The FOMC concluded its latest meeting by announcing that it will not cut US interest rates. This decision was largely priced in, and the crypto market hasn’t seriously suffered.

Rate cuts would’ve provided a bullish narrative to juice fresh investment, which the market desperately needs. Bearish signals are growing alongside fears of a US recession.

Federal Reserve Says No to Rate Cuts

The Federal Reserve just finished its Federal Open Market Committee (FOMC), which determines much of US financial policy. The crypto industry was waiting with bated breath to see if the FOMC would decide to cut interest rates.

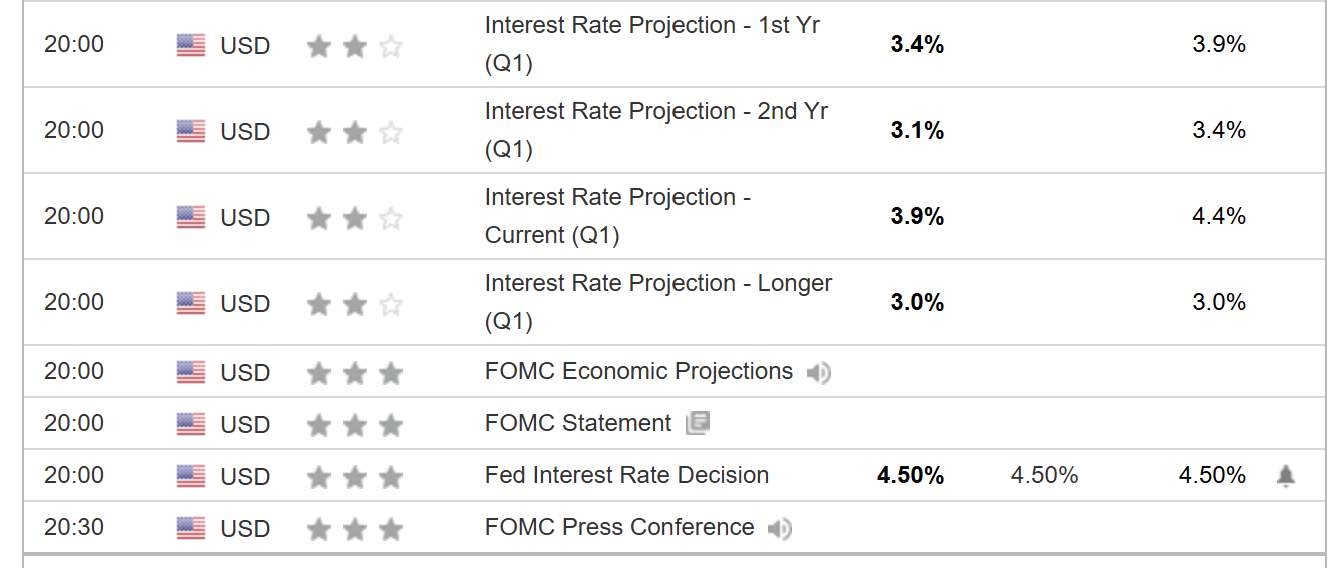

However, the FOMC made its report to the public and claimed that no rate cuts would be taking place.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25% to 4.5%,” it said.

This news more or less fits with the industry’s expectations. Fed Chair Jerome Powell already clearly stated that the FOMC doesn’t plan to cut interest rates.

The industry hoped that rate cuts could provide a bullish narrative, especially while the markets are afraid. For now, it seems like it’ll need to find an optimistic signal somewhere else.

Despite uncertainty from tariffs and bold fiscal policies, officials expect interest rates to drop by another half percentage point by 2025. Since the Fed typically adjusts rates in 0.25% steps, that means we’re likely to see two cuts this year.

Rate cuts would be bullish for investors, especially for risk-on assets like cryptoassets. However, this isn’t the Federal Reserve’s only concern. The FOMC alluded to its “dual mandate” when denying rate cuts. In other words, it needs to juggle investor concerns with consumer inflation fears, uncertainty around Trump’s tariffs, and a possible US recession.

If the FOMC were to slash interest rates, it would likely boost US inflation. The most recent CPI report was better than expected, and some in the industry hoped that this would build confidence. Ultimately, the main hopes rested with President Trump, who personally advocated for rate cuts. However, he didn’t make a major intervention.

