Ethereum recently failed to breach the $2,500 resistance, leading to a pullback. The altcoin king has since fallen, now trading at $2,354. Despite the decline, ETH shows signs of a gradual recovery.

A key shift in investor behavior, particularly among whale addresses, may provide the support needed for an uptrend.

Ethereum Selling Stops

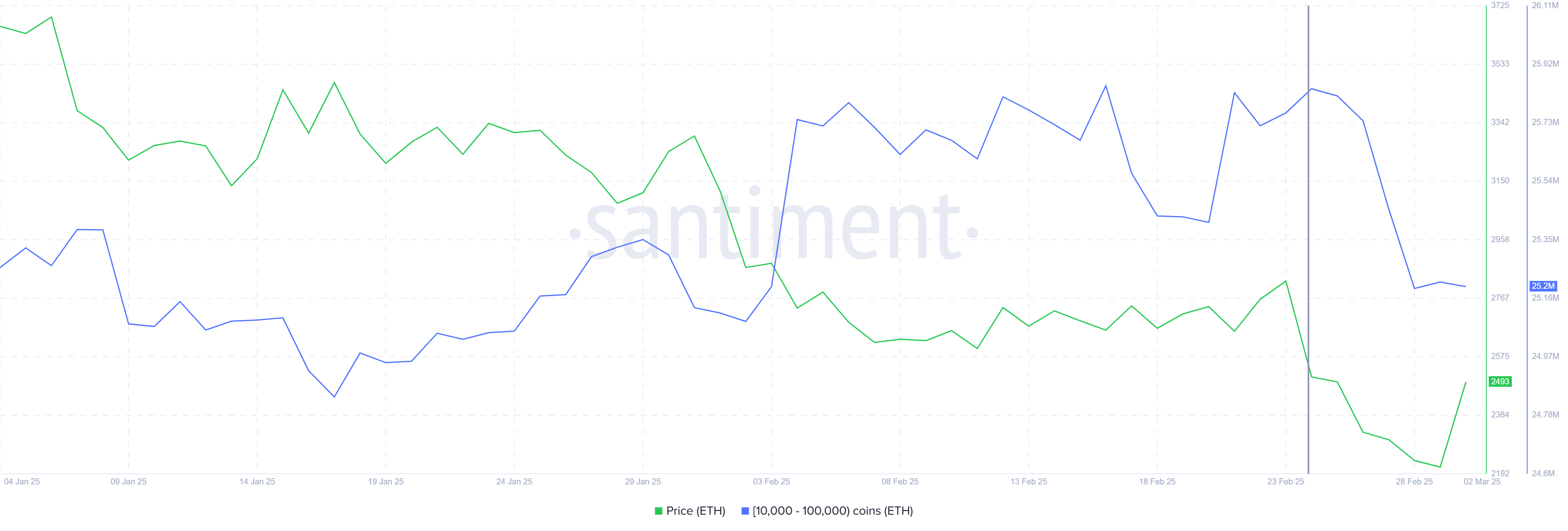

Whale addresses, holding between 10,000 to 100,000 ETH, had been selling aggressively. Over the past week, they offloaded 640,000 ETH worth $1.5 billion, contributing to Ethereum’s struggle near $2,500. However, selling pressure has eased, signaling a shift in sentiment.

In the last 24 hours, whales have paused their sell-off, aligning with Ethereum’s recent price stabilization. This behavioral change could indicate confidence in ETH’s recovery. If large holders continue to hold their assets, Ethereum may see reduced volatility and stronger price support.

