Best Crypto Exchanges for Beginners in 2026: Where to Start

Written & Edited by

Nikita Valshonok

Editorial note: Some links in this article are affiliate links. We may earn a commission if you take action, at no extra cost to you. Our recommendations remain independent and unbiased.

👉 Learn more in our Advertiser Disclosure

Ready to dive into crypto trading and wondering where to start? The first practical step is undoubtedly choosing a suitable crypto exchange. In this guide, you'll discover the best crypto exchanges designed to meet the needs of all types of traders, from beginners to professionals. Our team conducted an in-depth analysis and ranked each platform based on the most important metrics.

Lifehack: Don't hesitate to try the Comparator to compare them one against the other.

12 results found

Best for trading with automated tools

Spot trading fees

0.1% taker & makerFutures trading fees

0.06% taker, 0.02% makerSupported Cryptos

887Min Deposit

$0KYC required

RequiredDeposit Methods

P2P, Bank Transfer, Card & On-chainBest for beginners buying crypto for the first time

Spot trading fees

0.25% maker | 0.40% takerFutures trading fees

0.02% maker | 0.05% takerSupported Cryptos

500+Deposit Methods

Bank transfer, card, ACH, PayPal (region dependent)KYC required

YesMin Deposit

Varies by currency and payment methodBest for flexible deposit methods

Spot trading fees

0.1% taker, 0.1% makerFutures trading fees

0.035% taker, 0.01% makerSupported Cryptos

692Min Deposit

$0KYC required

RequiredDeposit Methods

Bank Transfer, Card & On-chainBest for a wide variety of user reward programs

Spot trading fees

0.2% taker & makerFutures trading fees

0.06% taker, 0.02% makerSupported Cryptos

700Min Deposit

$0KYC required

RequiredDeposit Methods

P2P, Bank Transfer, Card & On-chainBest for beginners due to its ease of use

Spot trading fees

0.6%-0.05% taker, 0.4%-0% makerFutures trading fees

0.6%-0.05% taker, 0.4%-0% makerSupported Cryptos

417Min Deposit

$10KYC required

RequiredDeposit Methods

Bank Transfer, Card & On-chainBest for mobile app & customer support

Spot trading fees

0.6%-0.05% taker, 0.4%-0% makerFutures trading fees

0.6%-0.05% taker, 0.4%-0% makerSupported Cryptos

417Min Deposit

$10KYC required

RequiredDeposit Methods

Bank Transfer, Card & On-chainBest for its comprehensive market information and analysis tools

Spot trading fees

0.2% taker & makerFutures trading fees

0.05% taker, 0.03% makerSupported Cryptos

1389Min Deposit

$0KYC required

RequiredDeposit Methods

P2P, Bank Transfer, Card & On-chainCompare User-Friendly Crypto Exchange and Apps for Beginners

| 0% maker, 0.02% taker | 0% maker, 0.02% taker | 3100 | $5 | Optional | Bank Transfer & On-chain | Explore MEXC | |

| 0.1% taker & maker | 0.06% taker, 0.02% maker | 887 | $0 | Required | P2P, Bank Transfer, Card & On-chain | Explore Bitget | |

| 0.25% maker | 0.40% taker | 0.02% maker | 0.05% taker | 500+ | Varies by currency and payment method | Yes | Bank transfer, card, ACH, PayPal (region dependent) | Explore Kraken | |

| 0.1% taker, 0.1% maker | 0.035% taker, 0.01% maker | 692 | $0 | Required | Bank Transfer, Card & On-chain | Explore WhiteBIT | |

| Depending on liquidity | N/A | 300+ | $10 | Required | Bank Transfer, Card & On-chain | Explore Uphold | |

| 0.1% taker & maker | 0.06% taker, 0.02% maker | 428 | $0 | Optional | Bank Transfer, Card & On-chain | Explore BloFin | |

