The price of IO, the native token of leading DePIN solutions provider io.net, has surged by 32% from its Monday low of $1.50. The altcoin had dropped to this low following a general market downturn that led to over $1 billion in liquidations.

As the broader market recovers, IO’s price has risen by double digits since Monday. However, this rally may be short-lived.

io.net Partners With Leonardo AI, IO Skyrockets

Apart from the broader market rally, the surge in IO’s price is also due to the hype around io.net’s new partnership with visual assets-generation platform Leonardo AI. The partnership will enable io.net to supply Leonardo AI with additional enterprise-grade NVIDIA GPUs, boosting the platform’s computational capacity and scalability.

“io.net has proven to be an invaluable partner in providing the compute Leonardo AI needs to scale in order to keep pace with our rapid growth. Leveraging these L40S GPUs from io.net will allow our platform to serve our customers faster than ever using best-in-class technology that has been optimized for AI inferencing. With the support of io.net, we look forward to onboarding millions of users, confident that we have the compute capacity we need, even during periods of peak demand,” Leonardo AI Co-Founder and CFO Chris Gillis said.

At press time, IO is trading at $1.75. However, key indicators on the one-day chart suggest that the token may soon lose the gains recorded since Monday.

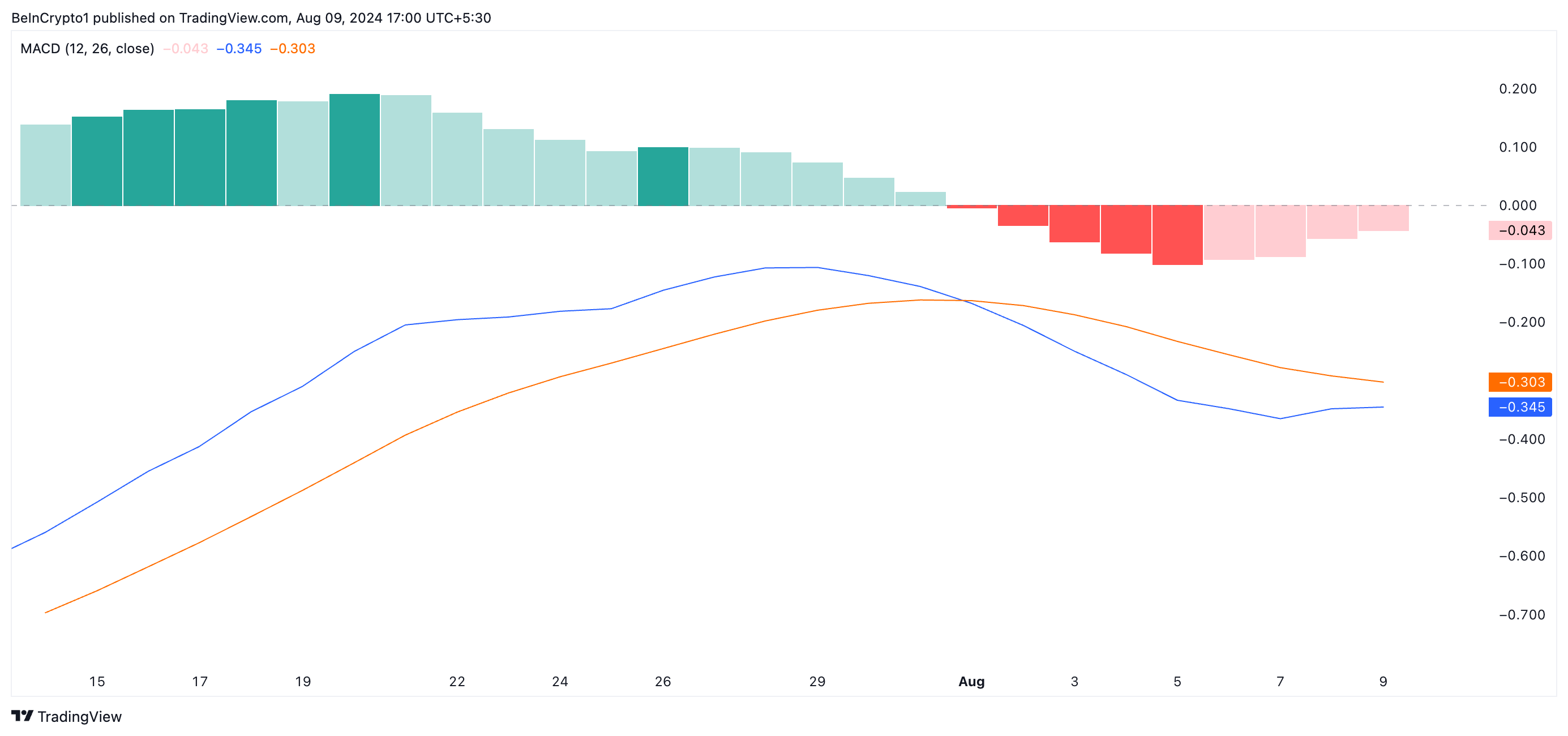

The Moving Average Convergence/Divergence (MACD) indicator shows that the bearish bias remains strong despite the rally. IO’s MACD line (blue) is currently below both its signal line (orange) and the zero line.

