In a landmark enforcement action, the Commodity Futures Trading Commission (CFTC) has issued fines totaling $1.7 million against FalconX, a prominent crypto prime brokerage firm.

This penalty stems from their failure to register as a futures commission merchant (FCM) while providing US customers access to trading platforms for crypto derivatives.

CFTC Fines FalconX $1.7 Million

This case marks the first time the CFTC has taken action against an unregistered intermediary in the crypto space, setting a significant precedent.

FalconX, organized under the laws of the Seychelles, facilitated access to crypto exchanges without proper registration. The CFTC’s order mandates that FalconX cease these activities immediately and pay $1,179,008 in disgorgement, alongside a $589,504 civil monetary penalty.

The reduced penalty reflects its substantial cooperation with the CFTC’s Division of Enforcement.

“The CFTC’s enforcement program has made clear it will not tolerate crypto exchanges that fail to register with the CFTC or comply with the agency’s rules that maintain integrity in the derivatives markets,” stated Ian McGinley, Director of Enforcement at the CFTC.

He emphasized that the CFTC would continue targeting exchanges and intermediaries, violating registration requirements.

Case Background

Between October 2021 and March 2023, FalconX solicited orders for crypto derivatives from US customers, acting as an intermediary. It created main accounts on various exchanges and then set up sub-accounts for customers, often bypassing customer-identifying information requirements.

Through these activities, FalconX collected approximately $1,179,008 in net fees.

The CFTC highlighted FalconX’s proactive steps to enhance its customer identification controls following the complaint against Binance and its affiliates for similar practices. This cooperation was a critical factor in the reduced penalty.

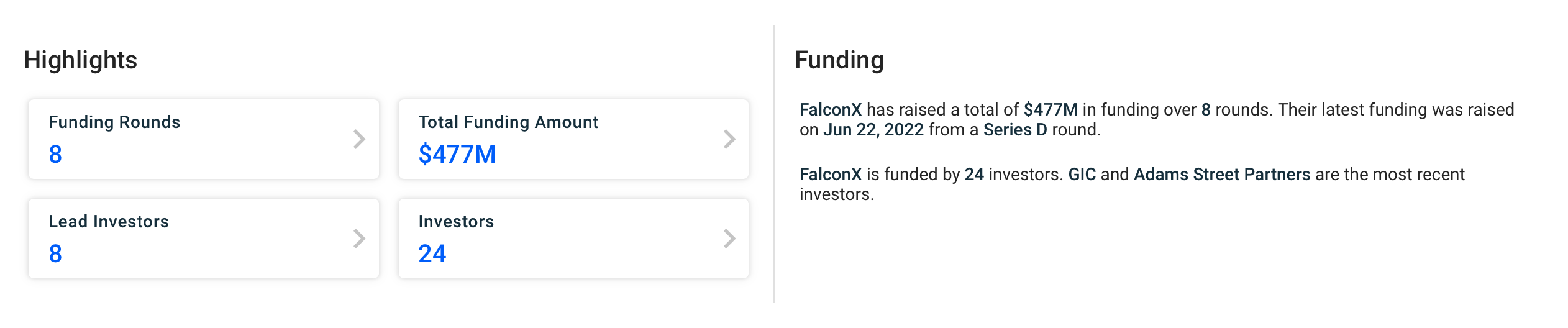

FalconX has raised substantial funding to $477 million over eight rounds, with notable contributions from GIC and Adams Street Partners. The most recent funding round, Series D, raised $150 million in June 2022, led by B Capital and GIC.

Despite the turbulent crypto market, FalconX has shown resilience and growth. In December 2022, the firm disclosed that 18% of its funds were stuck on the bankrupt FTX exchange. Nevertheless, FalconX assured stakeholders of its robust financial health.

It highlighted an 80% growth in trading volumes over the past year and maintained liquidity with 80% of its balance sheet in regulated U.S. banks.

Read more: Top Crypto Bankruptcies: What You Need To Know

While significant, FalconX’s exposure to FTX was within the firm’s risk management limits. The company confirmed it had no exposure to other troubled crypto firms like Genesis, Alameda, or BlockFi. FalconX stated it remains highly capitalized, with a debt-to-equity ratio under 5%, underscoring its financial footing.

In its statement, the CFTC urged the public to verify a company’s registration status before engaging in crypto transactions. Customers can check the National Futures Association’s BASIC database for registration information.