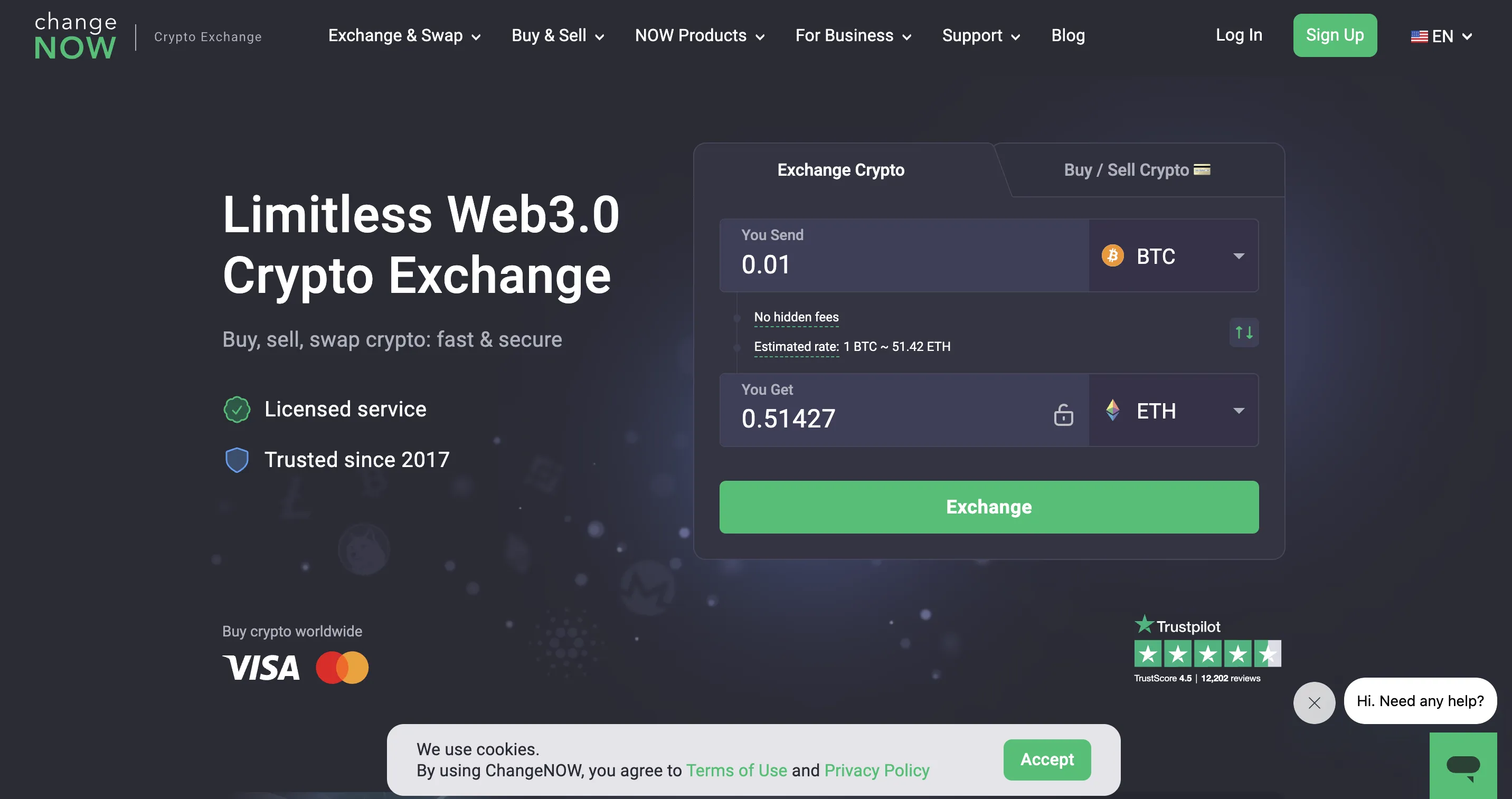

| Depend on currency | n/a | 1,000+ | $0 | Optional | Card & On-chain | Explore ChangeNOW | |

