One of the primary attractions of bitcoin (BTC) is that, unlike fiat currencies, the supply is finite. This gives the asset a highly deflationary characteristic which itself has become desirable in a world where central bank money printers are working overtime.

Bitcoin was mathematically designed this way as a decentralized hedge against a flawed banking system that was largely responsible for the last major economic crisis, in 2008. Over a decade later, the global economy is in turmoil again and banks are printing money like there is no tomorrow in order to try to keep their respective economies from falling into a financial abyss.

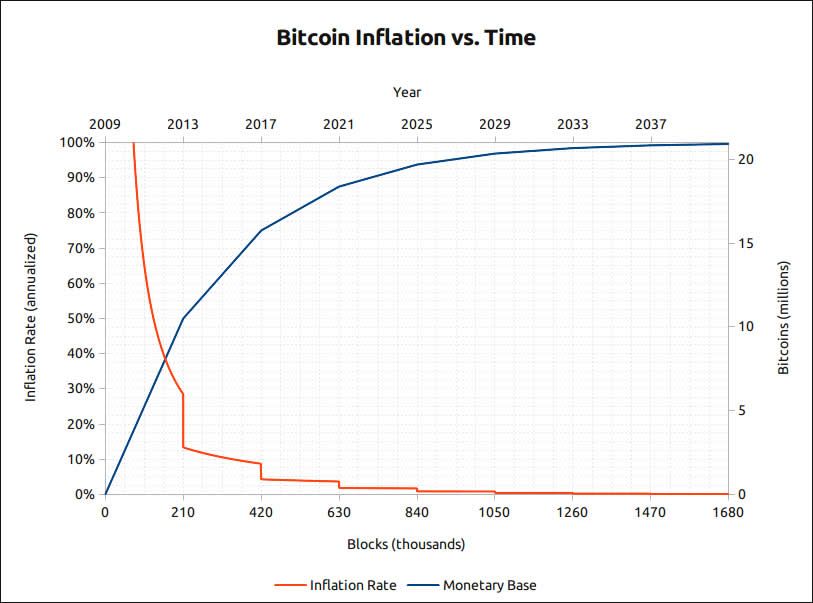

With almost 90% of the entire bitcoin supply already produced, in circulation, or lost forever, there are not many of them left to go. This basic chart simplifies Bitcoin’s predictable issuance and monetary supply:

To understand why bitcoin was designed this way, we have to go back a few years to its inception.

A brief history of bitcoin

Following a number of attempts at a digital currency, the most successful being computer engineer Wei Dai’s B-money in 1998, the enigmatic Satoshi Nakamoto apparently began working on his whitepaper in 2008. In October of the same year, it was published titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

The nine-page paper outlined the design and justification for a digital currency with the intention of doing what no other attempt could do before — create an anonymous, trustless, decentralized currency. It said:

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

Satoshi was no fan of the modern banking system, particularly fractional-reserve banking whereby a bank accepts deposits and makes loans or investments with other people’s money, but is required to hold reserves equal to only a fraction of these deposit liabilities.

In the early days, bitcoins were sent to and from users out of interest and to test the software. The first real use of BTC to actually buy something was made in 2010 when Laszlo Hanyecz famously asked for pizza on the bitcointalk forum in exchange for 10,000 bitcoins. He received a $25 order of pizza in exchange for the BTC, marking the first ever transaction for a tangible asset.

In the first year of bitcoin’s existence, there were no exchanges to change fiat into bitcoin and vice versa. This essential requirement was addressed by Jed McCaleb who turned his domain name mtgox.com into the first ever bitcoin exchange called Mt. Gox, which was originally known as Magic: The Gathering Online Exchange.

By 2014, Mt. Gox was handling 70% of global bitcoin transactions and its infrastructure was starting to feel the pressure. It had also been effectively frozen out of the United States banking system the previous year due to regulatory issues. The exchange was closed down in 2014, following the loss of over 744,000 BTC.

As the asset grew in popularity and price, more exchanges and trading platforms were spawned and worldwide adoption increased. On Jan. 3, 2019, bitcoin turned ten and was a globally recognized digital asset trading at around $3,870.