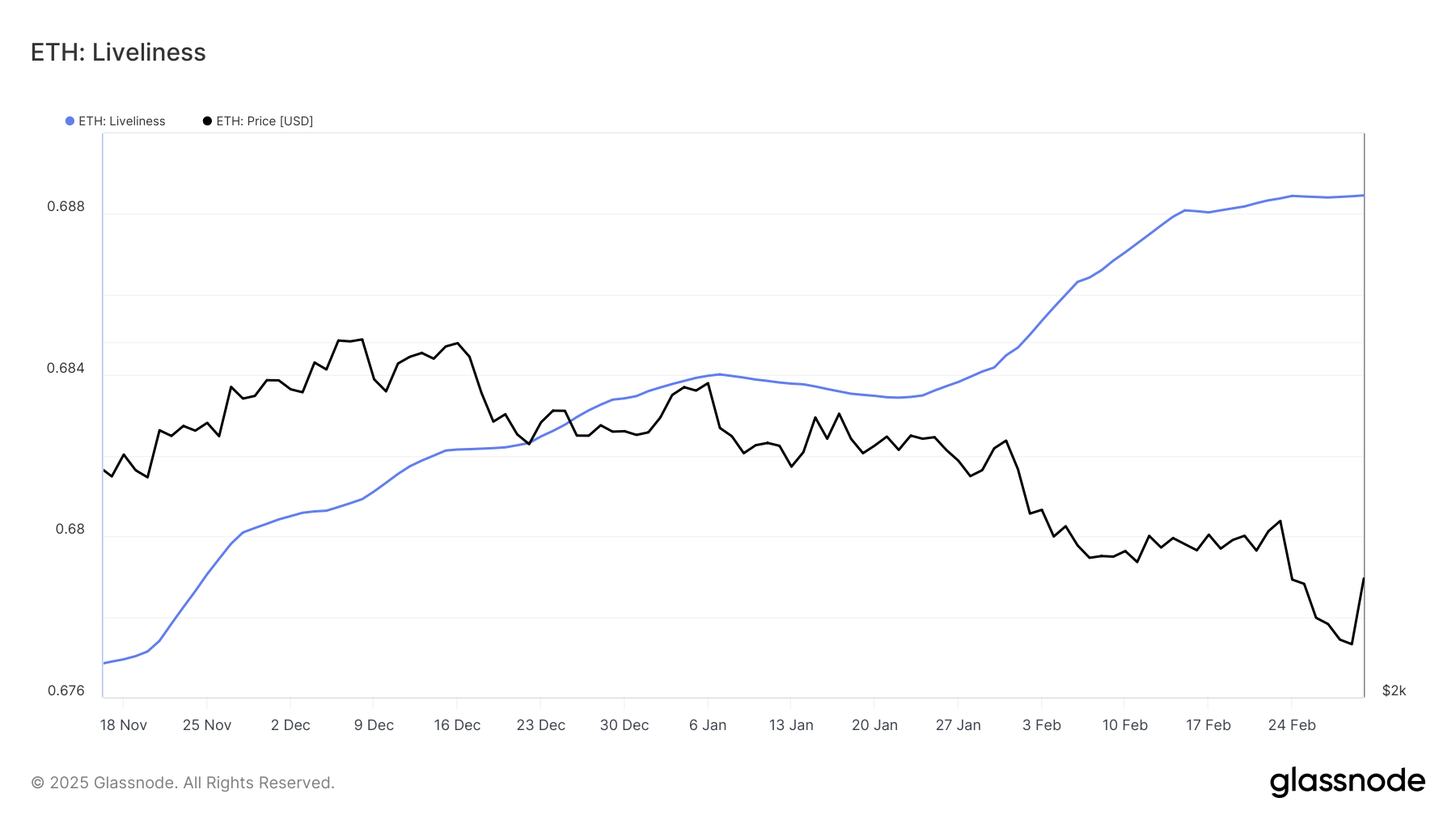

Ethereum’s Liveliness indicator suggests long-term holders (LTHs) have also stopped selling. This metric rises when LTHs liquidate holdings and declines when they accumulate or hold. Over the past few days, the indicator has remained flat, signaling a pause in selling.

This trend supports Ethereum’s price stability as long-term investors preserve market confidence. If LTHs maintain their holdings, ETH could build momentum for a breakout. A sustained downtick in Liveliness would reinforce bullish sentiment, indicating accumulation rather than distribution.

ETH Price Recovery Ahead

Ethereum is attempting to secure $2,344 as a support floor, now trading at $2,354. Holding this level could allow ETH to recover recent losses, targeting $2,549 as the next resistance. A successful retest of this zone would confirm bullish momentum.

If ETH breaches $2,549, it could rally toward $2,654. Surpassing this level may push Ethereum into consolidation below $2,814, mirroring previous market cycles. This would establish a stable price range before further upward movement.

However, failing to hold $2,344 could trigger a decline. ETH may fall through $2,267, potentially testing $2,170 as the next major support. A drop below this level would invalidate the bullish outlook, reinforcing bearish momentum in the short term.