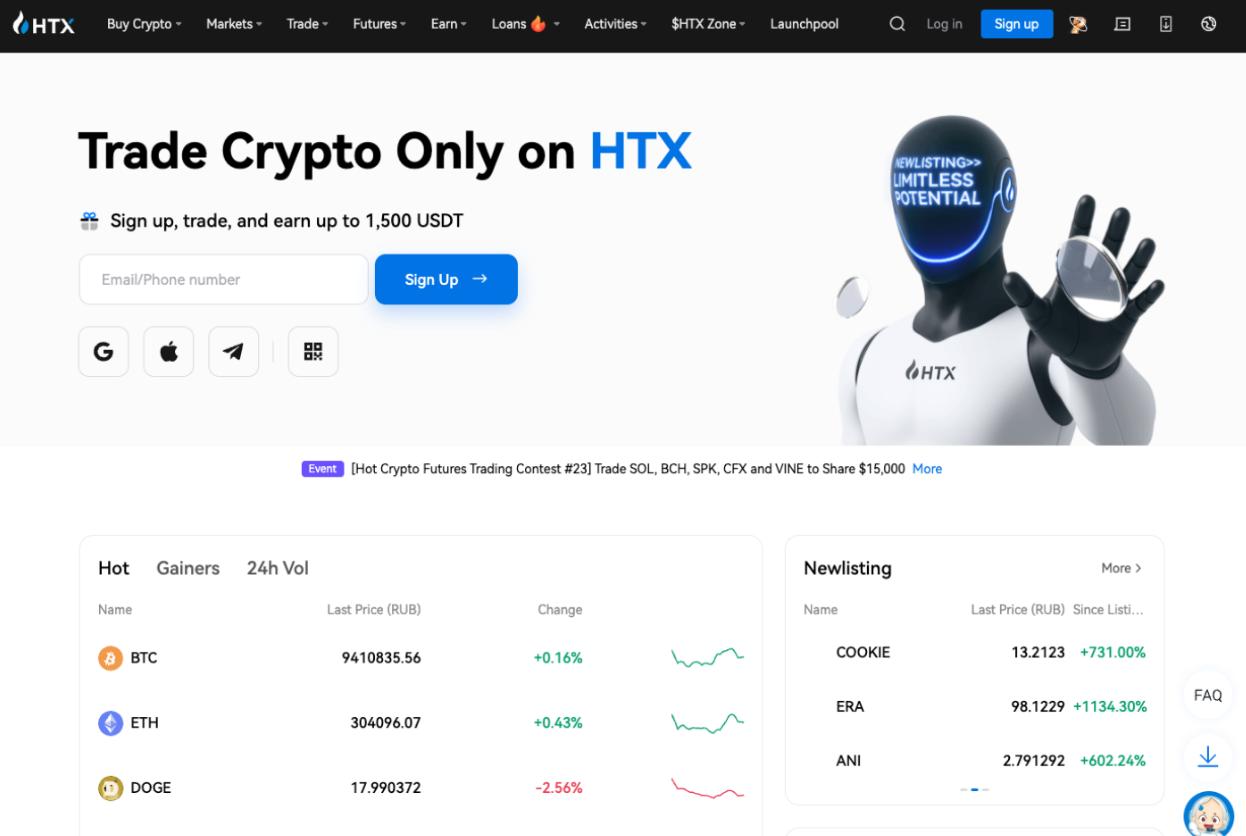

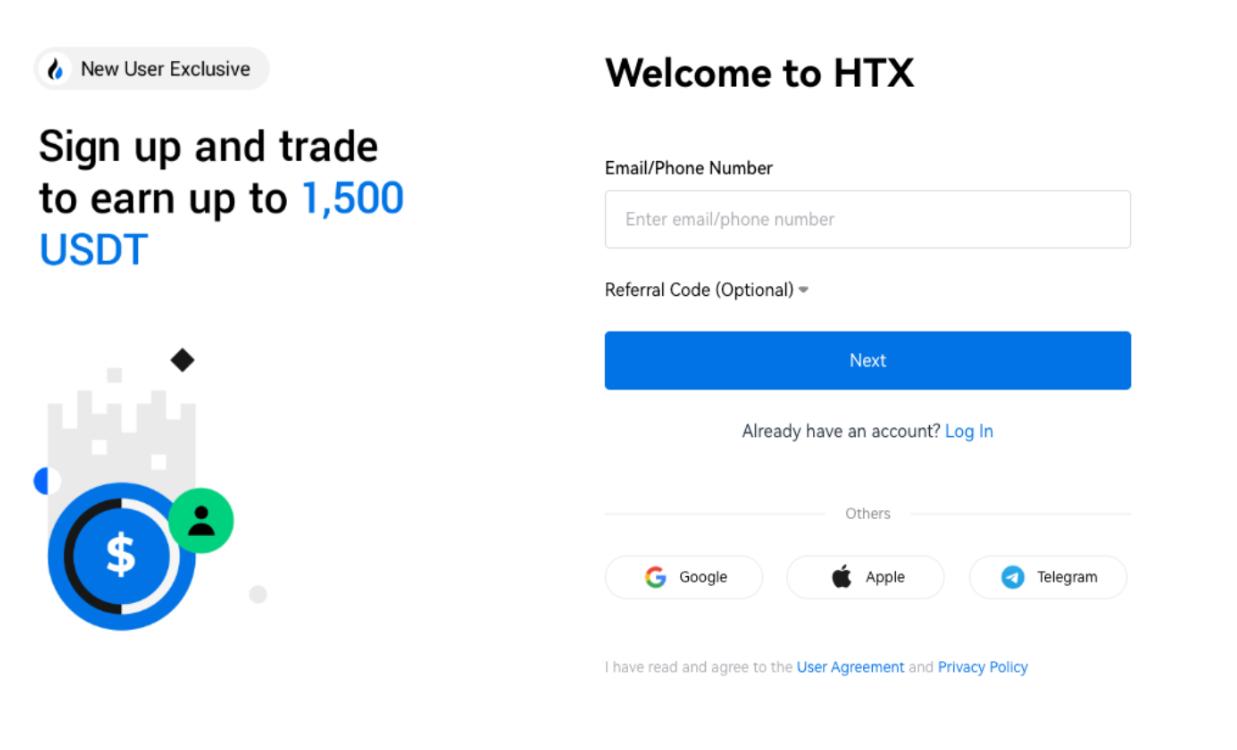

| 0.2% taker & maker | 0.06% taker, 0.02% maker | 700 | $0 | Required | P2P, Bank Transfer, Card & On-chain | Explore HTX | |

