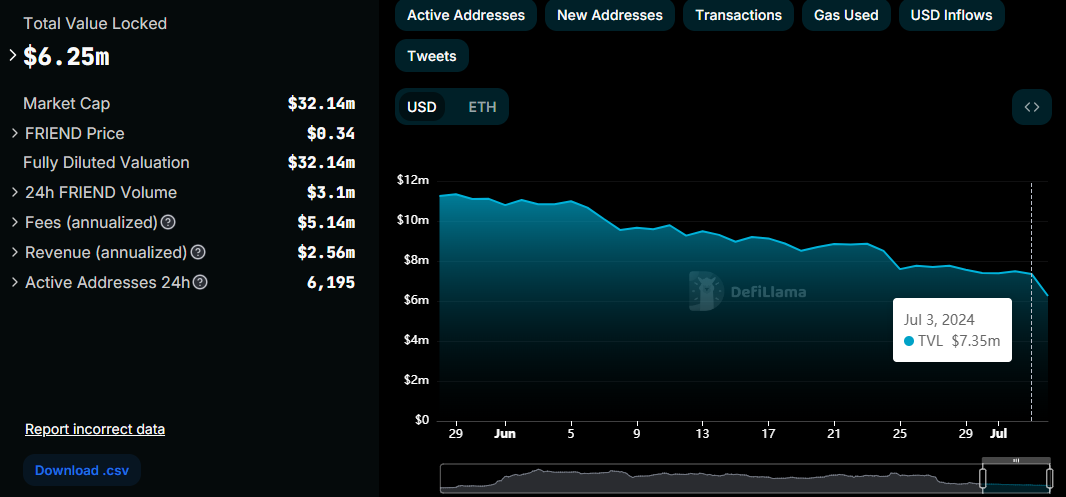

Friend.tech has seen over $1 million in total dollar value held in its smart contracts flow out in less than 24 hours. This has been happening for almost a month now, with the decentralized social media platform’s efforts to alleviate users proving futile.

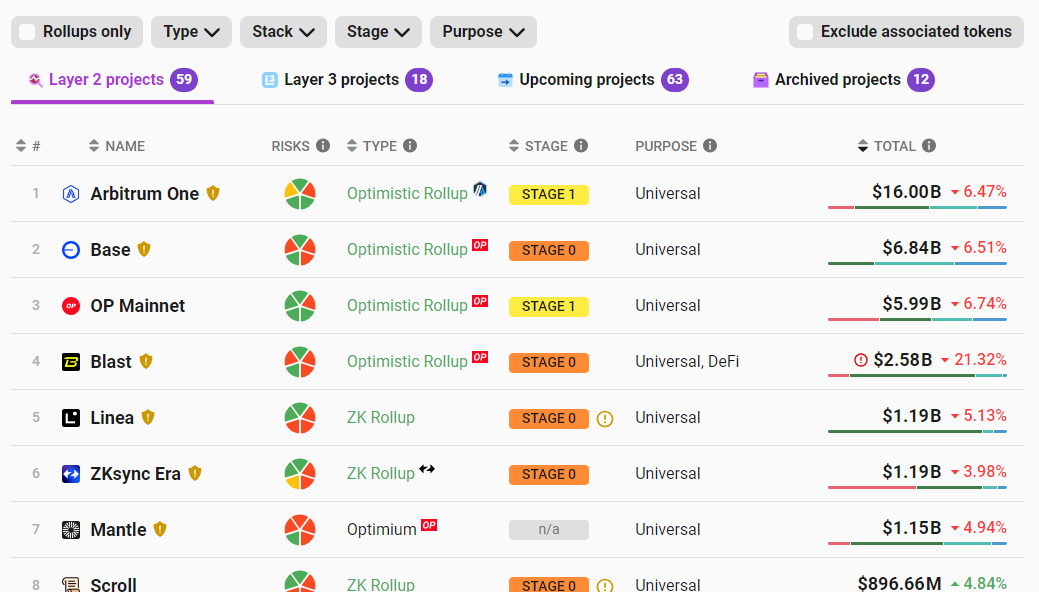

The Friend.tech decentralized app runs atop the Coinbase Layer-2 network, Base. It is only second to Arbitrum (ARB) among Ethereum-based L2s on value-locked metrics.

