Hedera’s native token HBAR is facing mounting sell-side pressure as it eyes a potential return to its two-month low. The token has plunged nearly 10% over the past week, amid the broader market’s decline.

With growing investor caution, HBAR may slide further if bearish sentiment intensifies.

HBAR Faces Rising Selling Pressure Amid Market Retreat

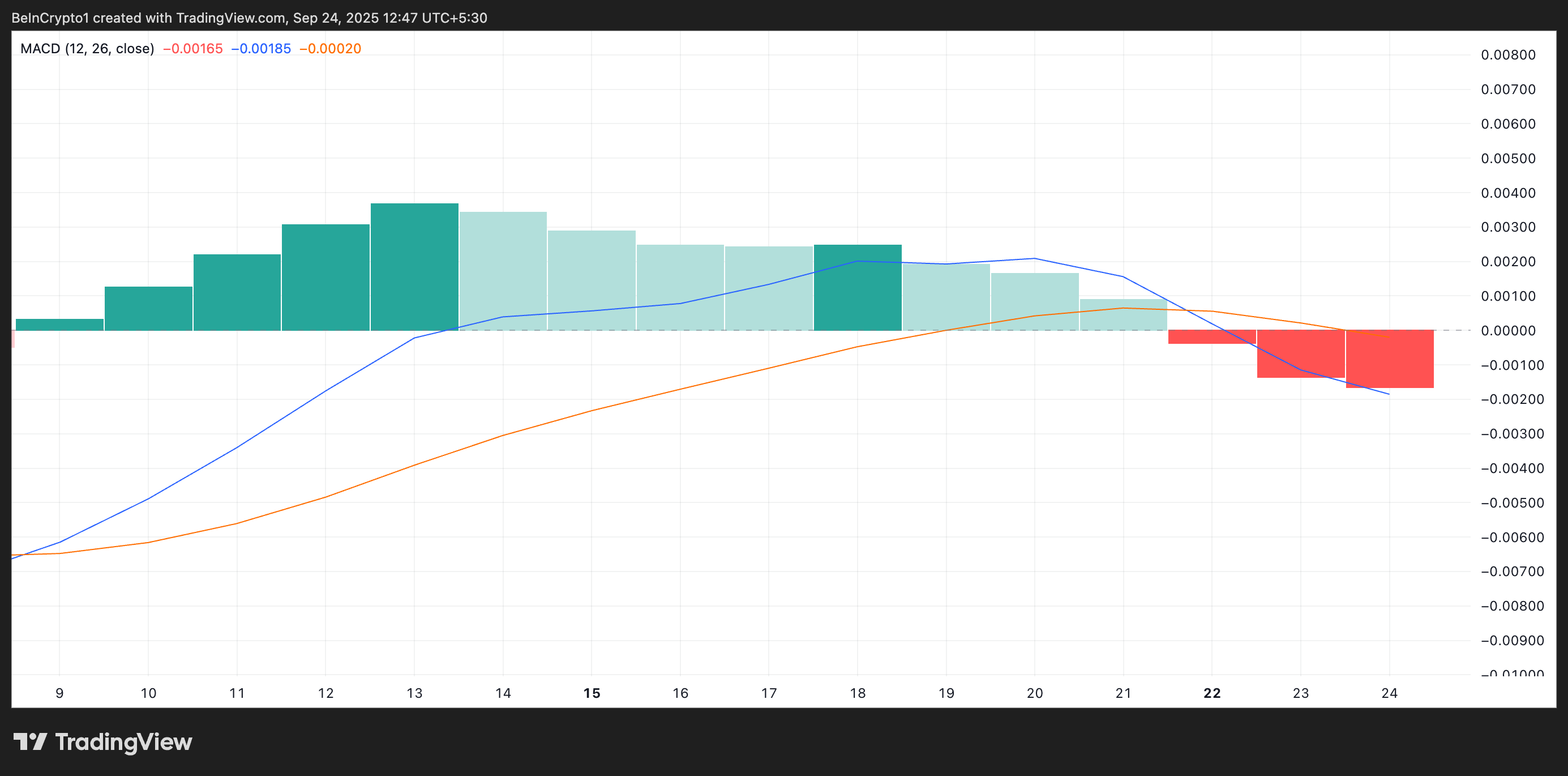

The setup of HBAR’s Moving Average Convergence Divergence (MACD) indicator on a daily chart highlights the negative bias toward the altcoin.

