Injective (INJ) has demonstrated a strong 24-hour performance, gaining 17%.

This surge raises the question: Can INJ recover from the 65% drawdown from its all-time high?

Injective Technical Analysis: Testing Key Levels

The Injective price has approached or tested the daily Ichimoku cloud, which is a very bullish sign. The size of the cloud highlights the significance of this level.

Key resistance levels in the mid-to-long term are $29.5, $34, $38.4, and $43. If the daily Ichimoku cloud breaks on INJ, it could witness a price appreciation toward $33. Additionally, if Bitcoin’s price reaches back to $73,000, the price could easily increase by another 18% in the mid-term.

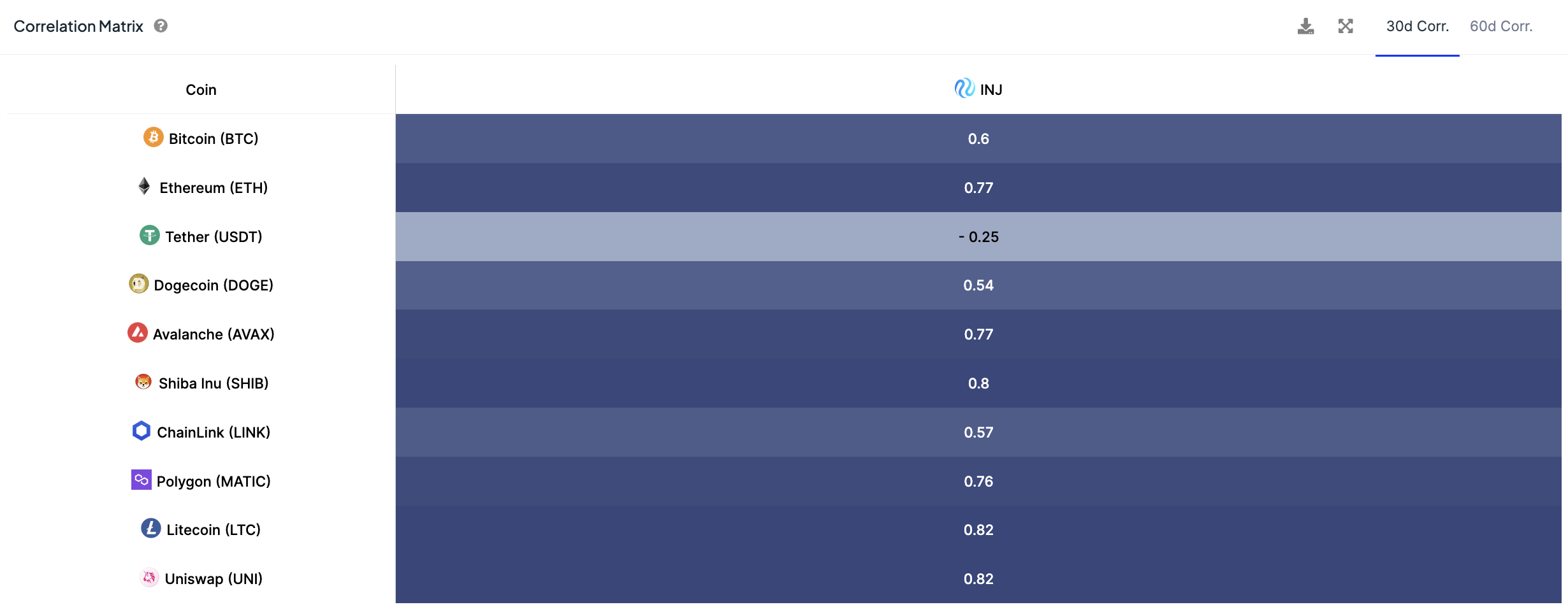

Correlation with Bitcoin: INJ has shown a notable correlation with Bitcoin, standing at 0.6. This suggests that movements in Bitcoin’s price significantly impact INJ. If Bitcoin continues its upward movement and reaches $73,000, we can expect INJ to trade between $30 and $34.

Read More: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

On-Chain Metrics: Validating Price Appreciation

On-chain activity indicates that the price appreciation is genuine, with notable spikes in key metrics:

