India’s finance minister has said that the country will take a considerate approach to regulating the crypto sector, but acknowledged the underlying risks they can pose.

Speaking at Stanford University, Nirmala Sitharaman said: “It will have to take its time. It can’t be rushed through.”

Sitharaman reiterated that the government is not against innovation in technology. “These are some of the concerns, not just in India, but in many countries of the world. So, our intention is in no way to hurt this [innovation]… but define [it] for ourselves.”

India to launch e-rupee next year

India is preparing to launch its own central bank digital currency (CBDC) with Sitharaman saying that an e-rupee is likely in 2023.

T. Rabi Sankar, deputy governor of the Reserve Bank of India (RBI), said earlier this month that the central bank is taking a nuanced approach toward its digital rupee.

“We will probably start off with one pilot and move on from one to the other. The wholesale segment is probably the first one we will try out as it will be the easiest to implement. The other segments are more technology-intensive,” he said.

Country lagging behind Asian peers

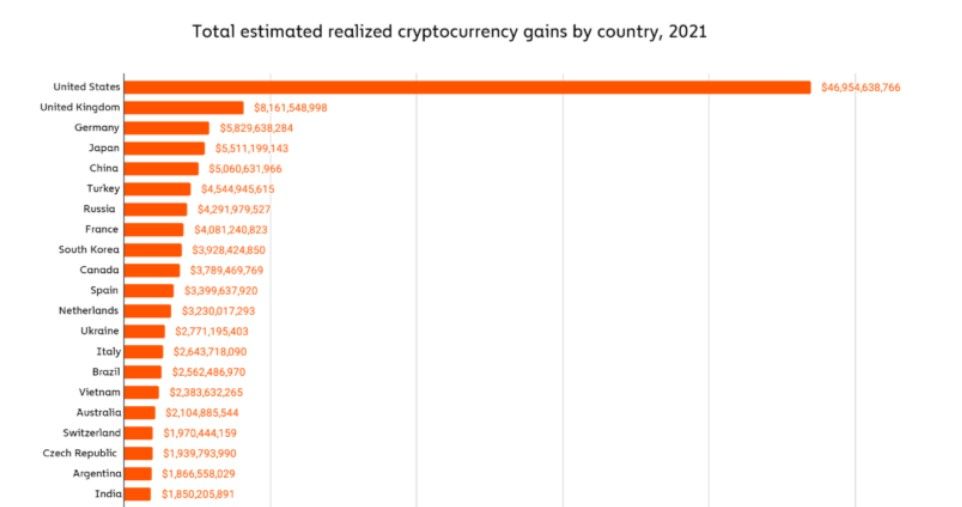

While India has been at the forefront of several technological innovations, the country is lagging behind its Asian peers in realized gains when it comes to crypto.

In a recent report by Chainalysis, India was in 21st position with an estimated realized gain of $1.85 billion. However, Turkey made it to the sixth spot with $4.6 billion, and Vietnam came 16th with $2.7 billion.

And despite China’s crackdown on the sector last year, it was in the top five performers at $5.1 billion in realized gains. Although the country did witness a lower year-on-year increase of 194% compared to countries like the United States and the United Kindom.

Shivam Thakral, CEO of BuyUcoin, said: “It’s a great encouragement for the crypto community across the globe to see that crypto investors have made handsome profits by putting their faith in crypto assets.”

Thakral also felt that India’s crypto gains are handsome despite regulatory uncertainty in the sector.

When it comes to crypto gains, the report found that Ethereum was the most noteworthy performer. The Chainalysis report said: “Ethereum just edged out bitcoin in total realized gains globally at $76.3 billion to $74.7 billion. We believe this reflects increased demand for Ethereum as the result of DeFi’s rise in 2021, as most DeFi protocols are built on the Ethereum blockchain and use Ethereum as their primary currency.”