Franklin Templeton announced it would expand its Benji Technology Platform to BNB Chain, signaling a stronger push into on-chain finance.

The move links one of the world’s largest asset managers with a blockchain known for low fees, fast settlement, and a growing base of retail and institutional users.

Institutional Push Deepens Tokenization Race

The Benji platform powers the Franklin OnChain US Government Money Fund (FOBXX), the first US-registered mutual fund to record share ownership and process transactions on a blockchain.

Each share equals one BENJI token, which supports daily subscriptions, peer-to-peer transfers, and real-time net asset values.

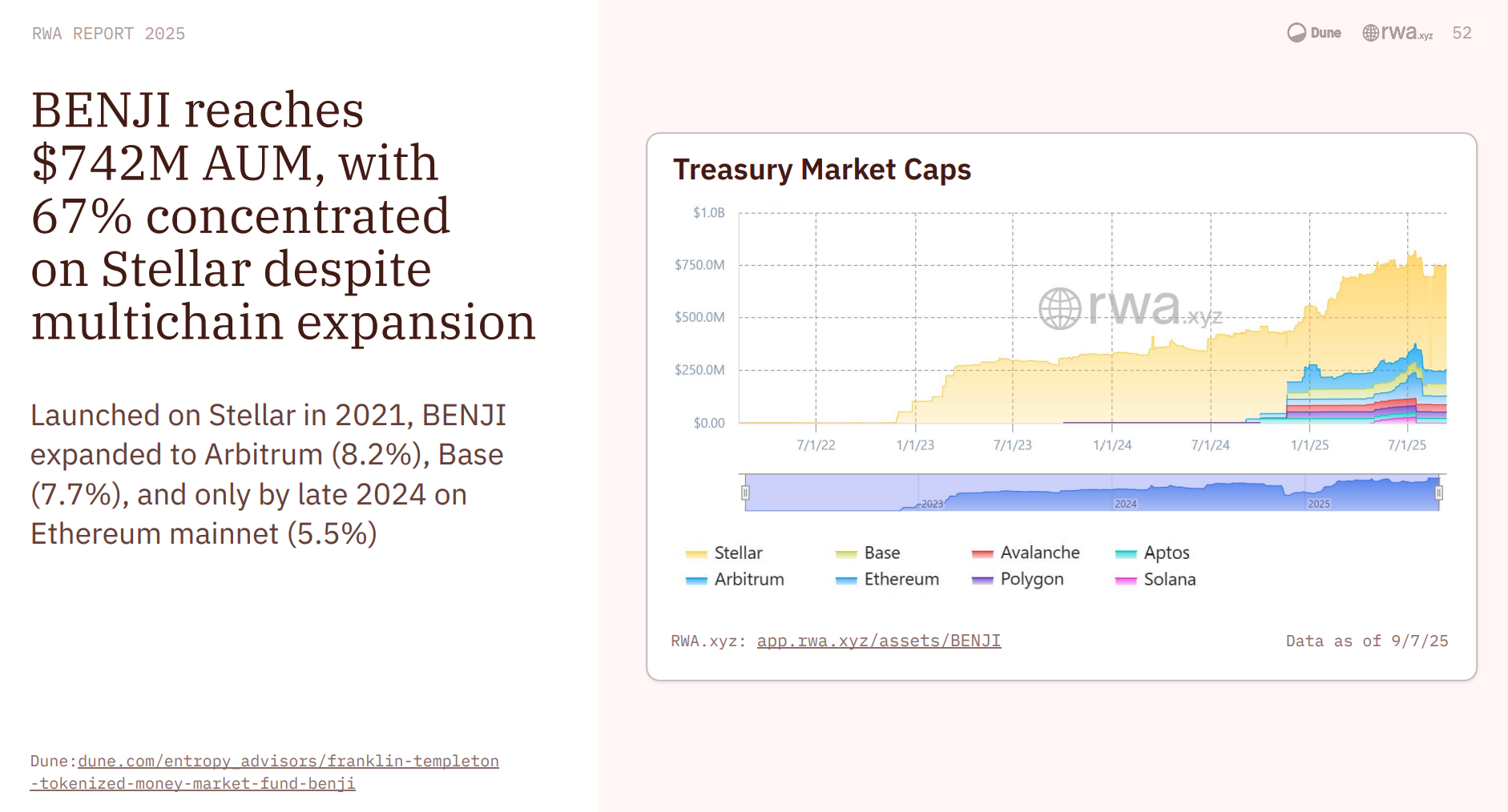

Since its launch, the fund has reached $742 million in assets and paid out more than $51 million in dividends, according to the RWA Report.

Franklin Templeton said adding BNB Chain helps the platform “meet more investors where they’re active” while keeping compliance and security at the center.

By cutting gas fees and running more than 200 transactions per second, BNB Chain expects to lower barriers for both large allocators and smaller retail users.

“Integrating with BNB Chain allows Franklin Templeton to be present where client demand is growing. It also positions us to be ready as the market evolves and interest grows for new types of products beyond what we’re doing with tokenized money funds,” Mike Reed, Senior Vice President and Head of Digital Asset Partnership Development for Franklin Templeton told BeInCrypto

Why BNB Chain?

BNB Chain has built a reputation as a hub for tokenized assets. Analysts highlighted $51 billion in perpetual trading volume on the network, pointing to deeper liquidity.

The addition of Benji follows earlier integrations such as Circle’s USYC token and Franklin Templeton’s recent partnership with Binance on digital asset projects.

Other chains are also competing for inflows. SolanaFloor noted that tokenized assets on Solana climbed to $671 million after new allocations to BlackRock’s BUIDL fund.

Ripple and Securitize introduced a 24/7 off-ramp for tokenized Treasuries, adding round-the-clock settlement options.

Risks remain even as momentum grows. JPMorgan analysts warn that fragmented rules and uncertain enforceability could slow adoption.

The RWA Report shows that tokenized assets have risen 224% since early 2024, yet most liquidity still sits in treasuries and short-term credit.

“The current macro environment is driving demand for new ways to hold and move value. Tokenized assets are well-suited for this moment because they combine transparency, liquidity, and efficiency. We’re prioritizing scaling existing tokenized offerings and expanding access globally so investors can directly benefit from these shifts.” said Mike Reed.

Franklin Templeton’s expansion to BNB Chain marks a move from testing to large-scale rollouts. Whether these products see broad uptake will depend on regulatory clarity, reliable infrastructure, and investor demand beyond safe-haven assets.