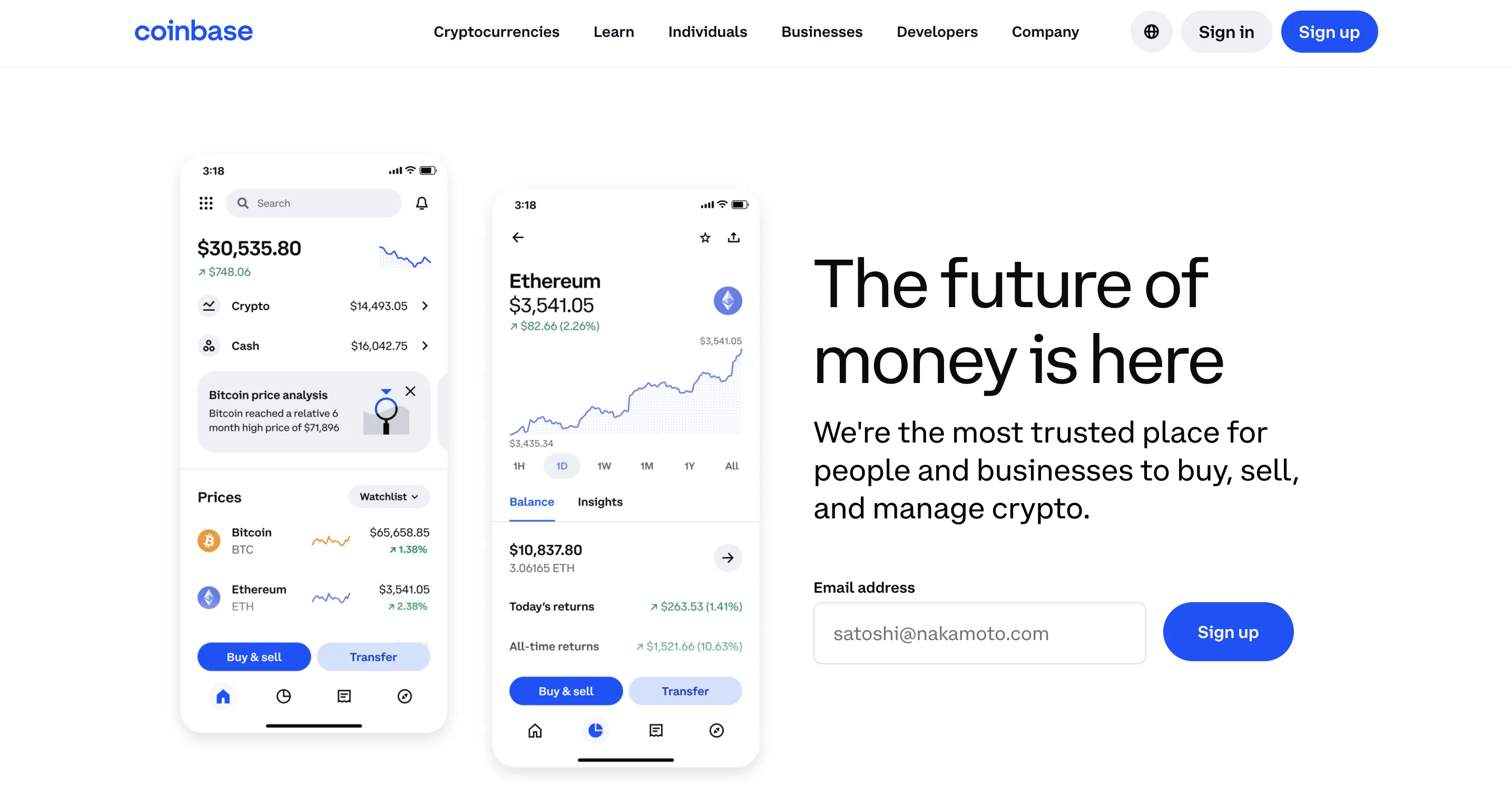

| 0.6%-0.05% taker, 0.4%-0% maker | 0.6%-0.05% taker, 0.4%-0% maker | 417 | $10 | Required | Bank Transfer, Card & On-chain | Explore Coinbase | |

| 0.1% taker, 0.08% maker | 0.05% taker, 0.018% maker | 608 | $0 | Required | P2P, Bank Transfer, Card & On-chain | Explore OKX | |

| 0.6%-0.05% taker, 0.4%-0% maker | 0.6%-0.05% taker, 0.4%-0% maker | 417 | $10 | Required | Bank Transfer, Card & On-chain | Explore BingX | |

| 0.2% taker & maker | 0.05% taker, 0.03% maker | 1389 | $0 | Required | P2P, Bank Transfer, Card & On-chain | Explore CoinEx |

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is a platform that allows users to buy, sell, and trade crypto. There are two main types of exchanges: centralized (CEX) and decentralized (DEX). They differ in that centralized exchanges act as intermediaries, holding users’ funds and transactions, while decentralized exchanges allow users to trade directly from their wallets, without an intermediary.

Today, cryptocurrency exchanges offer not only trading tools but also features like staking, lending, and yield farming, allowing users to earn crypto in various ways. For beginners, centralized exchanges are ideal. They offer a simple interface, high liquidity, and strong security, eliminating the need to manage private wallet keys independently, as with DEXs.

How to Choose an Crypto Exchange

Before selecting a cryptocurrency exchange, it’s important to carefully evaluate the platform to ensure it aligns with your trading goals and preferences. Here are 6 key factors to pay attention to:

- Security: The platform should ensure strong asset and data protection, including two-factor authentication (2FA), anti-phishing protection and regular security audits.

- Goals: Although most exchanges offer the necessary tools, some may have advantages on specific platforms, and you should define your trading goals. For example, low fees and high leverage are better suited for short-term traders. If you prefer automated trading, look for exchanges with a wide range of trading bot features.

