Elrond (EGLD) has broken out from a descending resistance line and moves towards the closest resistance at $169.

Icon (ICX) has broken out from a symmetrical triangle. It is expected to continue increasing at least until it reaches $3.30.

UMA (UMA) has bounced at a long-term support level. However, it has yet to break out from a short-term descending resistance line.

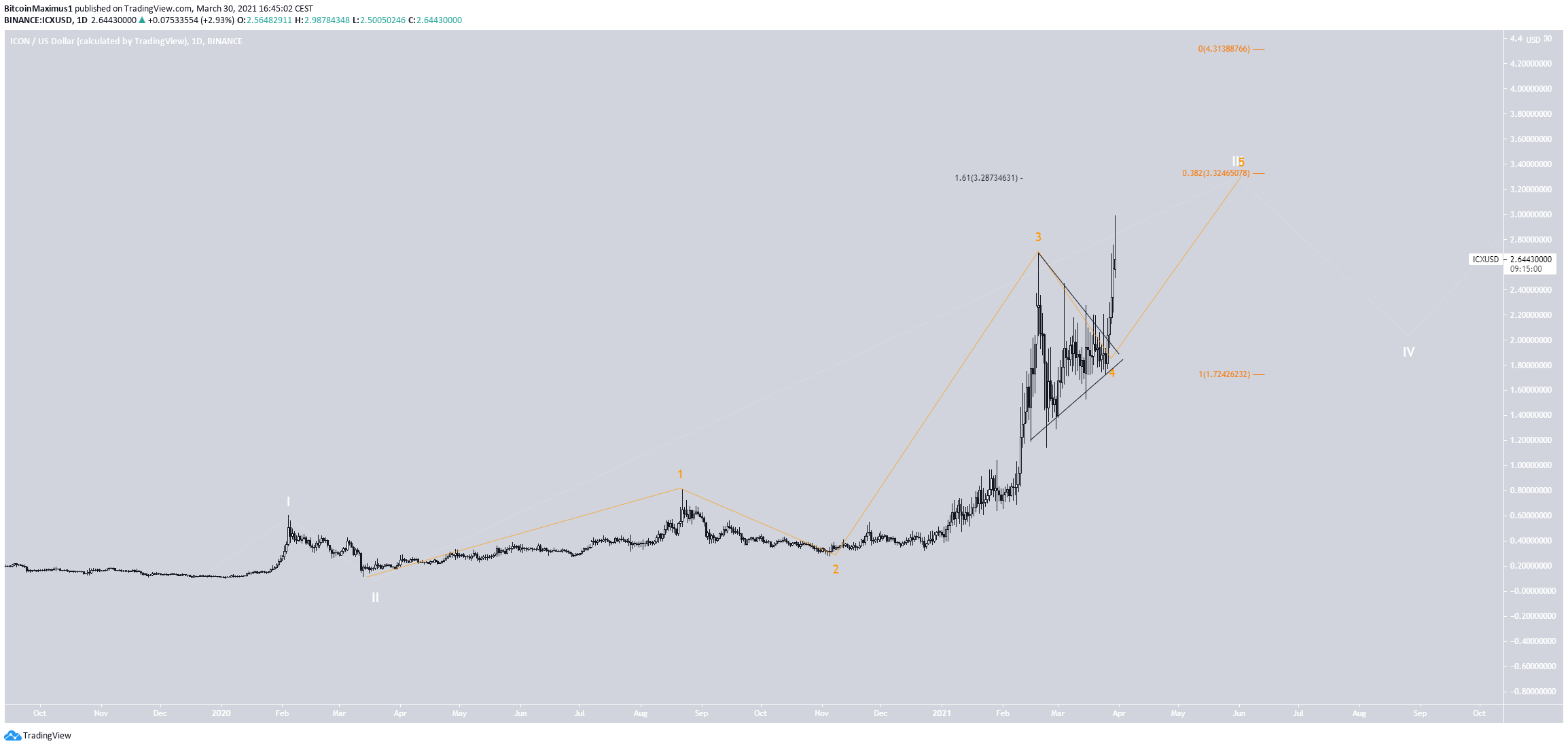

Icon (ICX)

On Feb. 29, ICX reached a high of $2.69 before decreasing. It failed to break out above the February high until exactly one month later, on March 29.

So far, it has managed to reach a high of $2.88 before decreasing slightly.

The main resistance area is $3.10, being the 0.618 Fib retracement of the previous downward movement. If successful in breaking out, ICX could increase all the way to $4.92.

Technical indicators in the weekly time-frame are bullish. Both the MACD & Stochastic Oscillator are increasing.

While the RSI has generated a potential bearish divergence, it has just crossed above 70.

The wave count suggests that ICX is in sub-wave five (orange) of wave three (white).

A potential target for the top of this move is found at $4.30. The target is found using an external retracement (black) on sub-wave four and a Fib projection on waves 1-3.

After $3.30, the next potential target would be found at $4.30.

Highlights

- ICX is facing long-term resistance at $3.10.

- It has broken out from a symmetrical triangle.

Elrond (EGLD)

EGLD has been decreasing since Feb. 9, when it reached an all-time high price of $216.99. Since then, it has been following a descending resistance line.

On March 26, it managed to break out above this line.

Technical indicators in the daily time-frame are bullish.

There is a hidden bullish divergence in the MACD, RSI & Stochastic oscillator. Furthermore, the MACD has given a bullish reversal signal, and the RSI has crossed above 50.

Therefore, EGLD is expected to increase at least towards $169 and possibly higher.

Highlights

- EGLD has broken out from a descending resistance line.

- There is resistance at $169.

UMA (UMA)

UMA has been increasing since bouncing at the $19 support area on Feb. 23. After reaching a high of $28.95 on March 9, UMA returned to validate the $19 support area once more. Since then, it has already created a higher low.

Technical indicators are turning bullish. The MACD has nearly given a bullish reversal signal, and the RSI is close to moving above 50. Similarly, the Stochastic oscillator has nearly made a bullish cross.

However, the shorter-term two-hour chart shows that UMA has yet to break out from a descending resistance line.

Nevertheless, the movement looks like a flat correction. If so, UMA would be expected to break out and increase towards $31.45. The two-hour MACD & RSI support the possibility of a breakout.

Highlights

- UMA has bounced at the $19 support area.

- It is following a short-term descending resistance line.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.