How many bitcoins are left to mine?

At the time of writing, there were 18.6 million BTC in circulation or 88.57% of the predetermined maximum of 21 million. This means that there are approximately 2.4 million left to mine. Due to the mathematical model governing bitcoin issuance, it will take around 119 years to mine the remaining 11.5% of the supply.

The year 2140 is the target date for the exhaustion of bitcoin production, according to the issuance chart and hardcoded blockchain. Every four years, the number of Bitcoins produced per block is cut in half.

It takes ten minutes to produce a block and the current mining reward is 6.250 BTC per block. In 2024, this will drop to 3.125 BTC per block, halving, again and again, every four years until the supply is exhausted. Currently, there are 900 BTC mined per day.

This halving feature also gives rise to pricing models such as “stock to flow” ratios. The currency in circulation — stock — is divided by the number of new coins generated — flow — making it a “hard” currency, which tends to increase in value as has been the case since inception.

Scarcity also drives demand and this has been clearly evidenced by the avaricious behavior of institutional funds in 2020, which have snapped up the asset at unprecedented levels. Using bitcoin as a hedge against state endorsed fiscal policy, aka money printing, these institutional players are unlikely to sell the asset if they perceive it will increase in value in the long term. This further fuels the scarcity property of the asset.

Lost bitcoins

In 2018, industry experts estimated that there are at least 4 million BTC that are “lost,” while 2 million had been stolen.

This leaves a current theoretical circulation closer to 14.5 million usable and tradable coins. The Wall Street Journal estimated that around 20% of all existing coins have been “misplaced” and are highly unlikely to return to circulation.

There are more extreme estimations of lost coins such as an April 2020 research paper by manager at Cane Island Alternative Advisors, Timothy Peterson, who claimed that 1,500 bitcoins are lost each day meaning only 14 million of them will ever circulate.

The significance of 1337

The figure 1337 is widely used online to represent the term “LEET,” which means “Elite.” It has often been attached to bitcoin with the premise that owning just 0.1337 BTC will put you among the global elite of investors should the asset reach those lofty seven-figure price predictions over the next decade.

At the previous all-time high prices of close to $42,000, that amount of BTC would only equate to around $5,600, but if the asset surges into seven figure territory in the next decade or so it could be worth a whole lot more. At the moment, owning just one bitcoin is beyond the majority of the average person of working age that does not have tens of thousands of dollars lying around.

Who are the bitcoin whales?

The ownership of bitcoin is very top-heavy, meaning that a few addresses own the majority of the asset. This has been exacerbated recently with huge institutional funds such as Grayscale and MicroStrategy hoovering up thousands of them at a time. It has also been widely reported that Satoshi mined about 1 million BTC and none of these coins have moved in the last decade.

According to the Bitcoin Rich List, just 101 addresses hold around 14% of the current supply of bitcoins, which equates to around $90 billion, though many of the larger ones belong to exchanges. An additional 30% of all bitcoin is also held in whale addresses with 1,000 to 10,000 coins in them.

Another eye-opening statistic is that around half of all addresses hold less than 0.001 BTC. So essentially, over 85% of all bitcoins currently circulating are held in addresses containing more than ten coins.

If this trend continues, and the whales have no intention of selling their holdings, the amount of bitcoin left over for the average Joe to buy will be severely limited.

Supply and demand

In conclusion, there are just 2.4 million bitcoins left to be mined over a period of 119 years. With almost 90% of all the BTC ever to exist already circulating or lost forever, those new ones will be spread very thin indeed.

The current market cycle indicates that institutions have been buying the asset at unprecedented levels and this is not likely to change given the current dire economic circumstances across the globe.

Over its twelve-year lifespan, the asset’s price has consistently made new peaks and higher lows during bear markets. The bulls and bears have battled it out in four distinct market cycles, but the overall trend has been up.

There is very little, aside from a catastrophic global power failure or the end of the internet as we know it, indicating that this trend will change in the future.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.