Galaxy Digital Holdings has gained approval from the US Securities and Exchange Commission (SEC) to reorganize, clearing the way for the company to list its shares on the Nasdaq Stock Exchange.

The digital asset and blockchain firm announced the development on Monday. This marks a pivotal moment in its long-standing ambition to expand its presence in the US market.

Galaxy Digital Stock Eyes Nasdaq Listing in May

In the latest press release, Galaxy Digital revealed that its registration statement with the SEC was approved, a critical regulatory step in the process. This approval sets the stage for the company’s reorganization.

It will involve moving its corporate structure from the Cayman Islands to Delaware. Additionally, a new parent company, New Pubco, will be created.

Galaxy’s CEO and Founder, Mike Novogratz, expressed confidence in the reorganization’s potential to propel the firm’s growth.

“We’re pleased to announce the effectiveness of our registration statement with the SEC. This marks an important milestone for Galaxy, as we take a significant step toward advancing our mission of driving innovation and growth across digital assets and artificial intelligence infrastructure. We look forward to completing the transaction this quarter,” stated Novogratz.

The SEC’s green light clears the way for Galaxy to proceed with a special shareholder meeting scheduled for May 9. Here, investors will vote on the proposed reorganization.

The plan includes transitioning the company’s listing from the Toronto Stock Exchange (TSX), where it currently trades, to the Nasdaq. This move also requires the TSX’s approval.

Galaxy Digital expects the reorganization to be completed by mid-May 2025, pending the necessary approvals. Once finalized, the company plans to list its Class A common stock on the Nasdaq under the ticker symbol “GLXY.” However, New Pubco will remain listed on the Toronto Stock Exchange for a period following the reorganization.

“It’s been a long road, but GLXY is finally on its way to a US listing. Thanks to all who believe in us, and congrats to those who have worked so hard to get @galaxyhq to this milestone. Let’s go!” Galaxy Digital’s Head of Research Alex Thorn posted.

If successful, the listing would position Galaxy as a prominent player among publicly traded crypto firms in the US. Notably, the market has previously proven challenging for the industry amid shifting regulatory landscapes.

Over the past few years, crypto companies’ plans to go public have faced significant hurdles under former President Joe Biden’s administration. The Biden-era “crypto crackdown” saw heightened scrutiny from regulators.

Nonetheless, President Donald Trump’s inauguration earlier this year signaled a more favorable approach to cryptocurrencies. This has prompted a wave of companies like Gemini, Kraken, and BitGo to revive their IPO ambitions.

Galaxy’s announcement aligns with this shift, capitalizing on a perceived thaw in regulatory hostility. Yet, the timing is not without risks. Recent market volatility, driven in part by uncertainty surrounding Trump’s reciprocal tariff policies, has cast a shadow over the market, with stocks and crypto facing the heat.

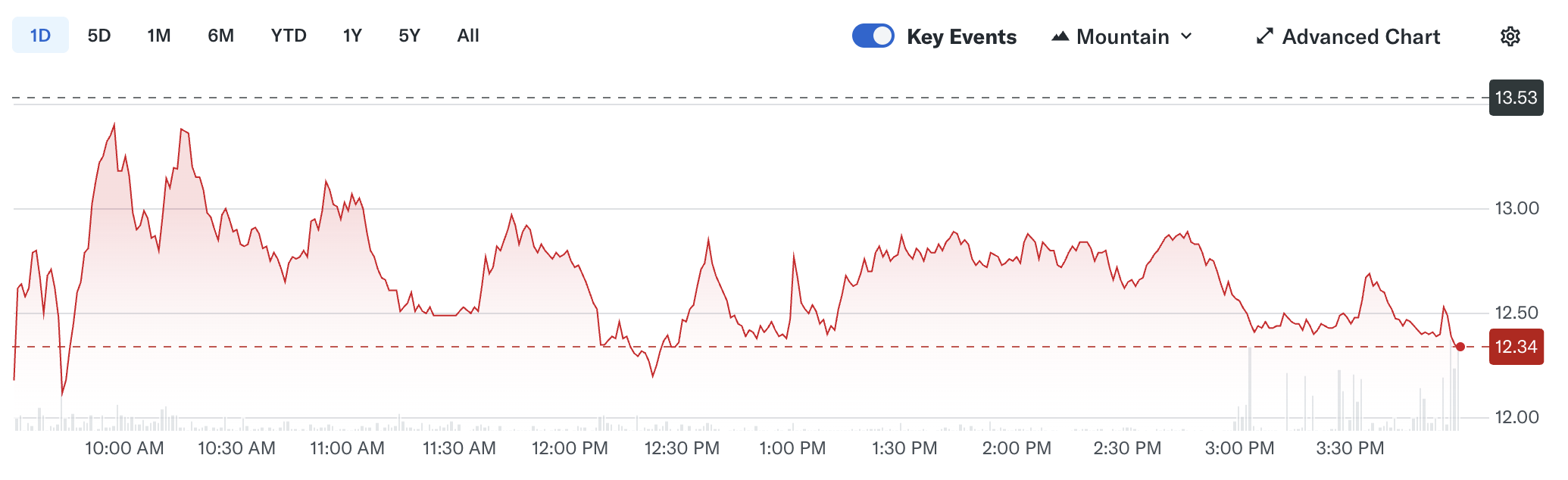

In fact, Galaxy Digital’s stock performance (GLXY.TO) has been quite grim. Even with the latest news, the stock failed to see any positive uptick.

According to Yahoo Finance data, GLXY.TO dipped 8.8%, closing at $12.3. Furthermore, the company’s stock has declined 50.6% since the beginning of the year.