Institutional investors maintain a robust interest in crypto despite the prevailing sideways market. A survey by Nickel Digital Asset Management reveals that the recent price action has not deterred these investors.

The study, encompassing institutional investors and wealth managers from countries such as the United States, United Kingdom, Germany, Switzerland, Singapore, Brazil, and the United Arab Emirates, discovered that an overwhelming 92% of respondents consider crypto vital for diversified portfolios.

Institutional Investors Are Bullish on Crypto

The majority of respondents, who collectively oversee about $3.5 trillion in assets, recommend a moderate investment approach toward crypto. The research also portrays a promising horizon for the crypto industry.

Indeed, 62% of those surveyed anticipate a spike in crypto-focused fund launches in the coming year. Furthermore, 85% foresee the growth of tokenization in investment funds and asset classes over the subsequent three years, with a quarter predicting significant expansion in this segment.

While the sentiment remains optimistic, 96% of respondents underline the need for endorsement from major financial institutions. For 57% of them, such support is crucial before delving into crypto investments.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2023

Yet, alongside the fervor, institutional investors pinpoint several obstacles in accessing the crypto market. Over 50% voice apprehensions about market volatility. Meanwhile, 45% flag security concerns, and 40% confess their limited understanding. Regulatory uncertainties also persist, echoed by 34% of those surveyed.

Anatoly Crachilov, CEO and Founding Partner at Nickel Digital, shared insights on the survey’s results.

“Institutional investors are increasingly recognizing the benefits of including digital assets in their portfolios for diversification purposes. While opinions vary, the general sentiment leans towards a moderate role for digital assets, aligning with expert views on how they can enhance portfolio performance,” Crachilov said.

Bitcoin Price Performance Contextualized

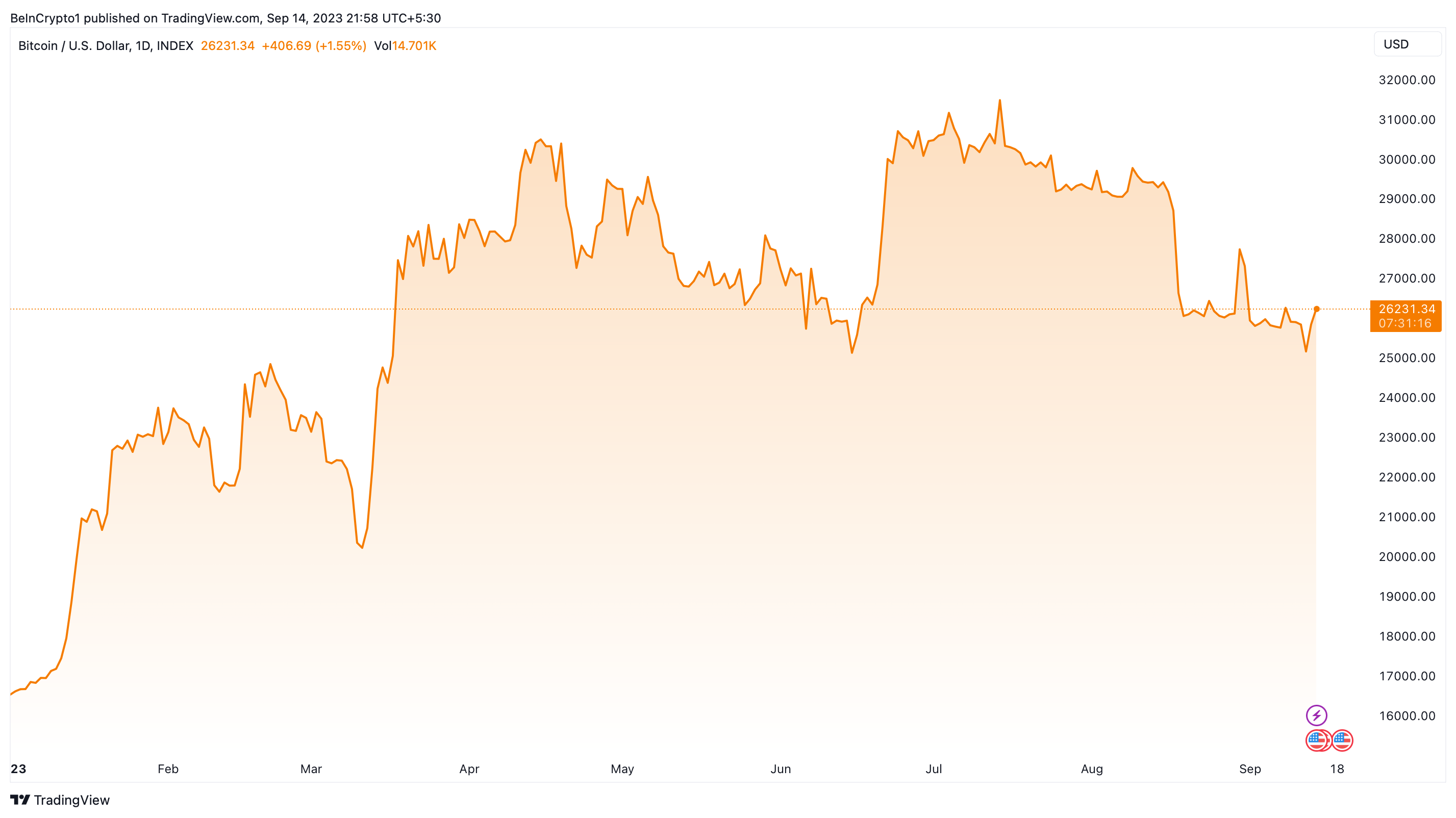

Notably, Bitcoin’s trading value hovers around $26,000 — mirroring its mid-March figures. However, it has witnessed almost a twofold increase since the year’s onset.

This year’s dynamics predominantly revolved around two distinct rallies in January and February, accompanied by a substantial market shock in mid-August. Such trajectories seem to have minimally affected the sustained interest of institutional investors in digital assets.

Read more: Investors Want Backing From Traditional Finance to Invest in Crypto

Nickel Digital Asset Management’s findings resonate with a prior survey by Laser Digital from June. Therein, 90% of participants expressed a greater propensity to invest in crypto if mainstream financial institutions were stakeholders.

This outlook elucidates the growing interest in Spot Bitcoin exchange-traded funds (ETFs). ETFs allow investors to tap into assets like Bitcoin without direct ownership. The SEC has deferred its verdict on several Bitcoin ETFs to October 17.

The participation of major institutions, like BlackRock and Fidelity, vying for SEC’s nod for their Bitcoin ETF, might further pique interest in crypto as a viable investment channel.