Friend.tech to Stay on Base L2

After a June 8 commitment to exit the Base blockchain and migrate to its own network, Friend.tech has revoked the plan. Its supply and liquidity will stay on Base, with Friendchain migration plans now shelved.

“We’ve heard your feedback: you don’t want FRIEND moving to another chain. We agree. FRIEND was always meant to be a 100% community-controlled token powering the Clubs contract. Migrating the supply and liquidity would not align with that spirit. You’ll still be able to create clubs, chat, buy keys, and use FRIEND on Base in the friend.tech app,” Friend.tech team wrote.

Changing networks has been controversial, with some saying it was too soon. Others saw it as a natural progression after Friend.tech co-founder Racer cited and offered a $200,000 reward for any developer capable of smoothly migrating the platform from Base without major disruptions.

Since then, Friend.tech Total Value Locked (TVL) has dwindled by $3.3 million and nosedived by over $1.1 million in the last 24 hours, provoked by the announcement that it would no longer be moving.

Read more: What is Friend.tech? A Deep Dive Into The Web3 Social Media App

TVL measures the total value of assets that are locked in a particular protocol or platform. It represents the amount of cryptocurrency locked in smart contracts within a DeFi ecosystem.

A drop in this metric suggests the withdrawal of assets from the DeFi platform. It may signal a loss of confidence in the platform or users seeking better opportunities elsewhere. Along with the drop in TVL, Friend.tech’s native token FRIEND has dipped by 30% in the past 24 hours.

Is Farcaster Siphoning from Friend.tech?

The drop in Friend.tech TVL can be ascribed to different reasons reasons. First, the current market crash, with the Bitcoin price plunging to the $57,000 range. As altcoins take their cues from BTC, the global market capitalization has plunged by over 5%. A drop in overall market value can lead to a decrease in TVL as the value of the locked assets also declines.

Otherwise, the drop in Friend.tech TVL points to a change in sentiment. This change indicates investors are seeking alternatives to one of the leading SocialFI dApps on the Base network. Ethereum co-founder Vitalik Buterin predicted this in February, criticizing the project for relying on financial speculation instead of genuine enjoyment.

“Bad GameFi is using financial speculation as a substitute for fun. Blockchain games need to be fun as games — approx quote I’ve said many times I believe a similar thing for crypto social,” he wrote.

If users are looking elsewhere, chances are that Farcaster is the destination. It is Friend.tech’s industry peer and market rival in the decentralized social media. While Buterin threw shade at the former, he expressed optimism for Farcaster, citing its decentralized architecture and developer freedom.

“Registering a prediction: Farcaster and lens will NOT be deserted in four months or 1 year,” Buterin wrote.

Friend.tech co-founder Racer also called out Farcaster for misconstruing their project at launch, blaming the latter for straining the relationship between Friend.tech and the Base community.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Meanwhile, with Base still domiciling Friend.tech, the L2 solution’s popularity continues to froth, especially as the hub for SocialFi apps. Its allure sprouts from using optimistic rollups to expedite transactions and reduce costs. Base batches transactions off the main Ethereum blockchain, consolidate them and finalize on the Ethereum mainnet.

According to L2Beat’s scaling tracker, Base is one of the largest L2 on TVL metrics, only second to Arbitrum. Notwithstanding, it is impossible to ignore the recent challenges on the Base network, including security concerns about its meme coin projects.

BeInCrypto recently reported that 91% of meme coin projects on the Base platform are susceptible to security breaches. Therefore, progressive improvements are critical for user protection and building trust in Base’s ecosystem.