Justin Sun claimed all his EIGEN tokens from the EigenLayer liquid restaking protocol on Tuesday via five different addresses and moved them to the HTX digital currency trading platform.

EIGEN is the native token for the EigenLayer ecosystem, a leading restaking protocol on the Ethereum blockchain. This development comes amid hype over the EIGEN token listing on multiple tier-one exchanges.

Justin Sun Transfers $21.5 Million in EIGEN Tokens to HTX

Spotonchain reported the transaction, indicating that the Tron executive deposited all 5.24 million EIGEN tokens to HTX during the early hours of the Asian session. The transaction happened shortly after EIGEN debuted on major exchanges, including Binance. WuBlockchain corroborated the report.

“Justin Sun’s team has transferred 5.37 million EIGEN to Huobi HTX through five addresses, worth about $21.8 million. Based on the current price of 4.06 USDT, the EIGEN FDV is about $6.8 billion,” Wu Blockchain reported.

Crypto researcher Ai on X speculated on whether Justin Sun “is ready to ship EIGEN,” noting that it is currently unclear whether the receiving address belongs to the exchange. Nevertheless, the expert highlighted that the controversial crypto executive could make a profit of around $22.19 million if he cashed in at the current price of $4.13.

Read more: What Is Liquid Staking in Crypto?

Sun reportedly received the largest airdrop of EigenLayer’s EIGEN tokens, amassing over $38.74 million in airdrops through the Ethereum Restaking track. This positions him to become the biggest beneficiary in the latest round of liquid restaking tokens (LRT), as per Ai’s report, which noted pending airdrop settlements from protocols like Puffer, Zircult, Swell, and Kelp.

Interestingly, when high-profile figures transfer significant token amounts to exchanges, it is often seen as a sign of intent to sell. While Justin Sun hints at selling his EIGEN tokens, two whales are accumulating, purchasing 702,324 EIGEN tokens valued at $2.86 million on Tuesday morning.

Specifically, one spent 588 ETH or $1.55 million to buy 383,672 EIGEN at an average price of $4.05. The other spent 1.31 million USDC to buy 318,651 EIGEN at $4.1 per token. These purchases come in time for the EIGEN token unlock.

Eigen Foundation Announces Token Unlock

The Eigen Foundation, which drives the growth of the EigenLayer ecosystem, has announced the unlocking of the EIGEN token for Season 2. This follows the opening of stake drop claims in mid-September, with the claim window running from October 1, 2024, to March 16, 2025, on the Eigen Foundation’s website.

Justin Sun’s involvement with EigenLayer isn’t new; his participation in the Season 1 airdrop in May sparked controversy. With this latest token unlock, users can freely transfer, trade, or stake their EIGEN tokens, fully engaging in the token’s utility.

EigenLayer also introduces a unique shared security system, where staked ETH serves as security for protocols beyond Ethereum. The EIGEN token plays a role in securing Actively Validated Services (AVSs), further enhancing its utility.

Read more: Ethereum Restaking: What Is It And How Does It Work?

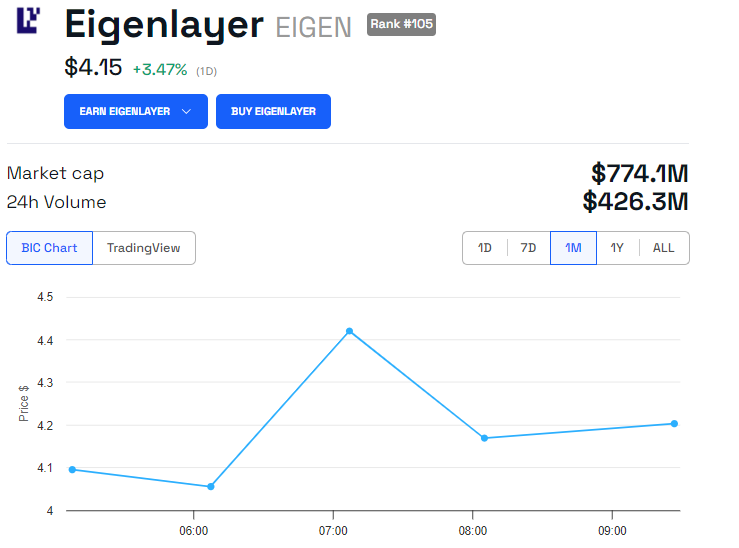

This development positions EigenLayer as a “verifiable cloud for crypto,” opening opportunities for sidechains, Oracle networks, bridges, and more. According to BeInCrypto, the EIGEN token is currently trading at $4.15, reflecting a 3.47% increase since Tuesday’s session opened.