Goldman Sachs strategists have weighed in on the current state of the US stock market, predicting that a bear market—a decline of 20% or more—is unlikely.

Despite high valuations, mixed growth prospects, and lingering policy uncertainty, the team led by Christian Mueller-Glissmann highlights the strength of the private sector. It anticipates supportive moves from the Federal Reserve as key factors preventing a market plunge.

Bear Market Unlikely, But Crypto Doesn’t Look Good

Mueller-Glissmann’s analysis draws from historical trends. Since the 1990s, the frequency of significant downturns in the S&P 500 has decreased. This is due in part to longer business cycles, reduced macroeconomic volatility, and proactive interventions by central banks. These elements create a buffer that minimizes the risk of a deep bear market.

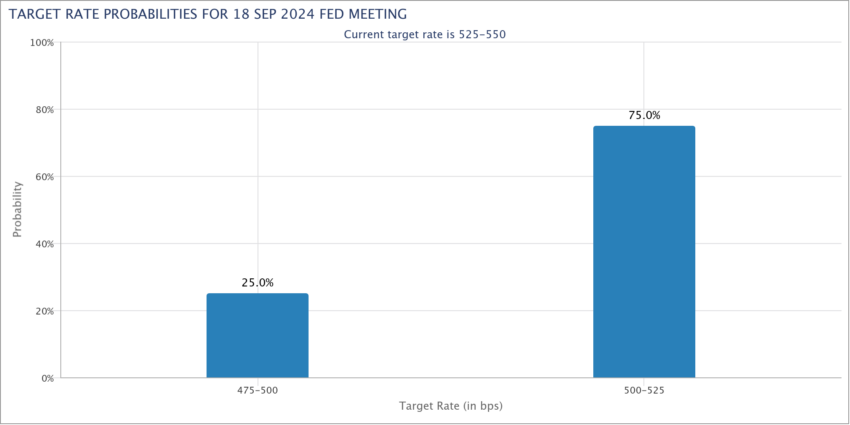

Additionally, Goldman Sachs expects the Federal Reserve to begin cutting interest rates, which could ease some pressure on the markets. While the stock market may still see a dip by year-end, the overall outlook remains cautiously optimistic.

The strategists maintain a neutral stance on asset allocation but carry a “mildly pro-risk” view for the next 12 months.

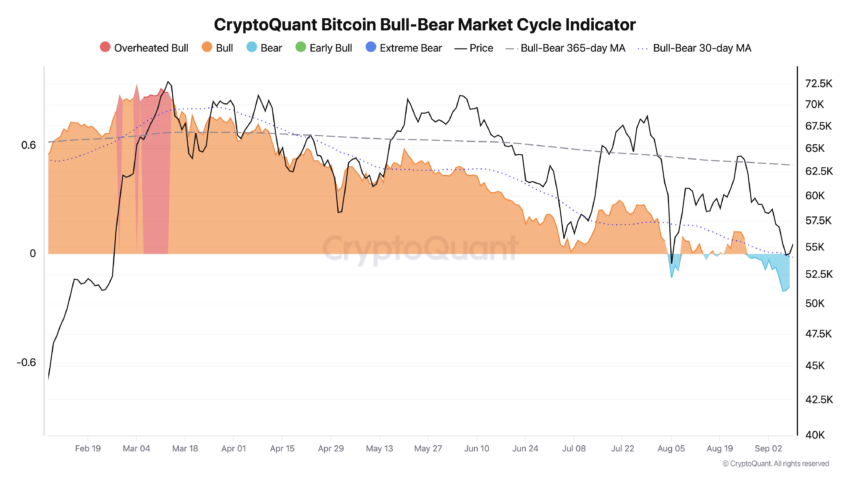

Contrary to the stock market outlook, the cryptocurrency market is showing signs of a potential bear market. Julio Moreno, Lead Analyst at CryptoQuant, notes that Bitcoin is struggling due to declining demand.

“All valuation metrics are in bearish territory,” Moreno said.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Veteran trader Peter Brandt adds that there’s a 65% probability Bitcoin could drop below $40,000, though he remains optimistic about a long-term price surge, potentially reaching $130,000 by 2025.

“In early June I was assigning a 50% probability of $30,000 (approximately a 50% price decline) and a 50% chance of $140,000 (approximately a doubling of price). Since June my technical price indicators have been stacking up in favor of the $30,000 probability,” Brandt said.

In conclusion, while the US stock market appears resilient, the cryptocurrency sector may face headwinds as investors navigate uncertain economic waters.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.