Hedera Hasgraph’s native token HBAR has surged nearly 15% in the past week, marking one of its strongest weekly performances since July.

However, on-chain metrics suggest the rally may already be running out of steam. The gradual bearish shift in the market’s sentiment may strain HBAR’s upward momentum and raise the risk of a pullback in the coming days.

SponsoredHBAR’s Sentiment Slumps Into Bearish Zone

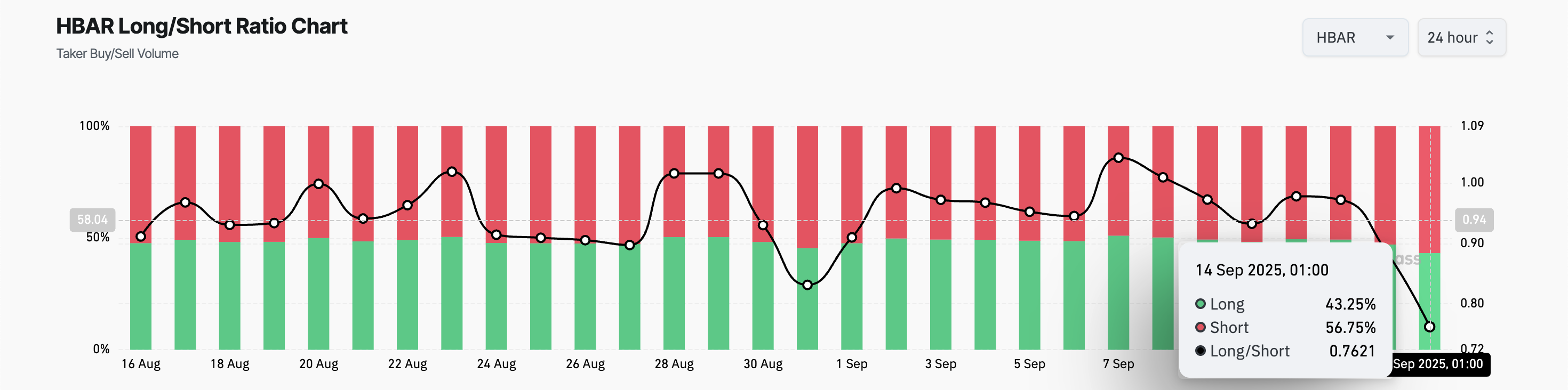

According to Coinglass, HBAR’s long/short ratio has plunged to a 30-day low, reflecting the bearish tilt in market sentiment. As of this writing, the ratio stands at 0.76, indicating more traders are betting against the altcoin’s sustained rally.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

An asset’s long/short ratio compares the number of its long and short positions in a market. When the ratio is above 1, there are more long than short positions, indicating that traders are predominantly betting on a price increase.

Conversely, as seen with HBAR, a ratio under one indicates that most traders are anticipating and positioning for a price decline. This reflects heightened bearish sentiment and signals that downside pressure may continue to build in the near term.

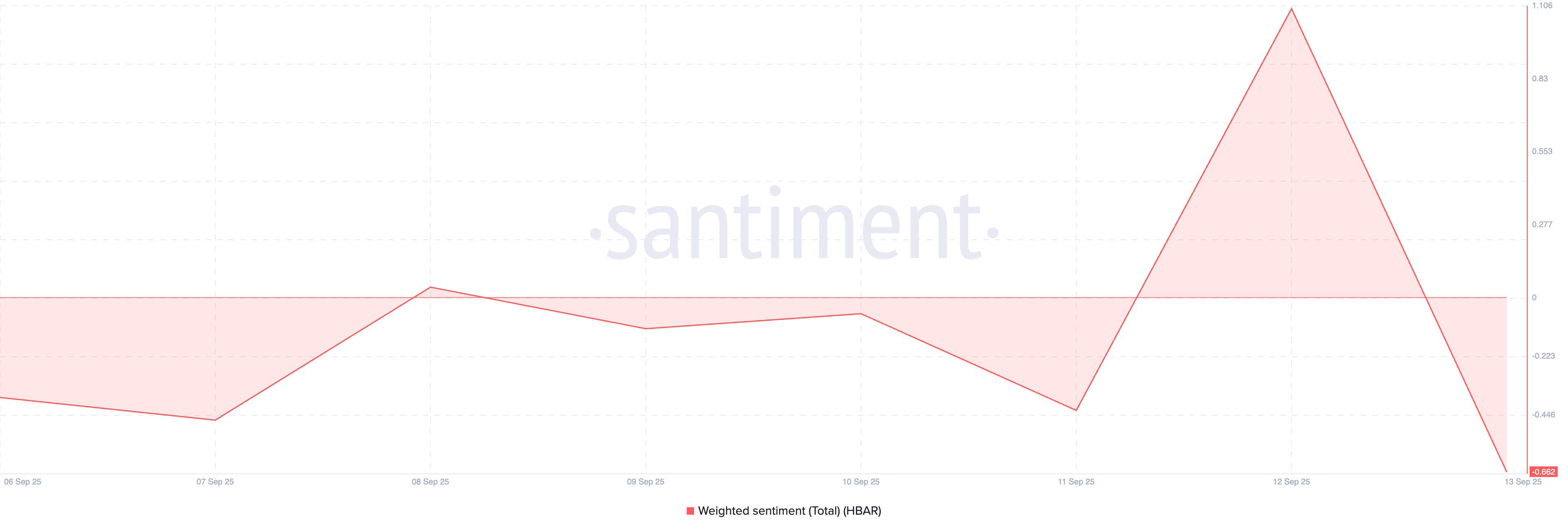

SponsoredFurthermore, HBAR’s negative weighted sentiment has flipped back below zero, confirming the growing sell-side pressure. At press time, this stands at -0.62.

The metric measures the balance of positive versus negative mentions of an asset across social media platforms, adjusted by how often it’s discussed.

When an asset’s weighted sentiment turns negative, it shows that market sentiment from social data is bearish. It means traders and investors are leaning pessimistic, which could weigh on HBAR’s price performance in the coming week.

Hedera Bulls Fight to Hold $0.2123 as Bears Loom Large

A dip in buying activity could trigger a price decline toward $0.2123. Should the bulls fail to defend this critical support floor, HBAR’s price could witness a deeper drop toward $0.1702.

However, HBAR could extend its rally to $0.2762 if demand regains momentum.