The EU watchdog, the European Systematic Risk Board (ESRB), is recommending limiting crypto leverage to avoid disrupting the financial stability of the broader market.

On various occasions, financial instability has been caused by firms collapsing following high-leveraged bets. As the firms cannot repay the debts, the broader market gets into a cash crunch, often leading to a recession.

ESRB Urges Limit on Crypto Leverage

According to Reuters, the watchdog is urging authorities to limit leveraged bets in the crypto industry. It wants to impose limitations primarily on investment funds, exchanges, and other firms.

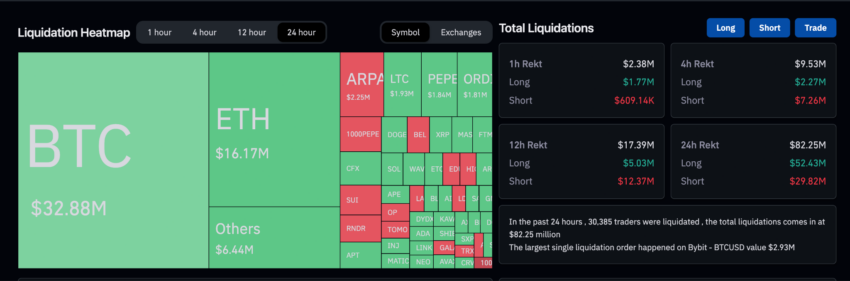

Even for retail investors, high-leveraged trades could result in a loss of initial capital. Such an event is called liquidation. Due to the high volatility of crypto, traders lose millions in liquidation daily.

The screenshot below shows that traders lost over $82 million to liquidations in the past 24 hours.

Did Japan’s Limitations Save Investors From FTX Collapse?

The ESRB said, “Systemic risks could arise quickly and suddenly. If the rapid growth trends observed in recent years were to continue, crypto-assets could pose risks to financial stability.”

Japan’s Financial Service Agency has already imposed similar limitations on crypto leverage. Wherein investors cannot borrow more than twice their investment amount for leverage trades.

Some believe that Japan’s strict regulations were the reason behind FTX’s Japanese entity enabling withdrawals in February.

The ESRB is responsible for overseeing the broader market and mitigating systematic risks. However, the watchdog cannot directly implement the limitations on crypto leverage.

But, it can give suggestions for the future versions of the Market in Crypto-Assets (MiCA) legislation to the EU.

Last week, all 27 members of the EU unanimously approved the MiCA rules, which are likely to come into force from July 2024.

Got something to say about crypto leverage or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.