Chainlink (LINK) is drawing the attention of crypto whales and institutional investors alike, signaling renewed confidence in the oracle token amid broader market uncertainty.

Recent on-chain data highlights a surge in accumulation activity, with both private whales and major fund managers doubling down on LINK positions.

Whales Accumulate Chainlink as Grayscale HODLs and Bitwise Prepares Spot ETF Launch

Data from Arkham shows that a single whale withdrew 171,000 LINK (approximately $2.36 million) from Binance on Tuesday. They added to an existing holding of nearly 790,000 LINK acquired over the past month at an average price of $12.72.

This sizable accumulation suggests long-term bullish sentiment, with the investor betting that LINK could outperform in the months ahead.

Derivatives markets are also reflecting heightened speculative interest. OnChain Lens reports that a newly created wallet deposited $5 million in USDC on Hyperliquid DEX. They opened leveraged long positions in LINK (5x) and DOGE (10x).

While the combined position is currently valued at $28.2 million, it is showing a floating loss of roughly $600,000.

The move shows the appetite among sophisticated traders to leverage LINK exposure despite short-term volatility.

Institutional Confidence and ETF Approval Push LINK Toward Scarcity

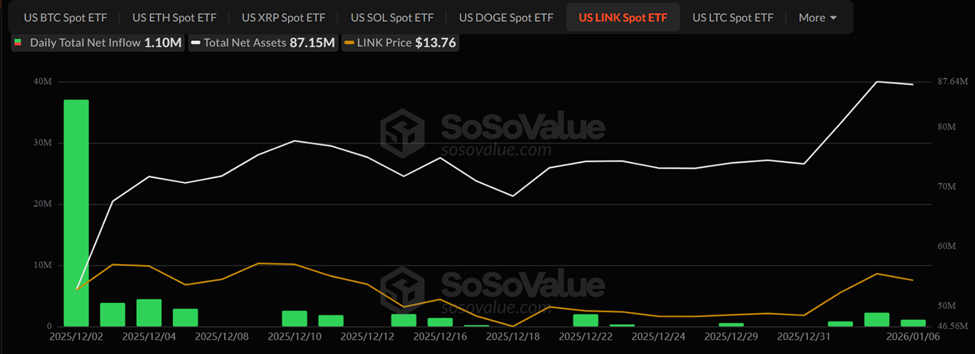

Institutional accumulation remains a central driver behind LINK’s momentum. Grayscale’s LINK Trust recently reached a new all-time high (ATH) in total net assets. Data on SoSoValue shows it is approaching $90 million, with current holdings at $87.15 million.

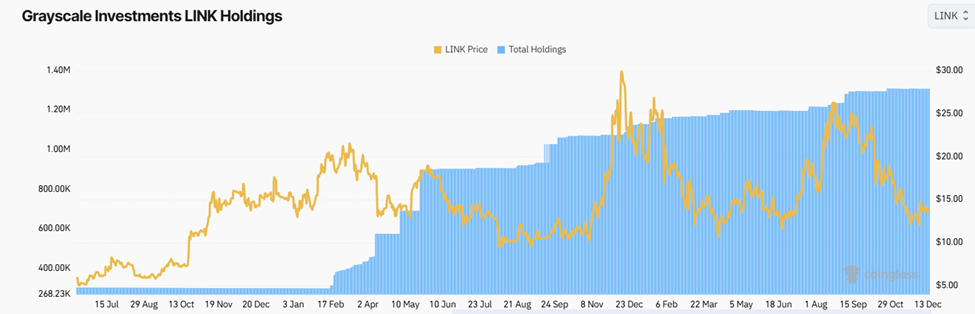

Meanwhile, data on Coinglass shows that over the past two years, Grayscale has held firm with 1.31 million LINK. This demonstrates a disciplined “diamond hand” approach with no sales.

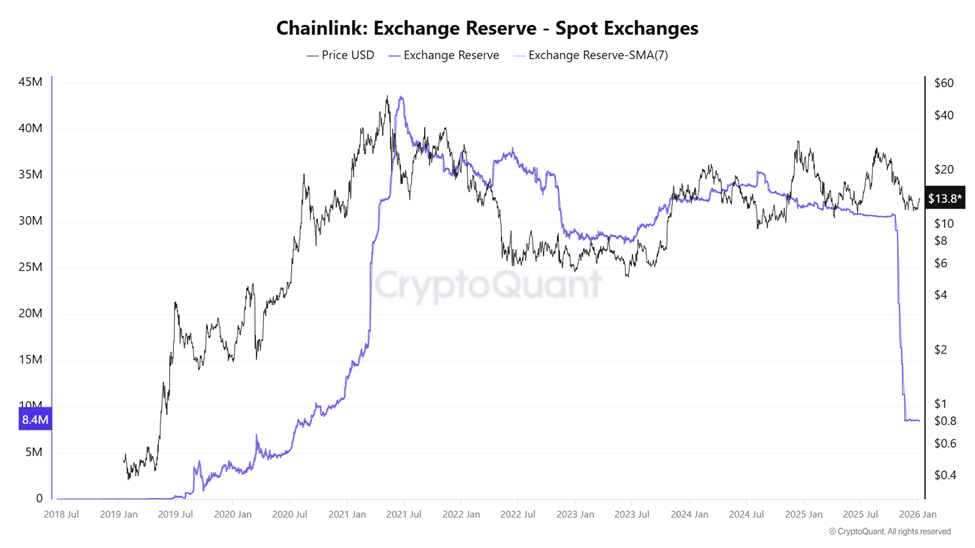

The combination of whale accumulation and institutional HODLing is contributing to historically low LINK balances on exchanges. Data on CryptoQuant shows this, with fewer tokens on exchange generally signaling scarcity. This can amplify price support and reduce selling pressure.

Adding to the bullish backdrop, Bitwise has secured SEC approval to launch a Chainlink spot ETF (CLNK) on NYSE Arca, with trading expected to begin this week. The move marks Chainlink’s first direct entry into US equity markets.

Assets for the LINK ETF will be held by Coinbase Custody and BNY Mellon, providing investors with a regulated and easily accessible vehicle to gain exposure to LINK without directly handling the underlying tokens.

The launch of CLNK could further boost institutional inflows and expand the base of LINK holders, potentially driving the Chainlink price. Despite this news, however, LINK price is only up by a modest 0.8% to trade for $13.84 as of this writing.

These developments are converging to create a favorable environment for LINK.

- Whale accumulation signals confidence among experienced traders.

- Grayscale’s long-term holding strategy reflects institutional trust in the token.

- The launch of a regulated spot ETF is likely to open the door for more conservative investors seeking exposure to Chainlink. It could drive additional demand and reduce liquidity on exchanges even further.

As LINK balances on exchanges reach historic lows and both whales and institutions continue to accumulate, the market appears to be positioning for a potential upward move.

Nonetheless, this bullish fundamental translation into sustained price growth depends on broader market conditions. Among them, investor appetite for both leveraged and spot exposure.