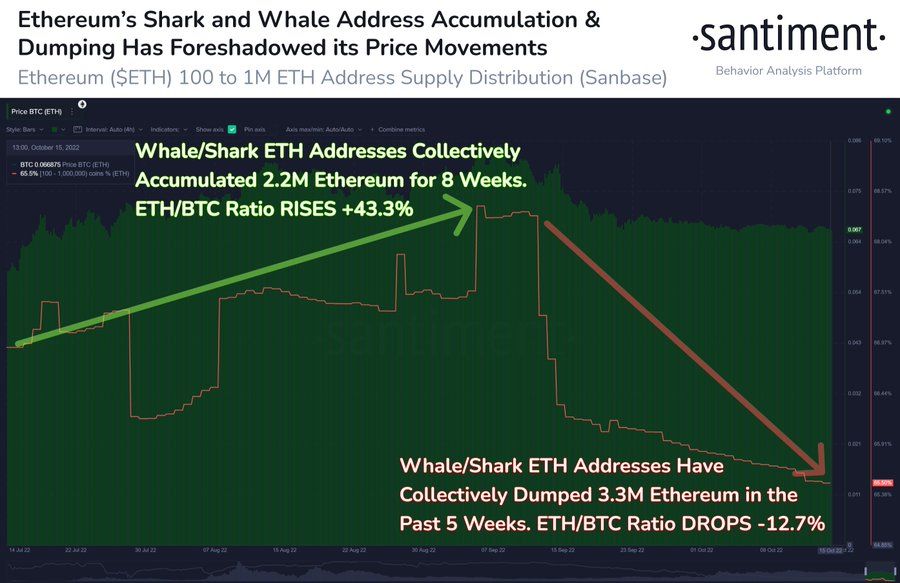

Ethereum (ETH) shark and whale address holdings have decreased by over 3 million ETH in the last five weeks, suggesting that the biggest holders are dumping, according to Santiment data.

According to the blockchain analytics company, sharks and whales have dumped $4.2 billion worth of Ethereum. Dumping has played a role in influencing the value of ETH versus Bitcoin during the period.

Before the dumping started, ETH whales and sharks accumulated 2.2 million ETH, causing ETH/BTC ratio to increase by 43.3%. However, since the massive sales began in the last five weeks, there has been a 12.7% drop in ETH/BTC ratio.

Ethereum Whales Face Price Manipulation Allegations

Earlier in the month, a CryptoQuant analyst wrote that whales were manipulating the market. According to the analyst, ETH whales were sending their holdings to exchanges to raise the value of ETH and sell it at a higher price.

However, whatever price manipulation might have happened is clearly not enough to influence the long-term market. The current selling activity of the whales and sharks appeared to prevent the asset from rallying.

Ethereum Price Remains Steady as ETH Becomes Deflationary

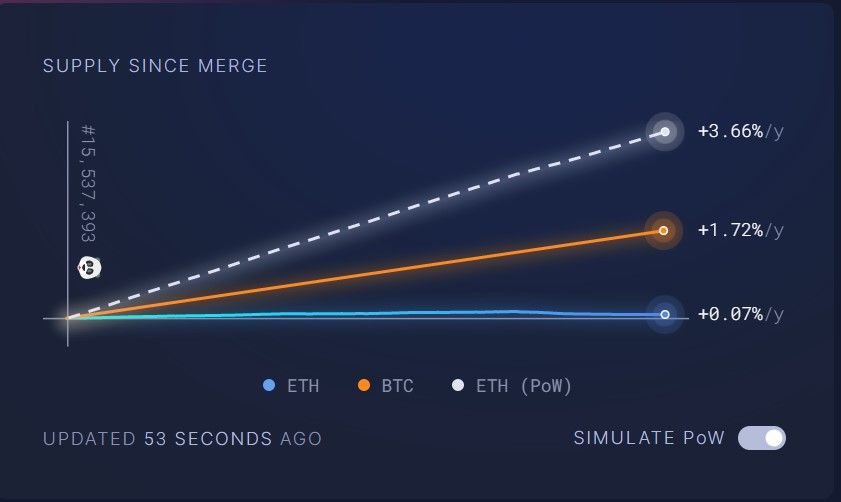

Available data from ultrasound.money shows that Ethereum has become deflationary for the first time since it completed its migration to a proof-of-stake network.

The deflation could be linked to the launch of a new crypto project, XEN crypto, which required minting and briefly increased activity on the network. According to the data, XEN Crypto alone is responsible for burning 3527 ETH, which is over two times the amount burned by leading DeFi protocol Uniswap.

As of press time, 6,850 ETH has hit the market since the Merge. If the asset were still running a proof-of-work consensus mechanism, it would have added over 370,000 ETH.

ETH Price Prediction: Still Struggling to push above $1,500

The ETH price has struggled since it completed the merge. The asset’s value has decreased by more than 9% in the last 30 days. During this period, Ethereum’s price value went from $1,600 to $1,386. For context, BTC only dropped by 3.14% over the same time.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here