It’s not all bad, though. The FOMC also announced would slow Quantitative tightening (QT) by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.

Some members of the community were pleased by this news, as slower QT can increase market liquidity. This announcement is at least some consolation for investors.

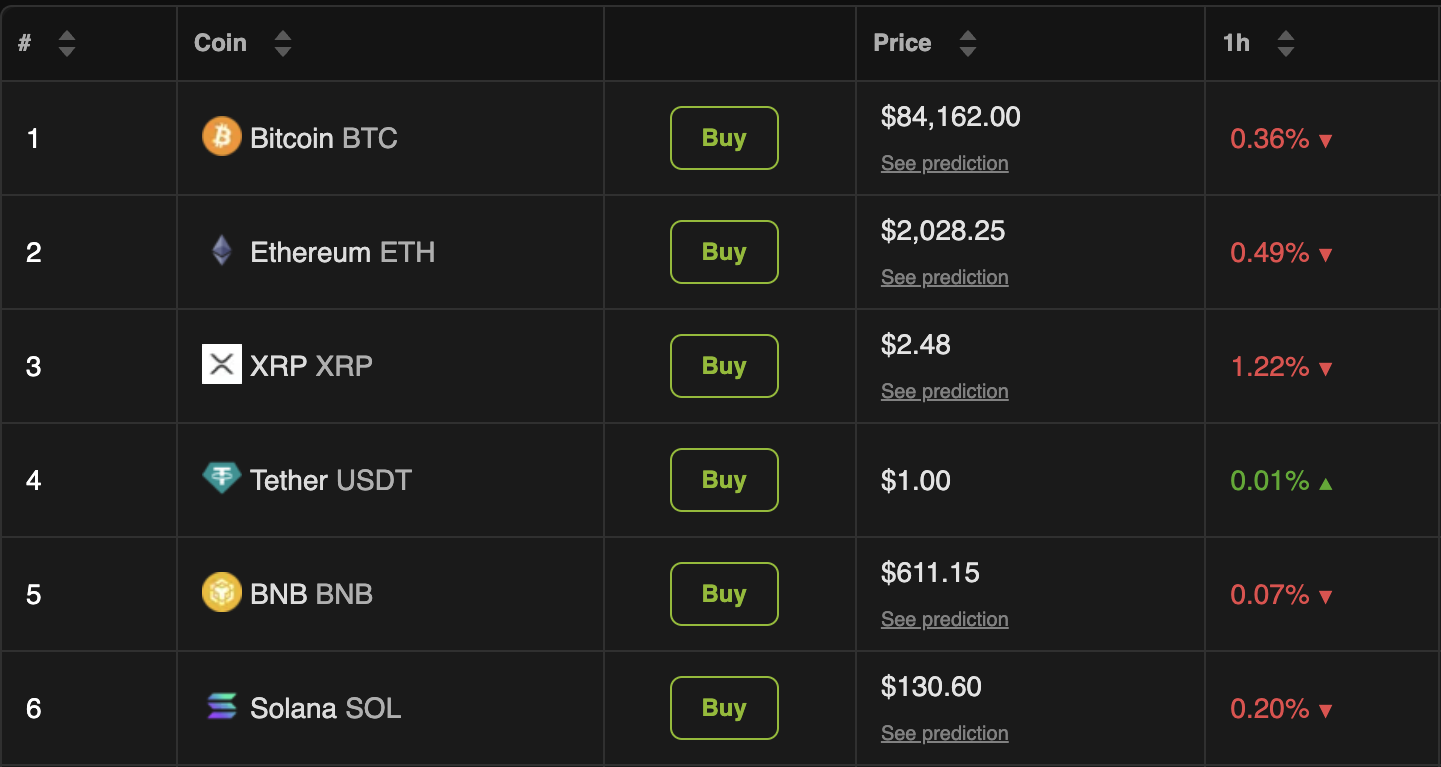

In any event, this lack of rate cuts was expected and priced in. The FOMC didn’t shock anybody by refusing to cut interest rates, and the market hasn’t been chaotic. A few of the top-performing cryptoassets suffered minor losses, but no substantial drops have materialized.

The crypto industry has been desperate for a bullish narrative, and some major players are visibly cracking at the seams.

The FOMC, however, did not provide this narrative via rate cuts. Hopefully, crypto will find something else to be optimistic about before a full-blown market correction takes hold.