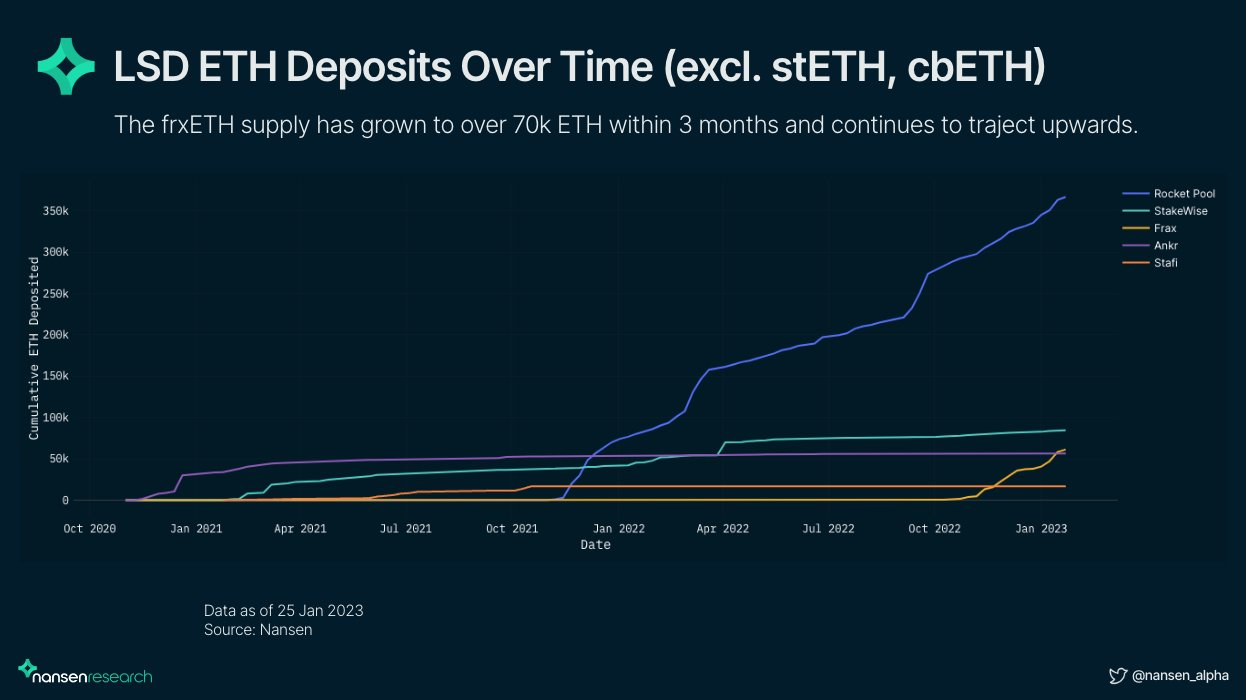

Decentralized finance (DeFi) protocol Frax Finance’s liquid staking derivatives (LSD), Frax Ethereum (frxETH), has gained wide attention and usage within three months of its launch. The protocol has grown to be the fourth-largest ETH LSD within the period.

Data from Nansen shows, the total value of assets locked (TVL) on Frax Ethereum has grown by 77% in the last month to surpass $140 million, making it the fastest-growing LSD.

On-chain data also showed that 84,893 ETH had been staked through the protocol within the previous three months, ahead of what rivals like Ankr, Rocket Pool, and StakeWise have seen during the same period.

Frax Ethereum Offers High Returns Amid Centralization Concerns

The protocol allows users to deposit Ether to receive frxETH, which is backed 1:1 with ETH. The liquid token can be traded on other DeFi protocols and used on Curve’s liquidity pools. The protocol has grown because stakers can earn up to 10% annualized returns – the biggest liquid derivatives product Lido offers depositors around 5%.

Blockchain analytical firm Nansen noted that its high return and CRV emission would help to “drive growth and additional revenue to the protocol.”

Despite its rapid growth, some community members have pointed out that the platform is highly centralized. In a recent report, investment platform Exponential DeFi said that the Frax Finance admin has unlimited minting access in the contract. It added:

“The admin can mint any amount of frxETH, can set any address as validator, and withdraw funds from the frxETHminter contract.”

Frax Finance Ecosystem Grows

Frax liquid staking derivatives product is not the only fast-growing project within its ecosystem. Data from DeFi Lama shows that Frax lending protocol, Fraxlend, has surged by over 70% in the past month to $177.44 million. Apart from that, the TVL of its Fraxswap exchange grew by over 30% during the same period.

The ecosystem’s native token Frax Share (FXS), has increased by more than 115% since the beginning of the year. The Frax algorithmic stablecoin supply stayed above $1 billion during this period.

Shanghai Upgrade Brings More Interest to LSDs

Meanwhile, the increased interest in ETH staking is because Ethereum developers’ said they would prioritize withdrawals in the Shanghai upgrade.

Following the news, LSD tokens have risen sharply, and Ethereum’s price has risen to new highs.

According to available data, over 16 million ETH has been deposited into the Ethereum Beacon chain contract. Lido remains the dominant liquid staking product with a TVL of $8.34 billion.