The European Union is poised for a significant financial revolution. It is considering including crypto assets in its $12.88 trillion mutual fund framework, Undertakings for Collective Investment in Transferable Securities (UCITS).

This bold initiative could dramatically transform the investment landscape across Europe. It can surpass the scale of the US’s spot Bitcoin exchange-traded funds (ETFs).

Tipping Point for Crypto Integration in EU’s $13 Trillion Mutual Fund Framework

The European Securities and Markets Authority (ESMA), the bloc’s financial markets watchdog, has started a thorough review. This initiative aims to expand UCITS’s eligible assets to potentially include crypto. Also, the authority seeks insights from industry stakeholders to assess the risks and rewards of such an integration.

Globally, financial markets are gradually adopting cryptocurrencies. Consequently, ESMA’s proactive stance is well-timed. The United States and Hong Kong recently approved Bitcoin ETFs, indicating a shift towards traditional financial entities engaging with crypto. For instance, ETFs by BlackRock and Grayscale have seen significant inflows, sparking a strong Bitcoin rally in early 2024.

Since their establishment in 2007, the current EAD rules have remained unchanged despite the significant increase in the variety of instruments traded on financial markets over that period.

“This has led to a variety of interpretations and practices in the market concerning the application of the UCITS directive, which could raise concerns about investor protection.” EMSA said.

Unlike in the US, where ETFs focus on specific assets and need individual approvals, UCITS funds could cover multiple cryptocurrencies without separate authorizations.

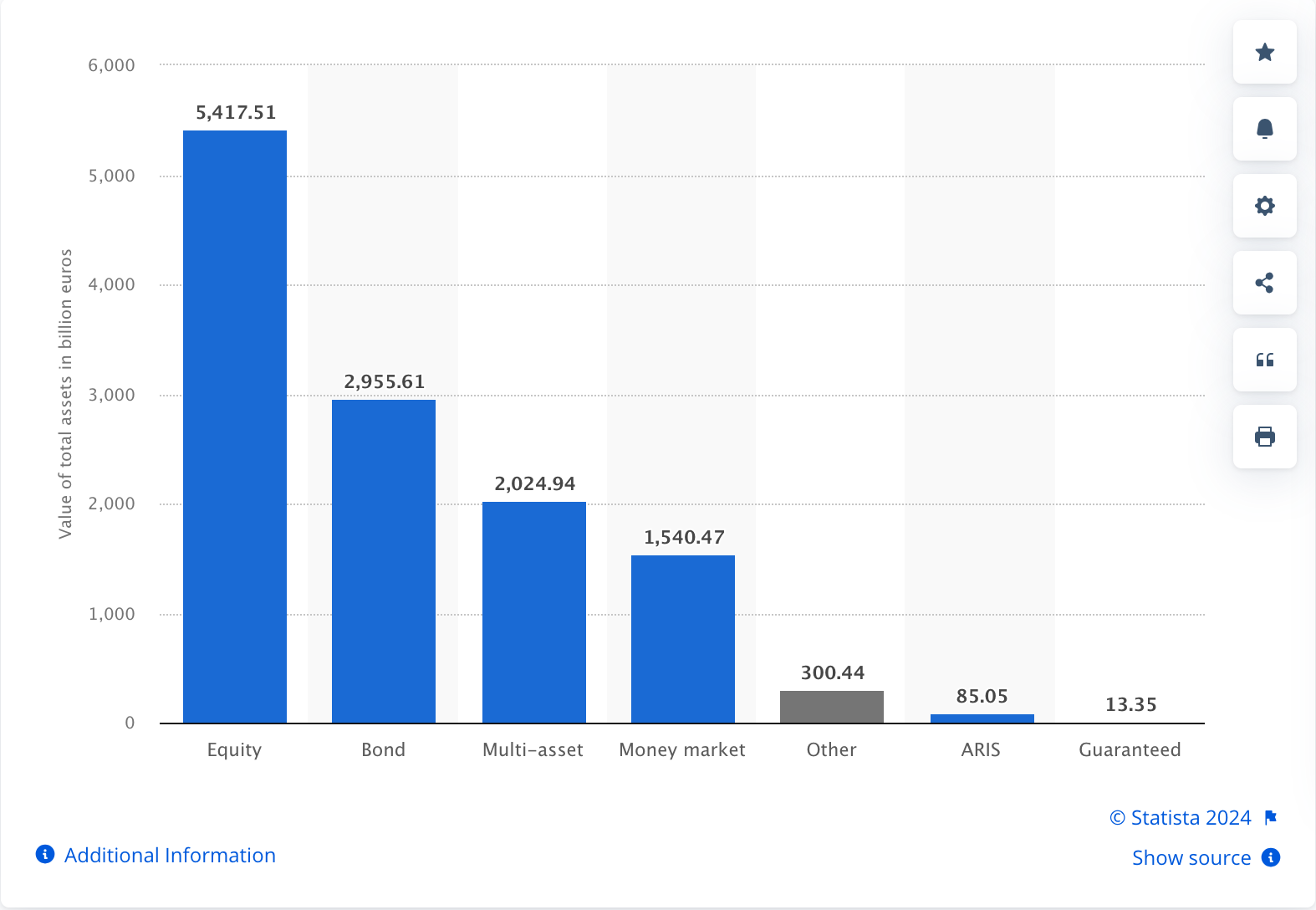

Investors have put over five trillion euros into equity assets from the total 12.4 trillion euros held in UCITS across Europe. This influx is set to change the dynamics of the crypto market significantly.

However, this process brings several challenges. A prime concern is custody. Crypto requires special safekeeping arrangements, potentially clashing with existing regulations for traditional fund depositories. The EU is actively developing the Markets in Crypto-Assets (MiCA) regulation, which sets strict rules for asset segregation and safekeeping, to address these concerns.

“By the end of the year, all of MiCA’s rules are scheduled to come online. Together with other initiatives like the EU DLT Pilot Regime, the regulatory landscape for cryptocurrency assets and blockchain-linked projects in the European Union is rapidly becoming the clearest out of all major jurisdictions.” Nicolas Streschinsky, Head of DeFi at Trilitech, told BeInCrypto.

Read more: What Is Markets in Crypto-Assets (MiCA)?

Feedback from stakeholders is crucial at this stage. ESMA actively seeks to align any policy updates with UCITS’s core goal of investor protection. The ongoing review, open for comments until August 7, 2024, will decide whether cryptocurrencies meet the stringent eligibility criteria of UCITS.

Furthermore, ESMA’s effort to expand asset classes and standardize definitions strives to ensure uniformity across the EU’s financial landscape.