HTX announced the launch of its “Sail Together” initiative, distributing $100 million in USDT to traders affected by the October 11 market downturn that triggered liquidations exceeding $19 billion across crypto markets.

The compensation program, running through November 15, targets users who sustained verified losses during the sharp price decline and aims to address the impact on the exchange’s global user base.

Market Context and Broader Implications

The program establishes eligibility criteria for participating traders. Users who sustained verified losses of at least $100 between October 9 and 11, 2025, qualify to claim compensation.

These losses must stem from futures trading activities on HTX or other exchanges. Distribution amounts are determined by documented trading losses submitted through the platform.

The airdrop period runs for one month, from October 16 through November 15, 2025, providing a defined window for affected traders to verify and claim their allocations.

HTX stated that compensation levels will be proportional to losses verified through submitted trading records.

The October 11 market event that prompted this initiative occurred amid elevated geopolitical tensions, particularly concerning US-China trade relations. The sharp price decline created significant market disruption, with substantial liquidations across major cryptocurrency trading venues. HTX’s response through the Sail Together program represents one of several industry responses to the volatility.

The incident prompted scrutiny regarding how major cryptocurrency platforms manage user exposure during volatile market conditions.

Analysts noted that such market events typically test institutional and exchange resilience. Platform responses often influence trader retention and confidence levels.

Industry Assessment of Support Measures

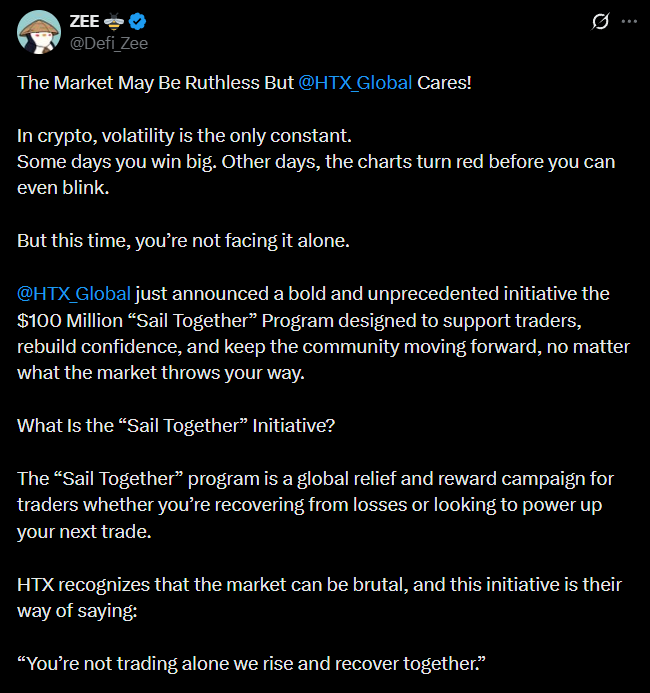

DeFi researcher Zee commented on the initiative via X(Twitter).

Other prominent voices in the Web3 space shared similar assessments on social media. Influencers Raph_GMI and Dìchén also commented on the initiative, highlighting its role in supporting traders during market turbulence.

The effectiveness of such initiatives in stabilizing user engagement remains subject to market observation. Industry participants continue monitoring similar support programs by other exchanges.

These programs may affect trader retention and platform participation rates during subsequent market cycles.