- Customer support: Reliable customer support is crucial, especially when you’re new to trading. Check if the platform offers 24/7 support and multiple contact methods like live chat, email, and phone.

- Ease of use: A crypto exchange should have an intuitive interface that makes it easy for new users to navigate. Look for platforms that offer educational resources and guides specifically tailored for beginners.

- Fees, trading pairs & payment options: Consider the range of cryptocurrencies supported by the exchange and compare the trading fees across platforms. Also, evaluate the deposit and withdrawal methods to ensure they align with your preferred payment options.

- Regulatory compliance: Check that the exchange complies with local regulations and has a transparent KYC process for added security and legal protection.

Conclusion

Choosing a cryptocurrency exchange is an important step and a key consideration for any trader, whether a beginner or experienced. If you are a beginner, the focus should be on the simplicity of the interface, security, and active support. For more experienced traders, the key criteria might be more specific, such as the availability of advanced trading tools, fee structures, or the range of supported assets.

By following the guidance provided in this article, you can easily select one or more exchanges that will allow you to start trading crypto in 2026 with simplicity, security, and confidence.

Frequently Asked Questions

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

We included MEXC in our list of the best crypto exchanges due to its high liquidity on new trading pairs. Despite its relatively low user rating, MEXC is a convenient platform for cryptocurrency trading. Additionally, the exchange offers a variety of promotional campaigns and airdrops for both new and existing users to help them build their initial capital.

