Japan’s financial regulator, the Financial Services Authority (FSA), plans to categorize algorithmic stablecoins in the same bracket as Bitcoin. Stablecoin issuers will also need licenses that deem it a bank, fund transfer service provider, or trust company.

The FSA aims to categorize algorithmic stablecoins under the same bracket as Bitcoin. The regulator released a report showing how it intended to deal with stablecoins.

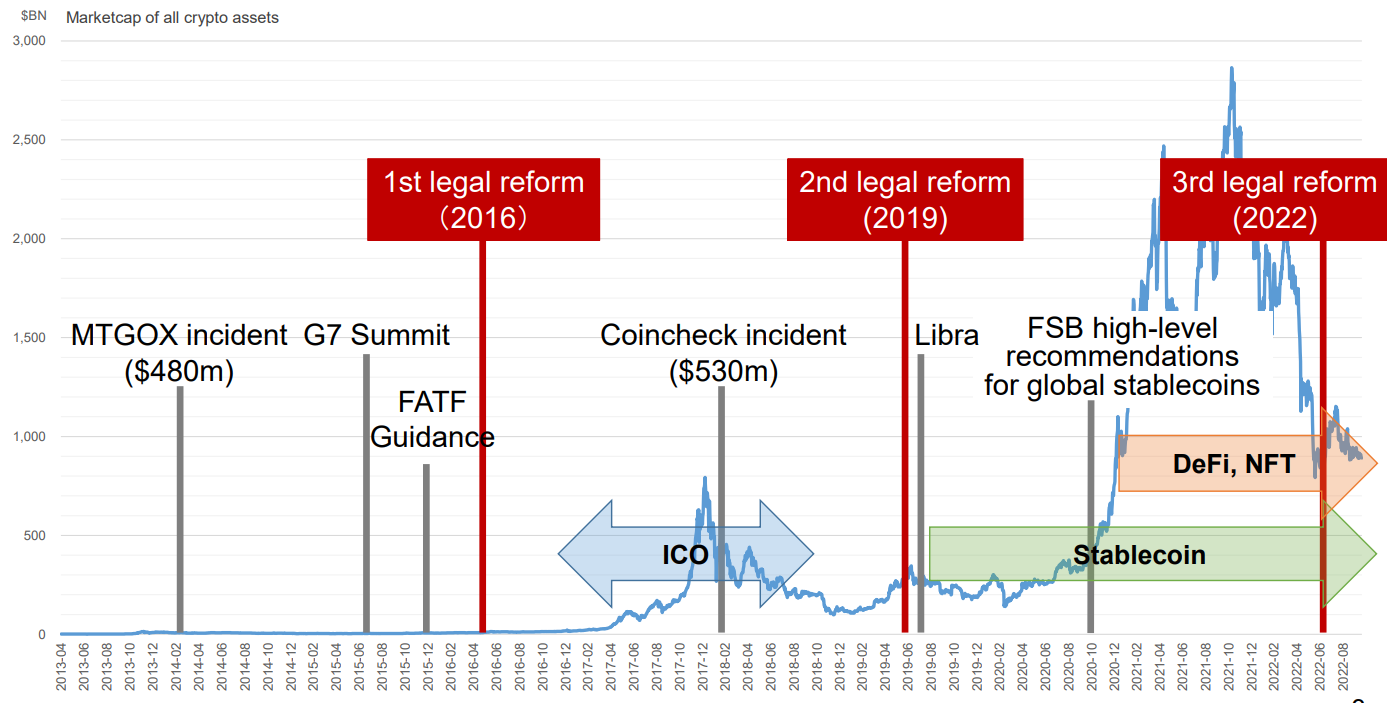

Titled “Regulating the crypto assets landscape in Japan,” the report also discusses the three eras of legal reform that Japan has undertaken. One of the key points in the report concerns stablecoin regulation.