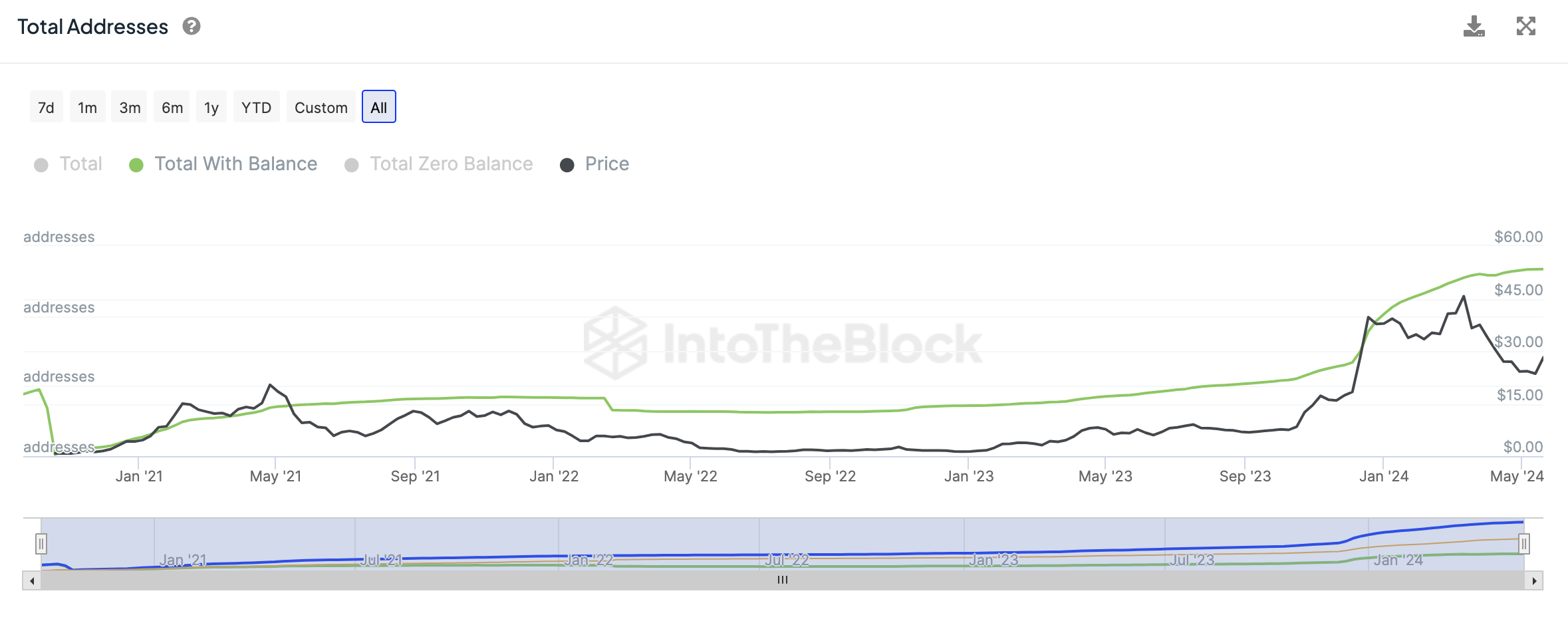

Total Addresses at All-Time High: The total number of addresses holding INJ is at an all-time high, signifying growing interest and adoption.

