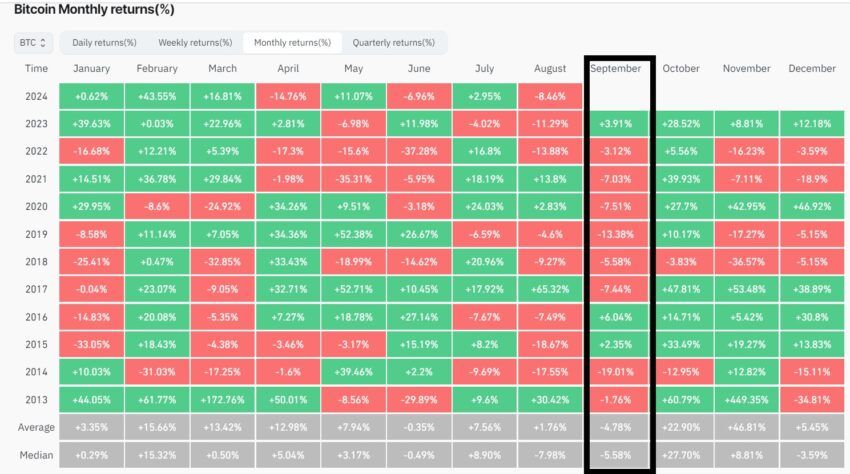

Bitcoin investors are bracing for September, historically the worst month for the cryptocurrency’s price. Digital assets platform Matrixport has issued a warning, suggesting Bitcoin could see further declines this month due to various looming risk factors.

Matrixport highlighted that Bitcoin faces additional pressure this year, which could impact its price. In its Matrix on Target report, the firm pointed to several key influences, including the US tech sector’s outlook, the Federal Reserve’s decisions, and the upcoming presidential debates, all of which could weigh on Bitcoin’s performance.

Key Factors Impacting Bitcoin’s September Performance

Matrixport noted a strong correlation between AI giant NVIDIA and Bitcoin from late 2022 through the second quarter of 2024. However, Bitcoin has recently lagged behind the AI rally, as seen in NVIDIA’s outperformance. But with both assets now making lower highs, this suggests that there is the potential for a deeper correction.

Last week, NVIDIA’s shares dropped by about 8%, despite exceeding Q2 earnings expectations. Similarly, Bitcoin’s price fell by a similar margin, even with substantial inflows into spot ETFs.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Macroeconomic factors, such as US employment data and potential inflation control measures, could also influence Bitcoin. Federal Reserve Chair Jerome Powell has signaled that interest rate cuts are likely, boosting optimism among investors who believe lower rates could benefit Bitcoin.

However, Matrixport cautioned that historical patterns suggest a less straightforward outcome. During the 2018/2019 rate-hiking cycle, Bitcoin struggled but rallied when the Fed paused rates. When rates were eventually cut, Bitcoin experienced a brief rally followed by a gradual decline, interrupted only by further rate cuts.

This historical pattern introduces uncertainty about Bitcoin’s response to the anticipated rate cut.

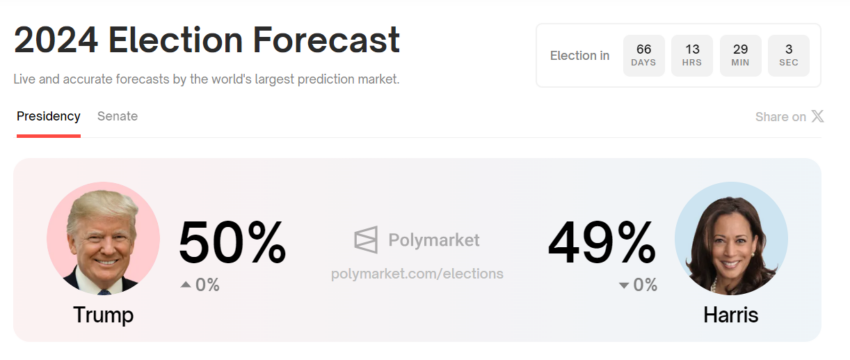

The upcoming US election adds to the uncertainty surrounding Bitcoin. While many in the crypto industry favor a Donald Trump presidency, Vice President Kamala Harris has gained significant support, bolstering her campaign.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

With both candidates expected to face off in debates imminently, this raises concerns about how the results could impact Bitcoin. A strong debate performance could boost the industry due to Trump’s pro-Bitcoin stance. Conversely, Harris’ victory could introduce further uncertainty, as she has not publicly clarified her position on the leading cryptocurrency.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.