An asset’s MACD identifies its trend direction, shifts, and potential price reversal points. When the MACD line crosses below both the signal and zero lines, it signals strong bearish sentiment in the market.

The drop below the signal line indicates weakening momentum, while crossing below the zero line confirms the strength of the downtrend. Traders often see this as an opportunity to exit long positions and take short ones.

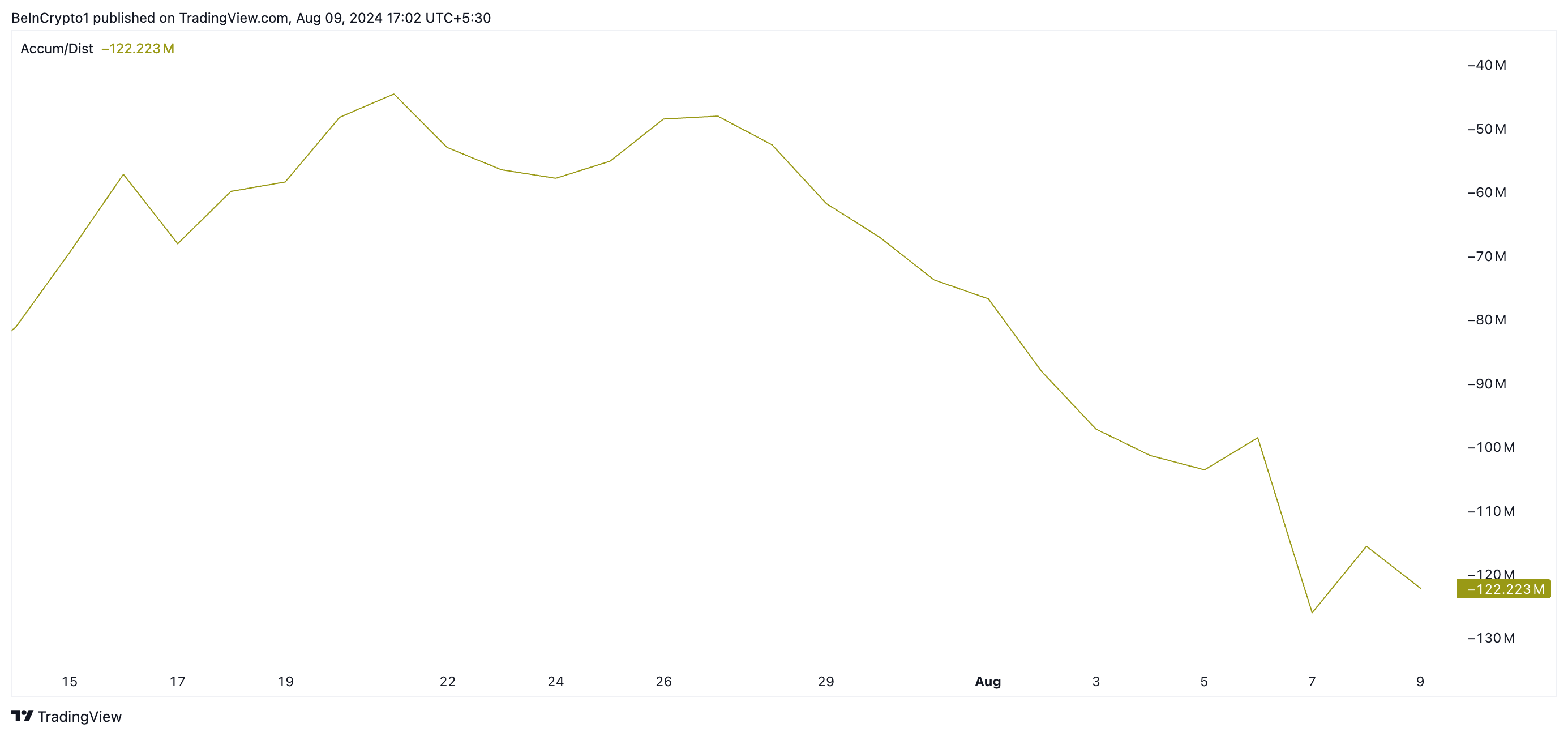

The possibility of a price decline is heightened by the fact that the current rally is supported by minimal buying pressure. This assessment comes from the token’s Accumulation/Distribution (A/D) Line. Although IO’s price has risen since Monday, the A/D Line has been trending downward, currently sitting at -121.22 million.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

This indicator tracks the cumulative flow of money into and out of an asset. A decline in the A/D Line reveals more distribution than accumulation, suggesting that selling pressure is overpowering buying pressure, which drives the asset’s price lower.

IO Price Prediction: New Losses Ahead

Traders interpret the setups of the indicators above as a warning sign that an asset is losing demand and could experience further declines. This prompts them to reduce trading activity, putting further downward pressure on the price.

IO’s price may revisit Monday’s low if selling pressure spikes.

Read more: Top 9 Web3 Projects That Are Revolutionizing the Industry

However, if actual demand for the altcoin emerges, it may push its value to $2.52.