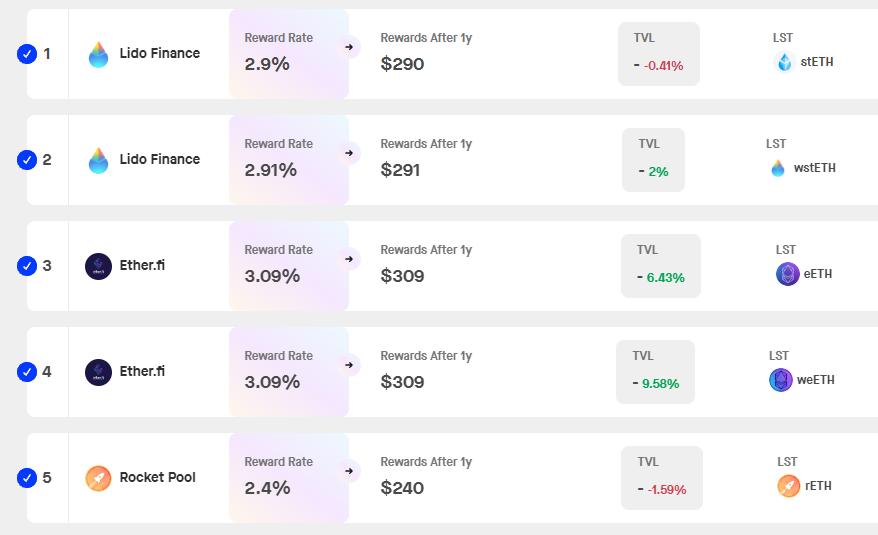

The Ethereum network maintained a staking rewards rate near 3% in the third quarter of 2024, showing a slight decline from over 3.5% earlier this year.

This yield remains well below that of other popular proof-of-stake networks, such as Cosmos, Polkadot, Celestia, and Solana. Staking rewards for these competing networks range between 7% and 21%.

Ethereum Continues to Underperform in the Bull Market

Lower staking rewards impact Ethereum’s ecosystem in two ways. While reduced yields help curb inflation on the network, which can appeal to long-term holders, they also discourage some new or current validators seeking more competitive returns.

Read More: Ethereum Restaking – What Is it and How Does it Work?

According to Kaiko Research, the network’s validator queue averaged less than a day recently, a notable shift from its peak wait time of 45 days in June 2023. Although this short wait time makes staking more accessible, it also signals weaker demand for staking activity.

The daily count of Ethereum validators awaiting entry has declined sharply, marking a substantial drop from over 95,000 in April 2023 to only 473 currently.

This trend suggests a cooling interest among potential validators, which could challenge the network’s ability to sustain a strong validator community if the trend persists.

Amid the broader bull market, Ethereum’s recent performance lags. Both Bitcoin and Solana saw over 6% gains in the past week, while ETH’s growth remained flat.

Additionally, according to DeFiLlama data, Solana generated $25.48 million in network fees last week, surpassing Ethereum’s $22.13 million.

Ethereum reserves on exchanges have also decreased, with a drop from over $42 billion to roughly $38.9 billion. This reduced supply on exchanges could support price stability or growth if demand strengthens.

Read More: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

“Solana’s fee model has made it such that only people who want to access very competitive apps pay fees for those apps, while other users are largely unaffected,” crypto enterpreneur Mert Mumtaz wrote in a recent X (formerly Twitter) post.

Despite these shifts, long-term ETH holders continue to express confidence in the asset’s future value, contrasting with a more cautious approach from short-term investors.