Gemini’s stock fell in post-market trading after the firm released its first quarterly earnings report since its initial public offering (IPO) in September.

The crypto exchange experienced a 52% increase in net quarterly revenue, but posted a net loss of $159.5 million, as operating expenses more than doubled from the same period a year earlier.

Gemini’s Q3 Financial Performance

The third quarter of 2025 was a pivotal one for the Gemini exchange, which went public in September 2025 and began trading under the symbol GEMI on the Nasdaq. In the latest shareholder letter, the firm highlighted that its net revenue reached $49.8 million, a 52% from the previous quarter.

Transaction revenue rose 26% quarter-over-quarter to $26.3 million. Meanwhile, services revenue surged 111% to $19.9 million. The service segment benefited from increased use of Gemini’s credit card, staking, and custody products.

Still, the strong revenue growth was overshadowed by mounting expenses. Gemini posted a net loss of $159.5 million, compared with $90.2 million a year earlier, as costs swelled amid its IPO. The exchange’s loss per share was $6.67, falling short of analysts’ estimates of a $3.24 loss.

Total operating expenses more than doubled to $171.4 million, up from $76.8 million a year earlier. The largest increases came from salaries and compensation.

It rose to $82.5 million, with sales and marketing increasing to $32.9 million as the company intensified its promotional efforts. Adjusted EBITDA came in at negative $52.4 million.

“We believe the increase in operating expenses this quarter primarily reflected higher marketing and customer reward investments, and elevated stock-based compensation costs associated with our transition to life as a public company. Our expense trends otherwise remained consistent with our investment in growth and platform scale,” the shareholder letter read.

Gemini also recorded mixed results from its crypto-related positions, including a $106.8 million gain on digital assets but an $83.1 million loss on related-party crypto loans.

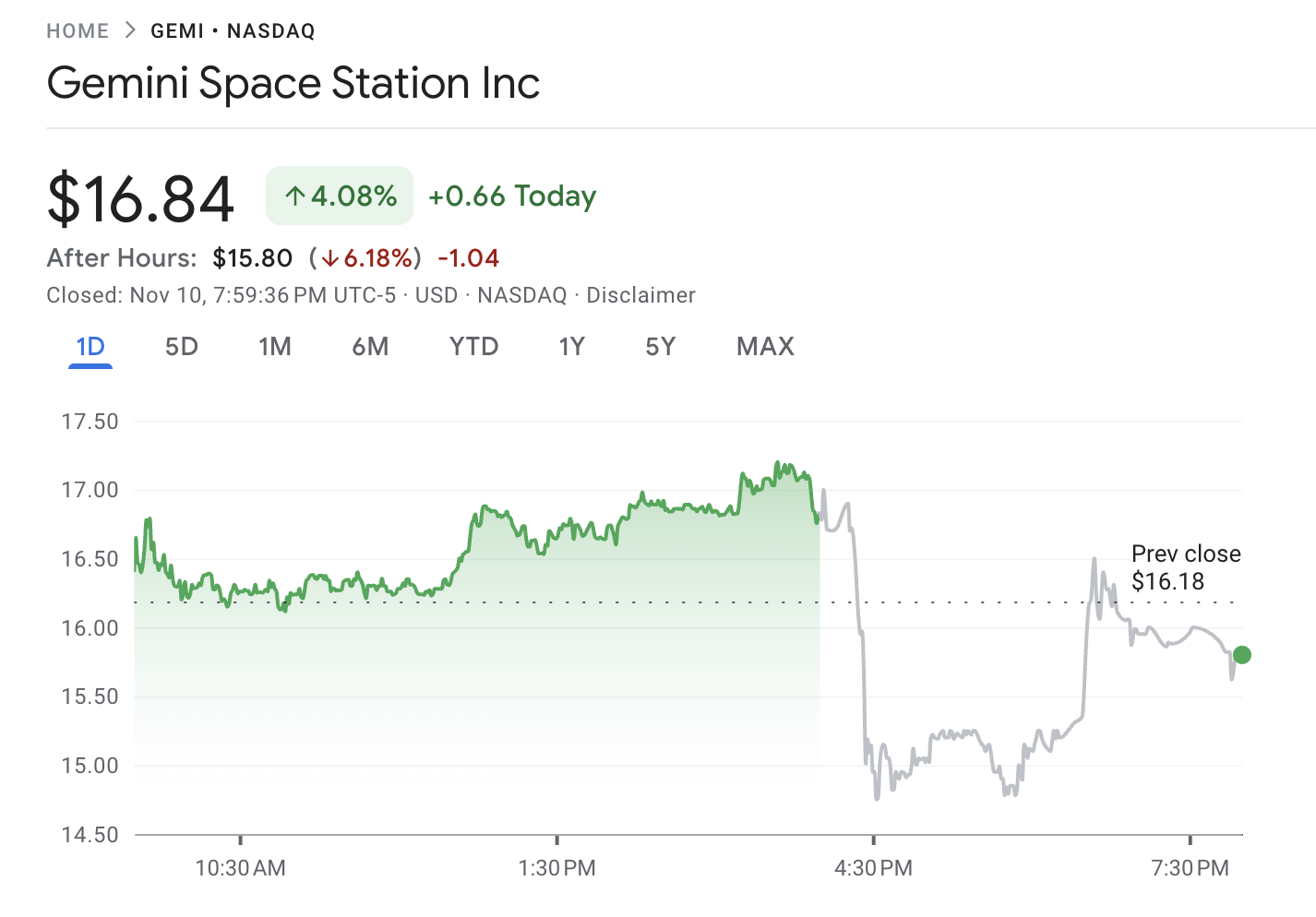

Despite the strong revenue momentum, the widening losses tempered investor sentiment, sending Gemini’s shares lower after the earnings release. Google Finance data showed that GEMI closed at $16.84, up more than 4% on the day. However, in post-market trading, the stock dropped 6.18%.

This performance contrasts sharply with competitors like Coinbase. The exchange’s stock climbed after it revealed a $433 million profit for the third quarter. Now, investors will be watching to see whether Gemini can shift from growth spending to profitability in the quarters ahead.