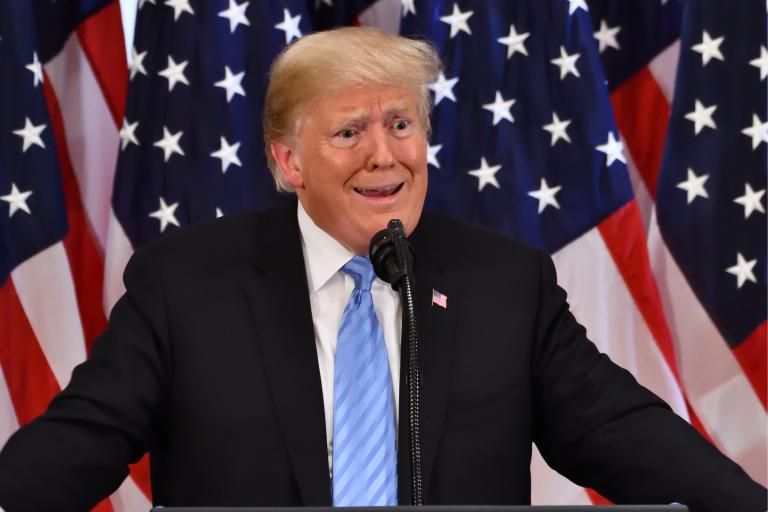

Tensions over the past week between the United States and China have continued to escalate. President Trump informed reporters that the trade agreements were moving too slowly, and steps would be taken in the form of a trade war — including a 25 percent tariff on $200 billion of imported goods.

Needless to say, Trump’s announcement turned markets negative. The potential of a trade war between the world’s two largest economies could spell market disaster. Equities markets responded quickly, losing several percents in inter-day trading.

Escalation Devastation

Trump’s international policies have come under some criticism. Many have suggested that his escalation of international tensions has not produced the correct levels of international cooperation. Others, though, see the escalation as an appropriate step toward balancing the trade deficit with China.

Regardless, the escalation will likely have a serious impact on markets. While the US equities market remains relatively strong, both Europe and China face serious consequences due to already-weakening positions. Morgan Stanley’s head of U.S. public policy strategy, Michael Zezas said:

“While we expect a re-escalation would be temporary, as market weakness would help bring both sides back together, any escalation inherently augments uncertainty and further undercuts risk markets. Negative surprises like a potential re-escalation of trade tensions can have a greater price impact than fundamentals might dictate.”

Fed to the Rescue?

Should the trade war escalate, the economic fallout could be substantial. This sort of pull-back would require a response from the Federal Reserve (Fed). The situation would mandate a drop in interest rates to protect the hoped-for economic ‘soft landing’. According to DataTrek co-founder Nick Colas:

“With US equity volatility looking to rise this week, markets will inevitably back into an ever-stronger view that Fed policy will have to shift. On the plus side, that should limit daily slides in stock prices. On the downside, it paints the Fed into an ever-tighter corner. And it will force equity investors to have higher conviction that a rate cut is coming than the central bank itself has just now.”

Though the Fed’s response could provide some limited support, the variance between fundamentals and market slide could set off a chain reaction.

If fundamentals are strong, a decrease in borrowing rates could produce substantial inflationary pressure. If the trade war suddenly halts, and fundamentals are weak, the market could drop off rapidly. Engineering a rescue would be tough.

Bitcoin FTW?

Trump’s threats places the Fed in a tight corner. This could actually drive Bitcoin prices higher because of the decentralization that protects Bitcoin from political intrigue.

Additionally, risks to the wider economy could put Bitcoin in a perfect position for growth. As equities markets decline, store of value (SoV) assets like Bitcoin provide safe haven protection for investors.

Already, uncertainty in the economy has driven the price of Bitcoin (BTC)over $6,000. Should greater uncertainty enter markets, there could be a substantial upside. Either way, the trade war with China could be just the medicine Bitcoin needs.

Do you think US-China relations will spark upside potential for Bitcoin, or will it follow the wider market back down? Let us know your thoughts in the comments below!