We included MEXC in our list of the best crypto exchanges due to its high liquidity on new trading pairs. Despite its relatively low user rating, MEXC is a convenient platform for cryptocurrency trading. Additionally, the exchange offers a variety of promotional campaigns and airdrops for both new and existing users to help them build their initial capital. We included Bitget in our list of the best crypto exchanges for its variety of trading tools and, most importantly, its extensive copy trading platform, which allows users to replicate strategies across spot, futures, and even trading bots. Although its fees are slightly higher than others, Bitget stands out with features like its own wallet and Web3 platform. Additionally, Bitget offers one of the most robust Earn programs, allowing users to earn rewards and participate in launchpads.

We included Bitget in our list of the best crypto exchanges for its variety of trading tools and, most importantly, its extensive copy trading platform, which allows users to replicate strategies across spot, futures, and even trading bots. Although its fees are slightly higher than others, Bitget stands out with features like its own wallet and Web3 platform. Additionally, Bitget offers one of the most robust Earn programs, allowing users to earn rewards and participate in launchpads. We included WhiteBIT in our list of the best crypto exchanges due to its extensive range of cryptocurrency tools, making it a versatile choice for both beginners and experienced users. The platform offers not only spot, margin, and futures trading but also automated investing options and participation in launchpads, all conveniently available in one place. Its user-friendly terminal allows traders to choose between basic charts and advanced TradingView charts, depending on their needs and preferences.

We included WhiteBIT in our list of the best crypto exchanges due to its extensive range of cryptocurrency tools, making it a versatile choice for both beginners and experienced users. The platform offers not only spot, margin, and futures trading but also automated investing options and participation in launchpads, all conveniently available in one place. Its user-friendly terminal allows traders to choose between basic charts and advanced TradingView charts, depending on their needs and preferences.

We included BloFin in our list of the best crypto exchanges because it is committed to prioritizing user fund security and offers an accessible platform for futures copy trading especially for beginners. Even though BloFin’s fees may be higher than average, the exchange often provides trading fee discounts. BloFin has a robust copy trading platform with a one-click trading feature, allowing users to easily replicate the strategies of experienced traders.

We included BloFin in our list of the best crypto exchanges because it is committed to prioritizing user fund security and offers an accessible platform for futures copy trading especially for beginners. Even though BloFin’s fees may be higher than average, the exchange often provides trading fee discounts. BloFin has a robust copy trading platform with a one-click trading feature, allowing users to easily replicate the strategies of experienced traders.

We included OKX in our list of the best crypto exchanges because it is a secure and reliable platform with a solid selection of investment products. One standout offering is Seagull, a trend-based investment product that lets users profit from market trends with strategies like Bullish Seagull (for upward trends) and Bearish Seagull (for downward trends), using BTC, ETH, or USDT for flexible returns.

We included OKX in our list of the best crypto exchanges because it is a secure and reliable platform with a solid selection of investment products. One standout offering is Seagull, a trend-based investment product that lets users profit from market trends with strategies like Bullish Seagull (for upward trends) and Bearish Seagull (for downward trends), using BTC, ETH, or USDT for flexible returns. We included BingX in our list of the best crypto exchanges due to its efficient trading platform, which includes inverse futures. Additionally, BingX offers responsive customer support, adheres to strong compliance standards, and provides an active community that supports learning and growth—making it a dependable choice for new traders.

We included BingX in our list of the best crypto exchanges due to its efficient trading platform, which includes inverse futures. Additionally, BingX offers responsive customer support, adheres to strong compliance standards, and provides an active community that supports learning and growth—making it a dependable choice for new traders.

We included CoinEx in our list of the best crypto exchanges based on its beginner-friendly environment. In addition to learn-to-earn programs, each section of the website features detailed, high-quality video guides that help users navigate the trading terminal with ease. CoinEx stands out for its large number of trading pairs and a wide range of market analysis tools, allowing users to track key statistical metrics directly on the exchange in real time.

We included CoinEx in our list of the best crypto exchanges based on its beginner-friendly environment. In addition to learn-to-earn programs, each section of the website features detailed, high-quality video guides that help users navigate the trading terminal with ease. CoinEx stands out for its large number of trading pairs and a wide range of market analysis tools, allowing users to track key statistical metrics directly on the exchange in real time.