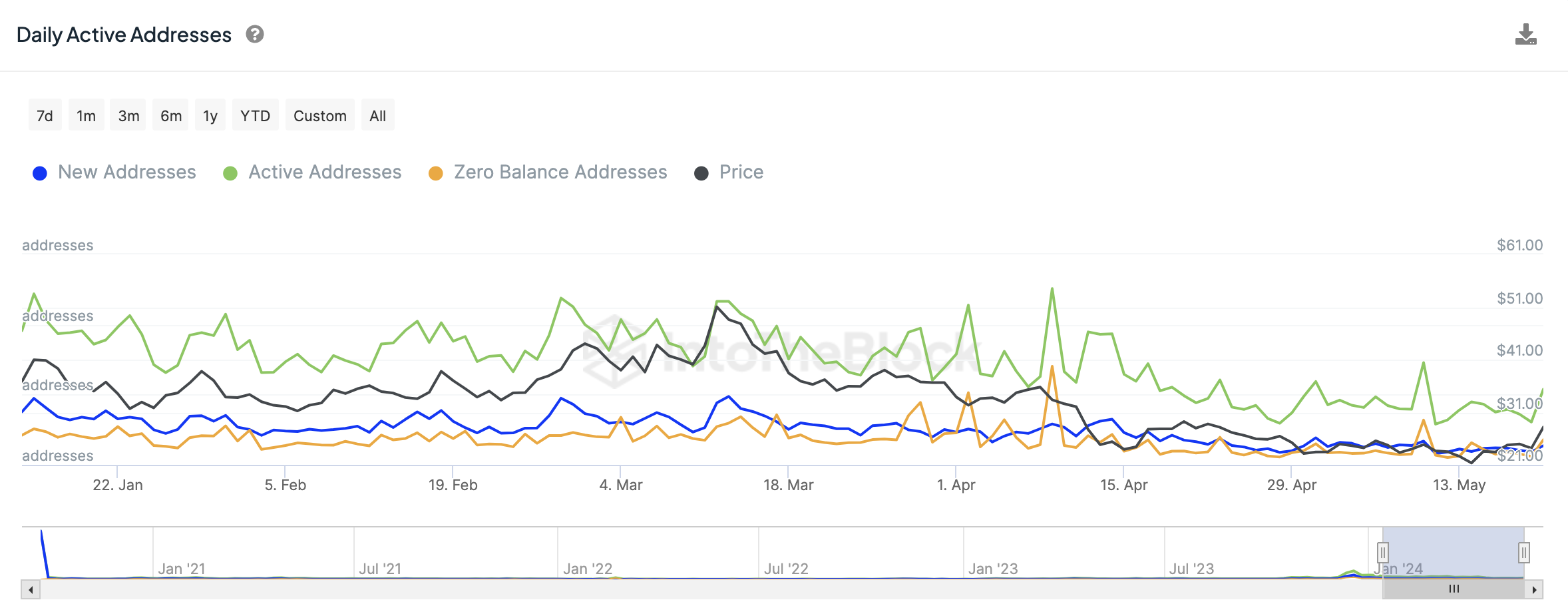

Active Addresses Rising: The number of active addresses has been increasing, which is a positive indicator of network activity and engagement.

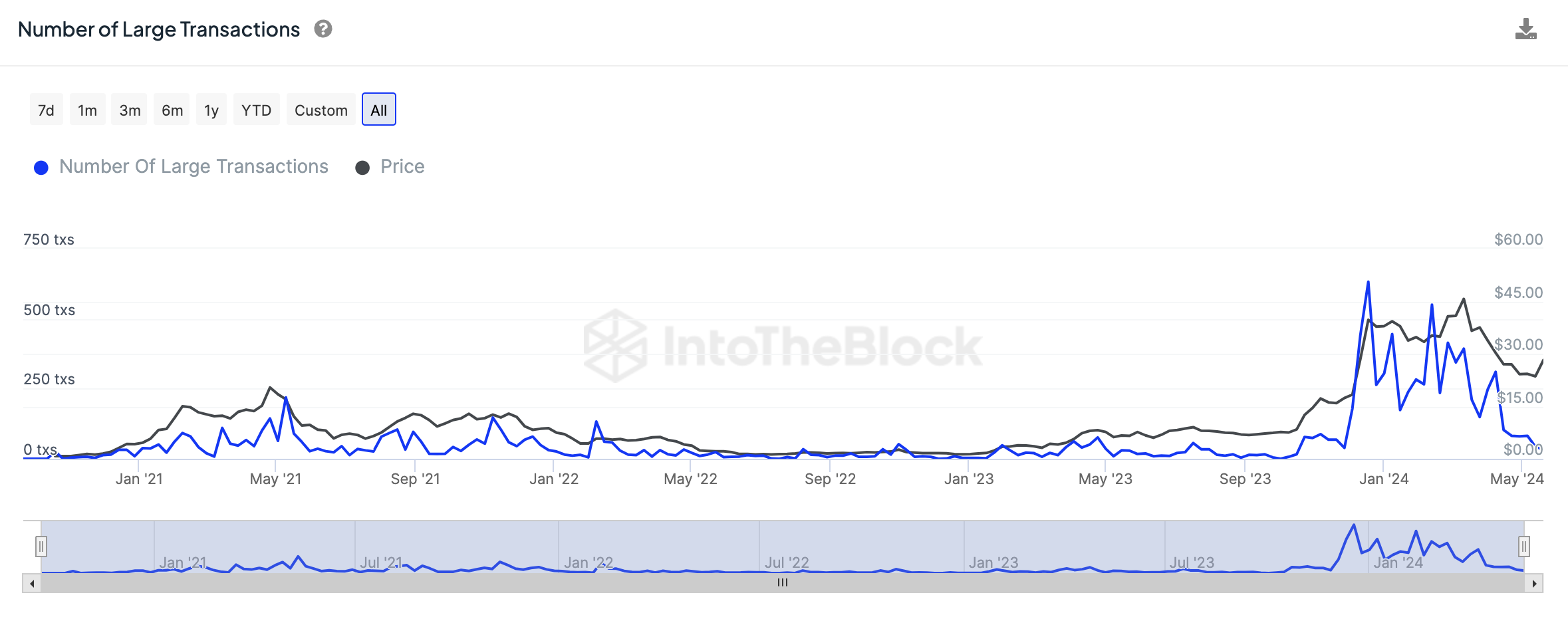

Large Transactions Decline: The number of large transactions has been declining noticeably, which can be beneficial for the coin’s stability. Decreasing large transactions can reduce volatility and make the market less susceptible to sudden, large-scale sell-offs, leading to a more stable price and a less risky investment environment.

Read More: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

Strategic Recommendations and Price Projections

Bullish to Neutral Outlook:

Target Level at $29.5: If the price enters the daily Ichimoku cloud, the initial target is $29.5. This level serves as a significant resistance.

Major Price Appreciation: A break above $29.5 could trigger major price appreciation, with potential targets at $34, $38.4, and potentially reclaiming $40.

Downside Risk: If the price tests the lower boundary of the Ichimoku cloud and fails to hold, it could lead to an exit to the downside, negating the bullish probability and leading to further declines.