The report says that self-claimed stablecoins, such as algorithmic stablecoins like TerraUSD, and non-redemption stablecoins, will be categorized in the same way as Bitcoin. It also says that banks can issue stablecoins as deposits.

The first of the three legal reforms took place in 2016 and mainly concerned investor protection and anti-money laundering (AML) and Combating the Financing of Terrorism (CFT) regulations. The second took place in 2019 and was expanded to cover derivatives trading, investor protection, and advertising and soliciting.

The third, which takes place this year, covers a regulatory framework for banks and, most importantly, stablecoins. Its priorities for stablecoins are financial stability, investor protection, and AML/CFT.

Stablecoin Issuers Will Face Major Changes

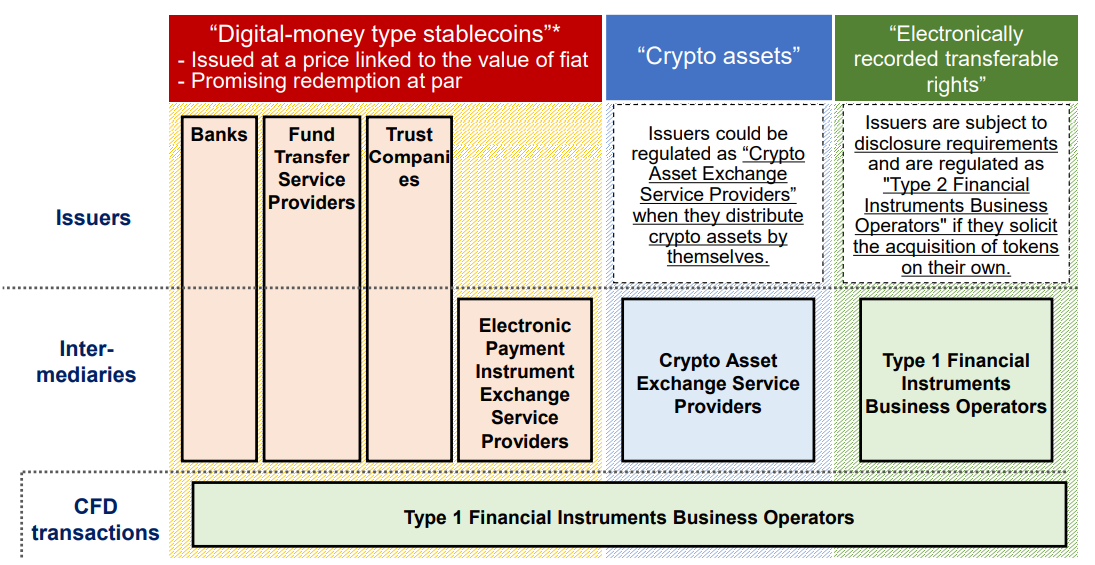

The third era of legal reforms, in particular, will bring a good deal of change to the stablecoin market. The reform covers issuers, intermediaries, and Contract for Differences (CFD) transactions.

Issuers will likely see classification as “crypto asset exchange service providers” and must follow disclosure requirements. Intermediaries will take the classification of “Electronic Payment Instrument Exchange Service Providers.” Issuers will also need licenses that deem it a bank, fund transfer service provider, or trust company.

Algorithmic Stablecoins Disapproved Of

The reforms introduce some comprehensive changes to stablecoins in Japan. The country’s regulator is clearly keen on ensuring that stablecoins follow the rulebook. After the collapse of TerraUSD earlier this year, many governments have been working on the same.

In its concluding section, the report discusses a way forward in terms of regulation. It recommends the Financial Stability Board’s view on algorithmic stablecoins. Namely, it recommends against their use.

It is likely that Japanese lawmakers will take the FSA’s recommendations under strong consideration when establishing policy. Japan has been ramping up its regulatory actions and is also keen on cooperating on an international level. The Digital Ministry will even launch a DAO to understand the technology.