Intel cancels the Bitcoin mining chip series, the Blockscale 1000 ASIC, for its Smartphones. It has barely been a year since the series’ rollout. Is artificial intelligence (AI) driving a strategic shift?

The tech industry is constantly evolving, and it is no surprise that the current landscape vastly differs from a few years ago. The advent of blockchain technology sparked much excitement in the tech industry. Many believe in its revolutionary potential. However, the crypto winter has shaken faith in blockchain tech. Thus, significantly impacting the industry.

The crypto winter refers to a significant decline in the value of cryptocurrencies. Particularly Bitcoin, which suffered in late 2017 and continued into 2018. This decline went hand in hand with a loss of faith in blockchain technology, which many had hoped would drive the next wave of innovation.

New Sherriff in Town

One reason for the decline in faith in blockchain was a slew of high-profile scams and fraud. Many investors lost fortunes in these scams, leading to a loss of trust in the technology. Additionally, the hype around blockchain technology led to many companies launching projects without understanding the technology, leading to failures.

Another factor contributing to the crisis of faith was the need for real-world use cases. While a few successful projects use blockchain technology, such as Bitcoin and Ethereum, relatively few examples of blockchain technology are used to solve real-world problems.

In contrast, AI has become a hot new investment in the tech industry. AI has been around for a while, but recent advances have driven renewed interest and investment. AI has the potential to revolutionize various sectors, from healthcare to finance to transportation, making it a popular area of investment for many companies.

One of the factors in the renewed interest in AI is the success of companies such as Google and Amazon, which have used AI to improve their products and services. Google, for example, uses AI to hone its search results and to develop new products such as Google Assistant. Amazon uses AI to make its recommendations and devise new products like Alexa.

The Shift in Innovation

Additionally, many real-world use cases for AI lead to increased technology investment. For example, AI can detect fraud in financial transactions, diagnose diseases in healthcare, and optimize supply-chain management in logistics.

The shift in focus from blockchain technology to AI has also led to many tech companies tightening their belts and shaking off less-than-core businesses. This is because AI is seen as a core area for many companies, and they are investing heavily in technology to gain a competitive edge. This has led to several companies divesting non-core businesses to focus on AI.

One example is IBM, which divested its managed infrastructure services business to focus on cloud computing and AI. Another example is Intel, which sold its NAND memory business to SK Hynix to focus on AI and other core areas.

The shift towards AI has also entailed a focus on talent acquisition as companies look to hire the best AI talent to drive innovation in the field. This has led to increased competition for AI talent, and many companies offer attractive packages to attract top talent.

Killing the Crypto Chip

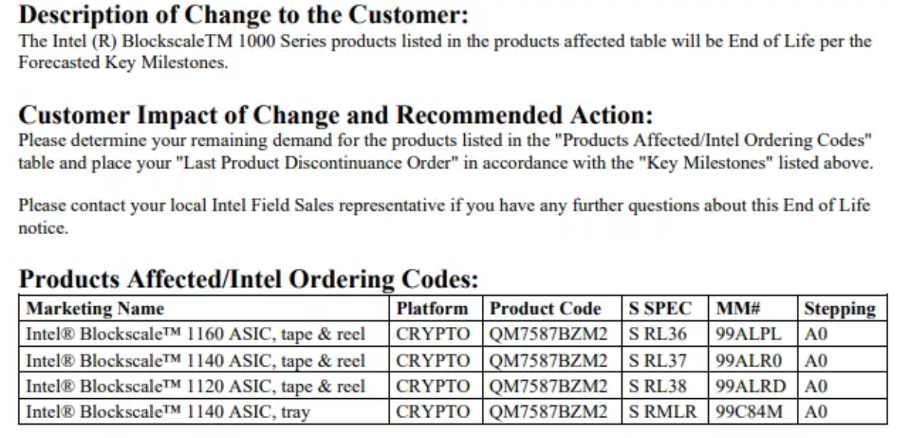

Intel announced that it is discontinuing the development of its Blockscale 1000 ASIC mining chip series for Bitcoin. The decision was made because the company has decided not to pursue any future generations of the chips. This marks the end of Intel’s brief foray into the Bitcoin mining market.

The Blockscale chips were to be high-performance mining chips for Bitcoin. Aiming to make mining more accessible to individual miners. And work in conjunction with mining software to perform the complex calculations required to mine new bitcoins.

