The United States Financial Industry Regulatory Authority (FINRA) conducted a review of more than 500 crypto marketing campaigns, uncovering a substantial number of violations.

Within the reviewed communications, FINRA alleges that around 70% of them violate FINRA Rule 2210. This rule, in part, states that broker-dealer communications with the public be fair and balanced.

Outline Affiliate Programs, Declares FINRA

In a recent statement, FINRA outlines that the distinction between cryptocurrency products offered through affiliate programs or by a crypto firm must be clear and transparent for potential customers:

“Failure to clearly differentiate in communications, including those on mobile apps, between crypto assets offered through an affiliate of the member or another third party, and products and services offered directly by the member itself.”

Crypto firms must deliver a fair and balanced presentation of the associated risks, reiterated FINRA.

FINRA explicitly outlines that crypto, like any investment, faces risks. However, with crypto, this is more relevant due to its exposure to volatile markets, resulting in more frequent price swings.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

Furthermore, it outlines that marketing promotions must acknowledge the lack of legal and regulatory protections in the crypto space.

“The lack of legal or regulatory protections (e.g., SIPC protections apply only to cash and securities held for an investor for certain purposes in a customer securities account at a SIPC-member broker-dealer and do not apply to Crypto Assets that do not qualify as SIPA ‘securities’)”

FINRA States Lack of Regulations Must be Transparent

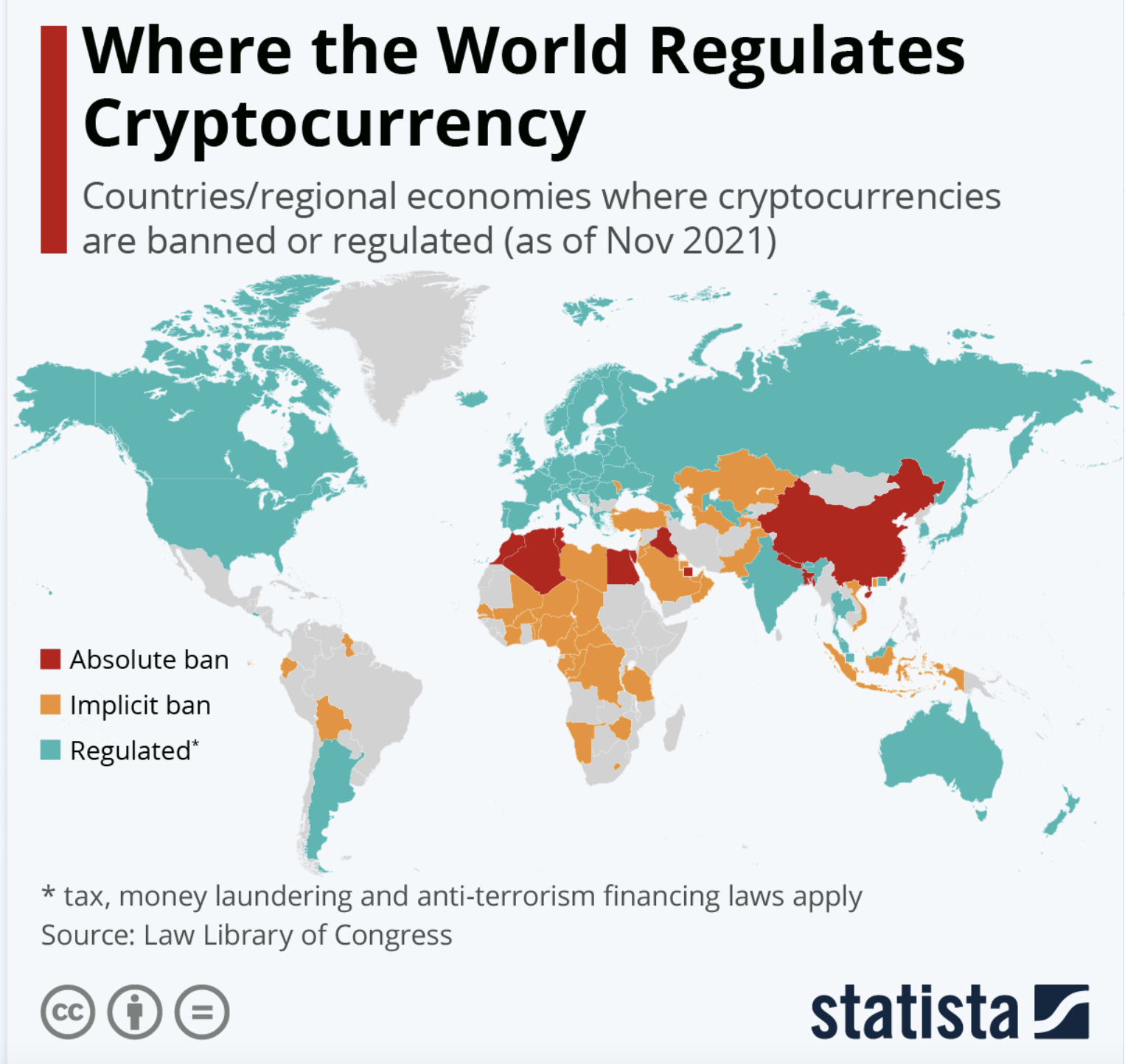

The crypto industry has been preparing for and wrestling with changing regulations within the sector, essentially since its inception.

Many crypto commentators believe there is a chance of more clarity following the US presidential election, which will take place this upcoming November.

Read more: Crypto Marketing vs. Branding: How They Differ and What You Should Focus On

However, many within the industry find the rules implemented by US regulators to be confusing.

The US Treasury Department and Internal Revenue Service (IRS) have recently updated their crypto tax reporting rule. This previously mandated detailed and transparent data from individuals engaging in crypto transactions exceeding $10,000.

However, the IRS has since retracted its proposed rules, indicating that they will not be implemented until clearer regulations are established.

While crypto gains mainstream prominence, it concurrently emerges as a significant talking point influencing voters’ decisions in the November election.

BeInCrypto reported in June 2023 that the Democratic Party’s anti-crypto stance might have electoral consequences.