The European Banking Authority (EBA) has released a consultation paper describing the liquidity requirements for stablecoin issuers under the Markets in Crypto-Assets (MiCA) regulation. The EBA specifies reserve requirements for stablecoins and proposes liquidity stress tests to determine an issuer’s risk tolerance.

According to the EBA, issuers of asset-referenced or e-money (stablecoin) tokens should be able to satisfy redemption requests at any time. An issuer needs to revise its risk management policies if the weighted make-up of its reserves is less than the weighted amounts of the assets referenced by the tokens.

How EU Stablecoin Issuers Can Manage Risk

The EBA recommends that issuers use historical data to assign stress factor weights to each asset and its reserves. The issuers can subject these assets to different withdrawal scenarios and then make any necessary adjustments.

Read more: What is a Stablecoin? A Beginner’s Guide

The reserve asset stress factor of a credit-based asset should depend on the risk tolerance of the credit issuer. If the reserve asset is a commodity, the risk factor should be based on how closely the reserve mimics the assets referenced by the tokens.

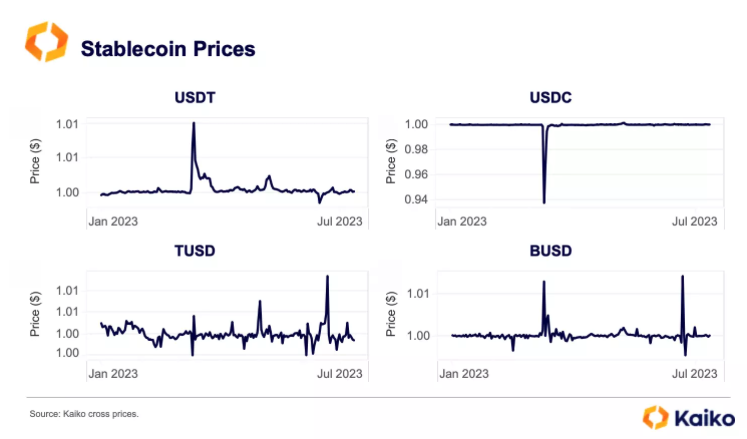

The stress factor for the stablecoin itself must consider the volatility risks associated with how the asset is distributed. The issuer must also cater for deviations between the token price and its market value during periods of market-wide stress.

The proposal suggests two approaches to a policy framework for issuers. The first option is for the EBA to harmonize policies in the European Union and allow liquidity adjustments based on each issuer’s size. Alternatively, the companies can have a high degree of freedom in developing a risk profile.

When finalized, the rules will be used in the upcoming MiCA legislation. While already in force for some time, crypto exchanges have until June 2024 to comply with the new rules.

UK Stablecoin Rules Also in Progress

The EBA follows the Bank of England (BoE) and the UK Financial Conduct Authority (FCA) who opened for comment two stablecoin papers. The BoE wants bank stablecoin issuers to ensure operational resilience and guard against liquidity and terrorism financing risks. The FCA wants issuers to ensure stablecoin issuers act in the best interest of their customers.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

In Hong Kong, where stablecoin regulation has arguably advanced more than Western financial centers, local politician Duncan Chiu said lawmakers are in their second phase of consultations on the matter. Singapore also finalized laws for privately issued stablecoins in August.

So far, the US government has shown little urgency in pushing stablecoin regulation through Congress. The bill was blocked from progressing by Representative Maxine Waters and other members of the House Financial Services Committee.

Do you have something to say about the stablecoin issuer proposal from the European Banking Authority or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.