However, the development of the Blockscale chips has been beset with delays and setbacks. Such as a chipmaker giant dropping the project altogether without announcing a new chip to succeed it. Intel dodged a question from Tom’s Hardware about whether it would exit the Bitcoin ASIC business, saying:

“We continue to monitor market opportunities.”

The company has cited several reasons for the decision, including the high costs of developing the chips and the low demand for them.

Crypto Out, AI In?

Intel’s decision to discontinue the Blockscale chips is unsurprising, given the challenges the Bitcoin mining market has faced in recent years. The high cost of mining equipment and the increasing difficulty of mining new bitcoins have made it difficult for individual miners to compete with large mining operations.

Additionally, the Bitcoin mining market has become increasingly centralized, with a few large mining operations controlling a significant portion of the network’s computing power. This has led to concerns about the security and decentralization of the network. Indeed, Intel feels the heat from the escalating regulatory attack on crypto. For that reason as well as factors mentioned above, some firms may choose to distance themselves.

At the same time, Bitcoin has performed unexpectedly well, reaching the $30,000 threshold. Yet an April 19 report in The Verge noted that Intel might be looking at AI.

Integration of the Latest Technology

The chipmaking giant is well-positioned to benefit from the growing demand for AI. After some digging, BeInCrypto found some interesting things. The company has a strong track record in developing and manufacturing high-performance chips, and AI is a natural extension of its core business.

AI applications require potent chips that can process large amounts of data quickly and efficiently. Intel has invested heavily in developing chips specifically designed for AI applications, such as its Nervana Neural Network Processor (NNP).

The Nervana NNP is designed to accelerate the training and inference of deep neural networks, a key technology in AI applications such as computer vision and natural language processing. The chip is optimized for high-performance computing and can process large amounts of data in parallel, making it ideal for AI applications.

In addition to developing specialized AI chips, Intel has also been working on integrating AI into its existing products. The company’s processors are increasingly designed with AI in mind, with features such as vector processing and integrated neural network accelerators.

AI Flying High

Intel has also invested in software tools and libraries, making it easier for developers to merge AI into their applications. For example, the company has developed the OpenVINO toolkit, which allows developers to optimize their AI applications for Intel hardware.

Intel’s focus on AI is already paying off. The company has reported strong growth in its data-centric businesses, which include AI and other high-performance computing applications. In the fourth quarter of 2021, Intel’s data-centric businesses generated $9.90 billion in revenue, a jump of 11% year-over-year.

Looking ahead, the demand for AI technology is only expected to grow. AI applications are in development across various industries, from healthcare and finance to retail and transportation. The market for AI hardware and software may reach $500 billion by 2025, according to a report from McKinsey & Company.

As a leader in the chipmaking industry, Intel is well positioned to benefit from this growth. The company has a strong track record in developing and manufacturing high-performance chips, and its focus on AI is helping to position it for success in the growing AI market. Other players within the industry have supported the innovation by incorporating it within their businesses.

Nvidia Corporation’s Chief Technology Officer, Michael Kagan, has criticized the cryptocurrency industry. Namely, stating that it does not provide anything valuable to society. Although Nvidia’s processors sell to the crypto industry, Kagan believes processing power’s use in artificial intelligence chatbots like ChatGPT is more beneficial than mining crypto.

Meanwhile, renowned figures like Elon Musk censured the use of artificial intelligence.

The Coming Backlash?

Intel’s sudden shift and scrapping of Bitcoin plans can raise concerns as a company providing value for its consumers and clients. Did the company choose the route following regulatory pressure? The US government has taken steps to sideline Bitcoin mining industries for years now. Coincidentally, Intel’s decision may align with regulators’ goals.

There are a few instances where Intel’s (secret) actions faced backlash. One of the most significant examples was the “Meltdown” and “Spectre” security vulnerabilities discovered in Intel’s processors in 2018. These vulnerabilities allowed attackers to access sensitive information, such as passwords and encryption keys, from the memory of affected devices.

The discovery of these vulnerabilities led to widespread concern among consumers and clients. Further, it raised questions about Intel’s security protocols and testing procedures.

Another example is the delay in releasing Intel’s 10nm processors. Initially expected to launch in 2016 but delayed multiple times until the eventual release in 2019. The delay bred frustration among consumers and clients, who eagerly awaited the release of the more powerful and energy-efficient processors. The delay also allowed Intel’s competitors, such as AMD, to gain market share and up their market value.

Additionally, there are concerns about Intel’s pricing strategies. Some consumers and clients accuse the company of charging high prices for its processors compared to its competitors. This has led some clients and consumers to look for alternative chip providers for their computing needs.