FET has experienced a 5% decline over the past week and now faces further downward pressure as dormant token holders reactivate and move their coins.

With bearish sentiment prevailing and insufficient demand to absorb the increased supply, FET’s price is likely to continue its downward trend.

Old FET Tokens Back in Circulation

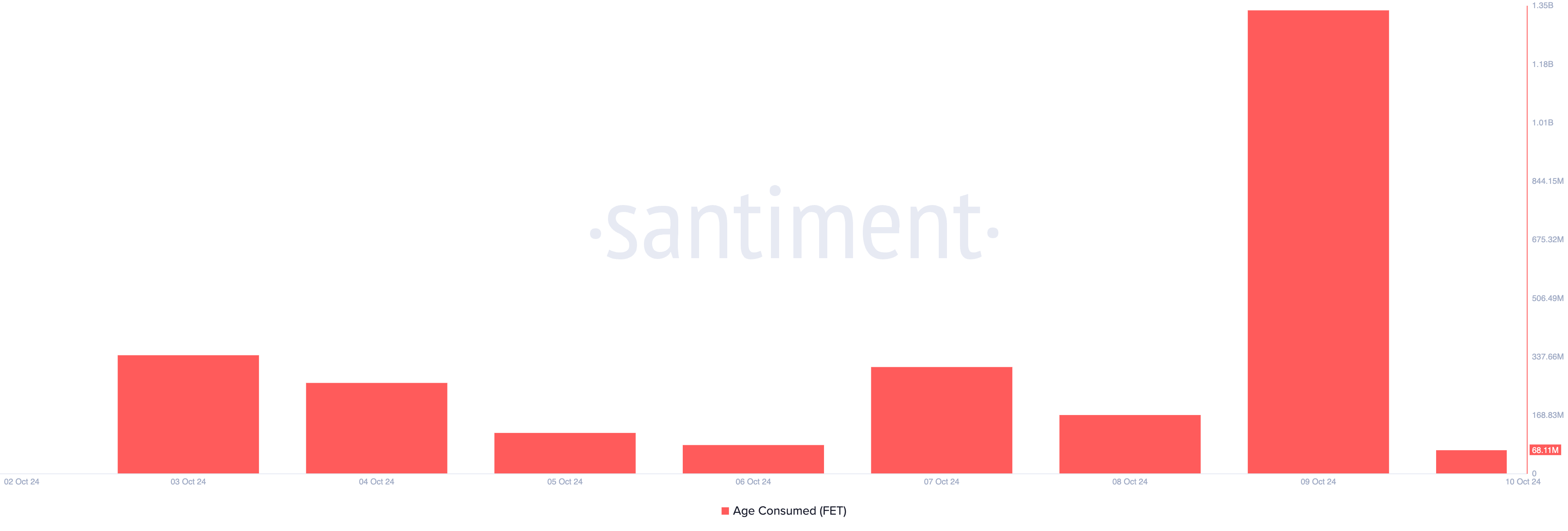

During the intraday trading session on Wednesday, FET recorded a significant surge in its age consumed. The metric, which tracks the movement of long-held coins, surged by over 600% in a single day, reaching 1.33 billion — its highest since September 13.

When an asset’s age consumed spikes, it indicates that many previously inactive coins or tokens have recently been moved or traded. These spikes are often noteworthy because long-term holders rarely move their assets. Therefore, when they happen, they are often a precursor to a change in market dynamics.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Generally, when dormant coins re-enter circulation, it indicates renewed activity from long-term holders. However, the market must show strong demand for this to translate into positive growth for an asset’s price.

In FET’s case, this is lacking as market sentiment toward the altcoin remains bearish. Hence, these previously stagnant coins have re-entered the market during a period of weak demand, adding to the downward pressure that the altcoin already faces.

Currently, FET’s price sits below its 20-day exponential moving average (EMA) and 50-day small moving average (SMA), confirming the weakening demand. The 20-day EMA measures its average close price over the last 20 trading days, while the 50-day SMA is a longer-term indicator that tracks the asset’s average closing price over the past 50 days.

When an asset’s price trades below these key moving averages, selling pressure outweighs buying activity. Traders interpret this setup as a signal for further downward movement.

FET Price Prediction: Token May Revisit Two-Month Low

Readings from FET’s moving average convergence/divergence (MACD) indicator show that its MACD line (blue) is below its signal line (orange) and is poised to breach its zero line. When this indicator, which tracks an asset’s trend direction and potential price reversal points, is set up this way, buying pressure is weakening, and a sustained price decline is likely.

If FET continues to witness a decrease in demand, its price may fall to a two-month low of $0.70.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

However, if market sentiment shifts from bearish to bullish, FET’s price may initiate an uptrend and rally toward $2.09.