cryptocurrency exchange. Of course, this requires you to sign up for one.

1. Sign up on a cryptocurrency exchange

Generally, you’ll want to do some research before deciding on one. Use BeInCrypto’s best exchange guide to help you out.

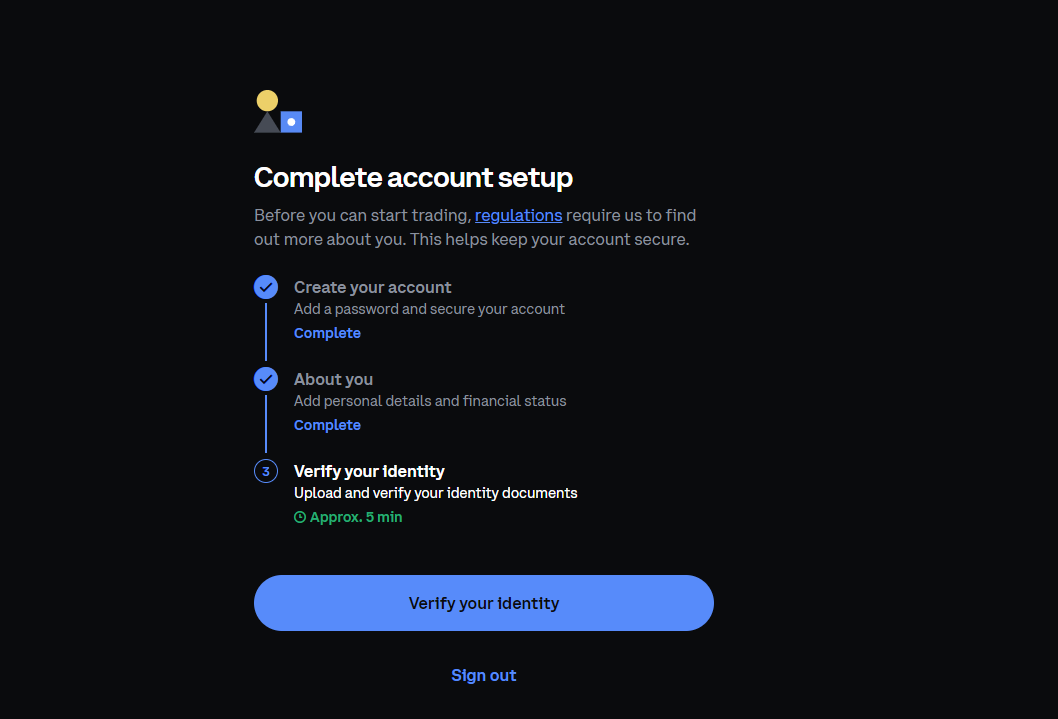

Once you’ve decided on an exchange, it’s time to sign up. Most of these platforms follow a similar signup process, which includes the following steps:

Sign up and verifying an email address

Verify identity and follow on-screen instructions. Then, input a payment method.

