After posting 73% year-to-date (YTD) gains, investors still wonder whether the Bitcoin bear market is over. Examining historical trends and the current state of the legacy banking system may shed light on the state of the crypto market.

Multiple factors may contribute to the resurgence of Bitcoin and the impact of the global economic climate on the cryptocurrency industry.

The End of the Bitcoin Bear Market?

Bitcoin has experienced four consecutive months of growth, an unprecedented event in its history. Historically, this trend has never led to new lows, indicating that the Bitcoin bear market may indeed be over.

Still, only time will tell if this pattern holds true and the Bitcoin bear market ends, as the legacy banking system is facing significant challenges.

The Troubled Legacy Banking System

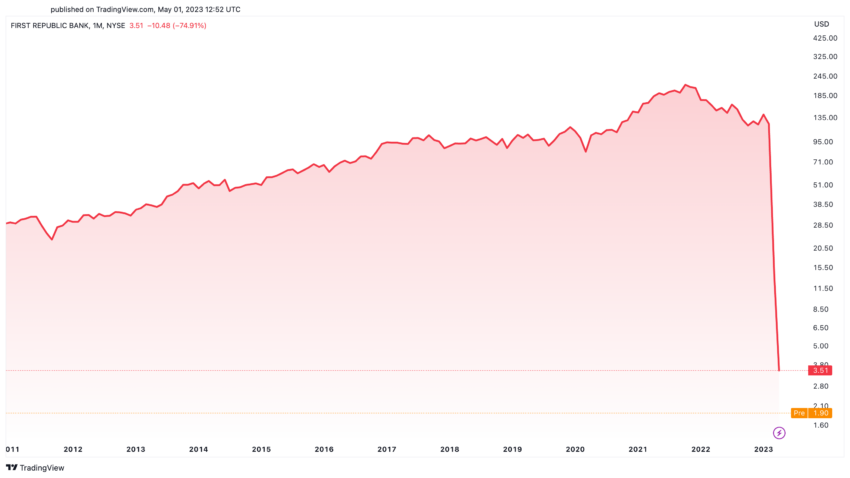

The second and third largest bank failures in US history occurred earlier this year. With First Republic Bank’s stock plummeting by over 50% in a single day, it appears this bank will also fail.

Such an unprecedented event would mean that three of the top five bank failures in US history happened within a four-month period.

This alarming development coincides with the Federal Reserve aggressively raising interest rates at a record pace. Some experts predict that the Fed may pause or even start cutting rates toward the end of the year.

Renowned Investors and Politicians Support Bitcoin

Stanley Druckenmiller, one of the world’s most successful investors, has shorted the US dollar in anticipation of potential rate cuts.

“One area I’m comfortable is I’m short the US dollar. Currency trends tend to run for two or three years. We have had a long [run] higher,” said Druckenmiller

If Druckenmiller’s prediction comes true and the dollar depreciates, the Bitcoin bear market could end, and prices soar to new heights.

Similarly, Texas politician Ted Cruz has publicly expressed his support for Bitcoin. He stated that he loves BTC because the Chinese government and other centralized powers cannot control it.

Cruz further emphasized the importance of Bitcoin as a symbol of freedom and democracy, stating:

“If you like freedom, if you like democracy, if you like capitalism and free markets, you’re probably going to like Bitcoin.”

Contrasting Stances on Bitcoin and the Crypto Industry

While the United States appears to be generally supportive of Bitcoin, its banking system is in turmoil, and the country has implemented strict regulations on crypto. In contrast, Hong Kong is opening up its banking system to attract crypto companies to set up accounts there.

This discrepancy between the US and Asian markets could potentially lead to a disastrous outcome for the American financial landscape and the end of the Bitcoin bear market.

The Future of the Bitcoin Bear Market and Cryptocurrency

The end of the Bitcoin bear market may be near, as suggested by the cryptocurrency’s four-month growth streak.

Still, the future of Bitcoin and other cryptocurrencies remains uncertain due to the challenges faced by the legacy banking system and the differing regulatory approaches taken by various countries.

As the world of finance continues to evolve, it will be crucial for governments, banks, and investors to closely monitor these developments and adapt accordingly to ensure a stable and prosperous future for the cryptocurrency industry.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.