FTX is under more scrutiny after a string of recent developments. Among them is the fact that the exchange holds only $659,000 in less liquid assets.

As more information emerges on the state of FTX, the public is becoming increasingly upset with how the finances of the exchange were managed. New financial information shows that FTX held only a small amount in fair value assets. A court filing also shows some developments which could have an enormous impact on how the case proceeds.

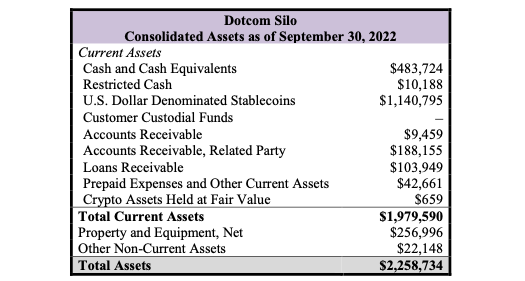

FTX held only merely $659,000 in fair value assets, financial information shows. This is remarkable, given the investment the exchange received, which came from some of the biggest firms in the world. FTX had approximately $1.8 billion from Sequoia, SoftBank, Temasek, Tiger Global, and Ontario Teachers’ Pension Plan.

The filing suggests that Bahamian regulators gained unauthorized access to the exchange to obtain assets after FTX had filed for bankruptcy. The exchange said that the request could put into question the capacity of Bahamian regulators to act as liquidators. The financial mishandling even had new CEO John Ray state the following in a filing,

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

The filing by the new CEO also says that FTX, FTX US, and Alameda do not have accounting departments. He also stated that he couldn’t find the finances for Island Bay Ventures, the entity that holds FTX’s stake in Anthony Scaramucci’s SkyBridge Capital.

Personal drama continues in the FTX saga

Sam Bankman-Fried has been in the headlines endlessly since the collapse of FTX. Most recently, he was interviewed by Vox, when he criticized regulators harshly. He also stated that he regretted filing for bankruptcy.

The interview of Sam Bankman-Fried adds to what is already a very dramatic case, which has included such wild allegations as a sex tape. More information on how the highest executives led the company is still being released to much discussion within the community.

Bahamian authorities request SBF to gain access to funds

The court filing remains one of the most significant events since the bankruptcy filing was made. The Securities Commission of the Bahamas assumed control on Nov. 18.

Bankman-Fried had said that he was asked to gain unauthorized access to obtain the locked digital assets. The authorities responded by stating that “urgent interim regulatory action was necessary to protect the interests of clients and creditors of FTX Digital.”

FTX says this is a serious issue, but it’s not clear how matters will proceed. The market will continue to watch the case, which continues to have an impact on prices.