At press time, the token’s MACD line (blue) rests below the signal line (orange), while the red histogram bars have grown in size in the past three sessions, a sign that bearish activity is increasing.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

When the MACD line sits above the signal line, it indicates weakening selling pressure and strengthening buy-side momentum.

Conversely, as with HBAR, when the MACD line drops below the signal line and the histogram displays expanding red bars, it signals intensifying bearish momentum and growing selling pressure in the market.

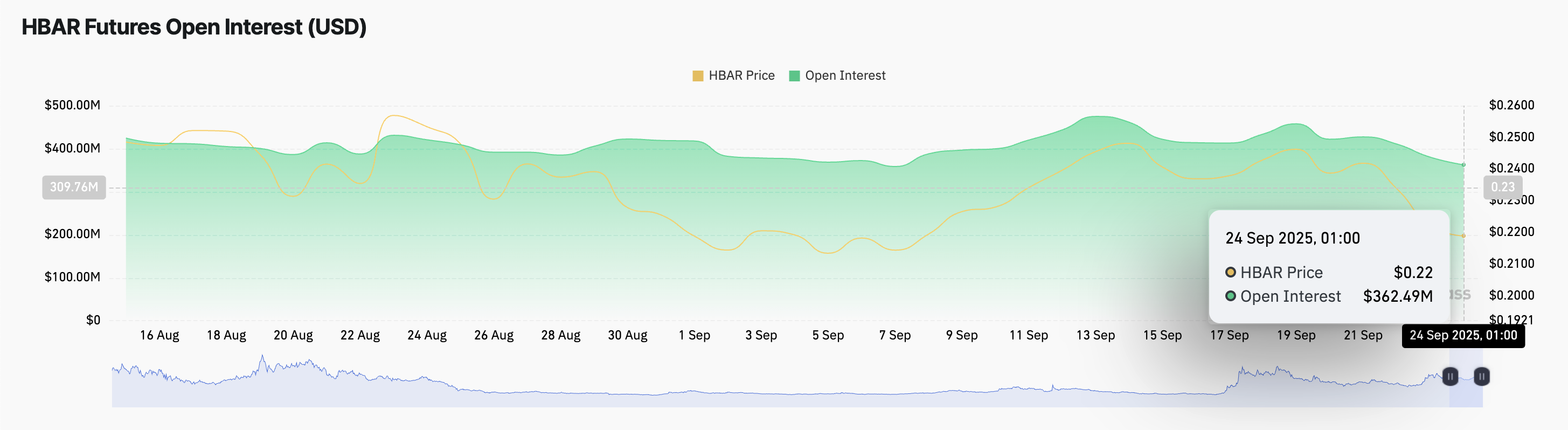

Further, HBAR’s declining futures open interest confirms the waning market participation. Per Coinglass, this currently sits at $362.49 million, down 20% over the past five days.

Open interest represents the total value of outstanding derivative contracts, such as futures or options, that have not yet been settled.

When an asset’s open interest dips, it indicates that traders are closing positions or stepping back from the market, reflecting reduced confidence.

For HBAR, this decline suggests that fewer investors are actively trading the token in derivatives markets, potentially leaving it more vulnerable to continued selling pressure.

HBAR May Plunge Further if Support Fails

A sustained sell-side pressure could cause HBAR’s price to test the support floor at $0.2155. If the bulls cannot defend this level, the altcoin could extend its fall and plummet to a two-month low of $0.1944.

However, if new demand returns to the HBAR market, it could trigger a rally toward $0.2667.