2. Select Bitcoin as Your Asset

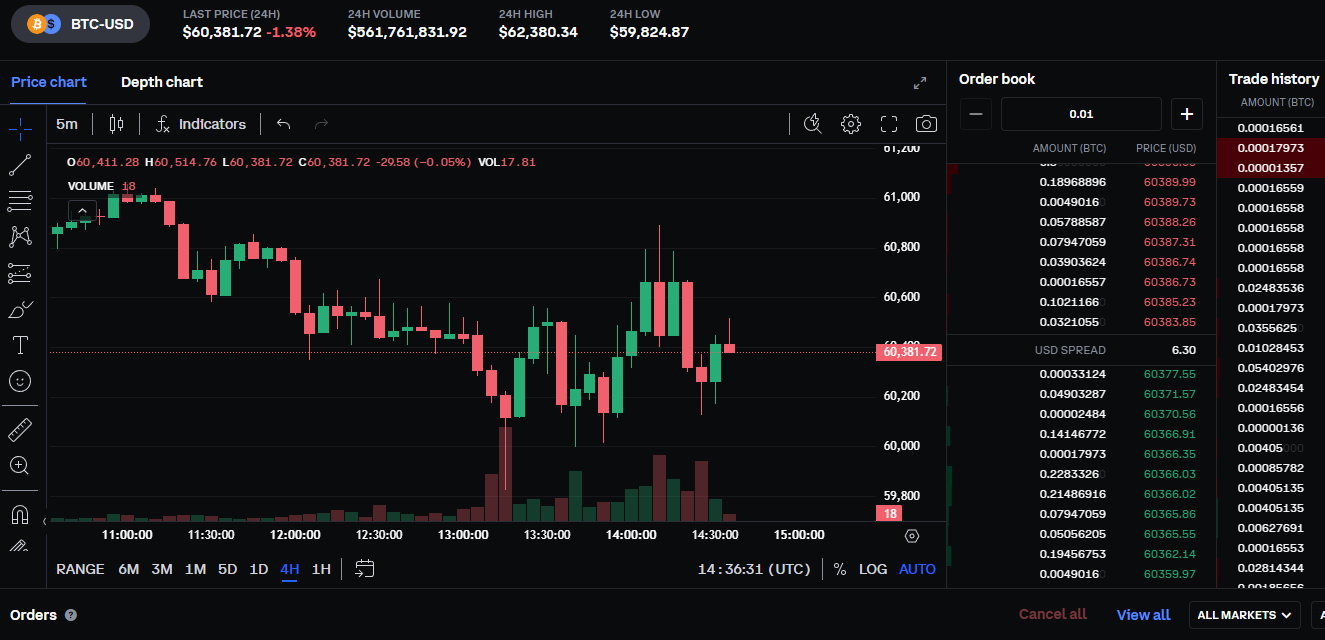

Once your account is set up and verified, log in to the exchange platform. Go to your portfolio and select BTC (bitcoin) as the asset you wish to sell. Most platforms offer a straightforward dashboard with clear options to buy or sell, making it easy to locate the necessary features.

3. Choose the Type of Sell Order

You’ll need to decide on the type of order you want to place. Sell orders are categorized based on different criteria. Here are the most commonly used order types:

- Limit Order: A limit order lets you specify a minimum price at which you want to sell your bitcoin. This order only executes if the market reaches or exceeds your set price. While it can take time, it offers better control over the sale price.

- Market Order: Market orders allow you to sell bitcoin at the current market price. This type of order is executed almost immediately, making it ideal for those who want quick liquidity.

- Stop Order: Similar to a limit order, a stop order is triggered when bitcoin reaches a certain price, ensuring you lock in profits or minimize losses.

While there are other, more advanced order types like trailing stops or iceberg orders, the above options are the most commonly used for beginners.

4. Complete the Sale

After selecting your order type, specify the amount of BTC you want to sell. Most exchanges display the equivalent value in your local currency (e.g., USD, EUR), which makes it easier to understand your transaction.

Confirm the details and submit your sell order. Once executed, you will receive a notification confirming the sale, and your balance will be updated.

Selling BTC for cash: Methods and considerations

If you want to convert your BTC to cash, you basically get two main options to choose from in addition to several relatively less common ones, such as Bitcoin ATMs. Both of these options come with different considerations regarding fees, transaction times, and security.

1. Using Cryptocurrency Exchanges

Selling bitcoin for cash through an exchange is the most straightforward method. After executing a sell order, the cash equivalent will be credited to your exchange account. From there, you can withdraw it to your linked bank account.

2. Peer-to-Peer (P2P) Transactions

P2P platforms like Binance P2P, Paxful, and LocalBitcoin (now defunct) allow users to sell bitcoin directly to others, often for cash or other payment methods. This approach offers more privacy and potentially lower fees.

However, it requires caution to avoid fraudulent transactions. Using a reputable P2P network with an escrow service is recommended to protect your assets until the transaction is confirmed.

Sell BTC for crypto using bridges

It is important to remember that cryptocurrency is a new order of the financial economy. As such, it is possible to sell Bitcoin for other cryptocurrencies. Stablecoins are a great way to maintain the purchasing power of your bitcoin.

This, however simple, is more complex in practice. The simple fact that Bitcoin is not Turing complete makes it difficult to sell Bitcoin on-chain. On the contrary, there are popular solutions.

Bridges are a great way to bring the value of Bitcoin onto other blockchain networks. Bitcoin on Ethereum, or any other smart contract platform, makes it easy to cash out your BTC. The process of bridging an asset is very simple:

- Send your asset (Bitcoin, in our case) to the bridge.

- The bridge takes custody and stores the asset.

- A “wrapped” token is minted on the corresponding network.

Although, like many solutions in the world, there are trade-offs to using a bridge. Bridges are very difficult to build, and suffer from regular hacks. Furthermore, there are two types of bridges: trusted (custodial) and trustless (non-custodial). Ironically, trusted bridges are operated by central parties.

All wBTC (wrapped Bitcoin) on Ethereum is held by BitGo. When one company controls all aspects of an asset, it creates a single point of failure. If the company is corrupt, goes bankrupt, or has other fundamental issues, the cryptocurrency in its possession is at risk.

Legal aspect: Is selling Bitcoin illegal?

Selling bitcoin is not illegal in most jurisdictions, provided that you use a licensed platform and follow local regulations. Ensure you report your bitcoin sales during tax season to avoid legal complications.

For more information, consult local financial authorities or legal experts specializing in cryptocurrency.

We have a guide for that, which you can view right here. Therefore, feel free to sell your BTC without any repercussions.

Best Ways to sell Bitcoin

Broadly speaking, cryptocurrency exchanges are usually the easiest medium to sell Bitcoin. They ensure efficient transactions with minimal effort. However, peer-to-peer (P2P) platforms provide more privacy and control, allowing sellers to set their own prices and choose buyers directly. P2P transactions avoid exchange fees but involve risks like potential fraud and unverified buyers. So, all sides considered, you should weigh these factors carefully before making up your mind to go with either.