Ethereum began November with a remarkable 40% rally, but sustaining the momentum has proven challenging for the altcoin king.

As the price stabilizes above $3,000, a significant boost from institutional interest might help reignite Ethereum’s bullish trend. Ethereum ETFs are at the center of this resurgence, recording historic inflows.

Ethereum Has the Institutions’ Support

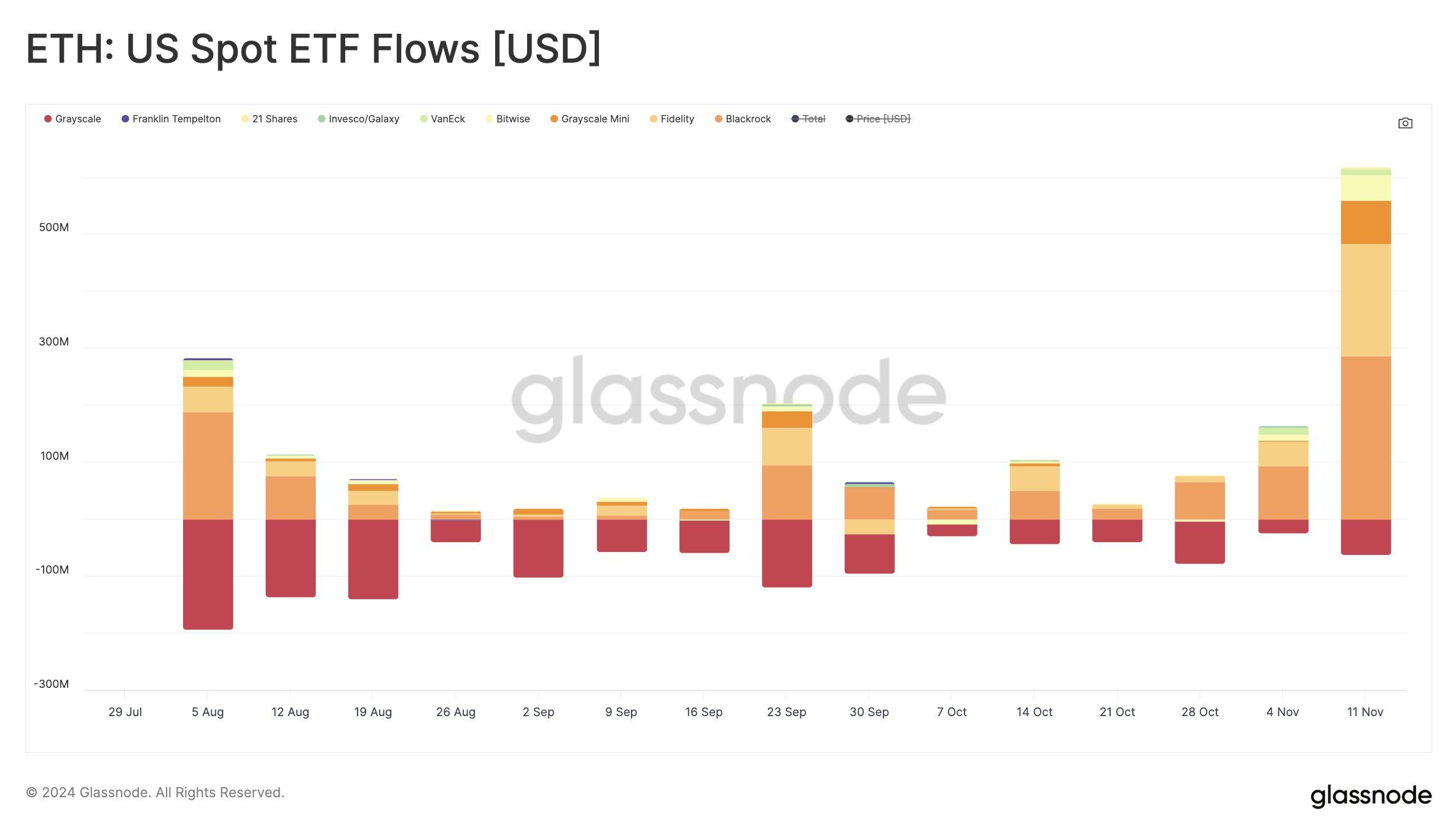

Over the past week, Ethereum ETFs experienced their largest weekly inflows since launch. BlackRock led the surge with a staggering $286 million, while the combined inflows across all ETFs reached $550 million. This influx reflects growing institutional confidence, driven by Ethereum’s price recovery and Bitcoin’s recent all-time highs.

The surge in ETF activity highlights institutional investors’ increasing reliance on Ethereum as a diversified asset. This trend is strengthening Ethereum’s position in the crypto market, potentially providing the momentum needed to overcome its recent price stagnation. Market sentiment appears to be favoring a bullish outlook.

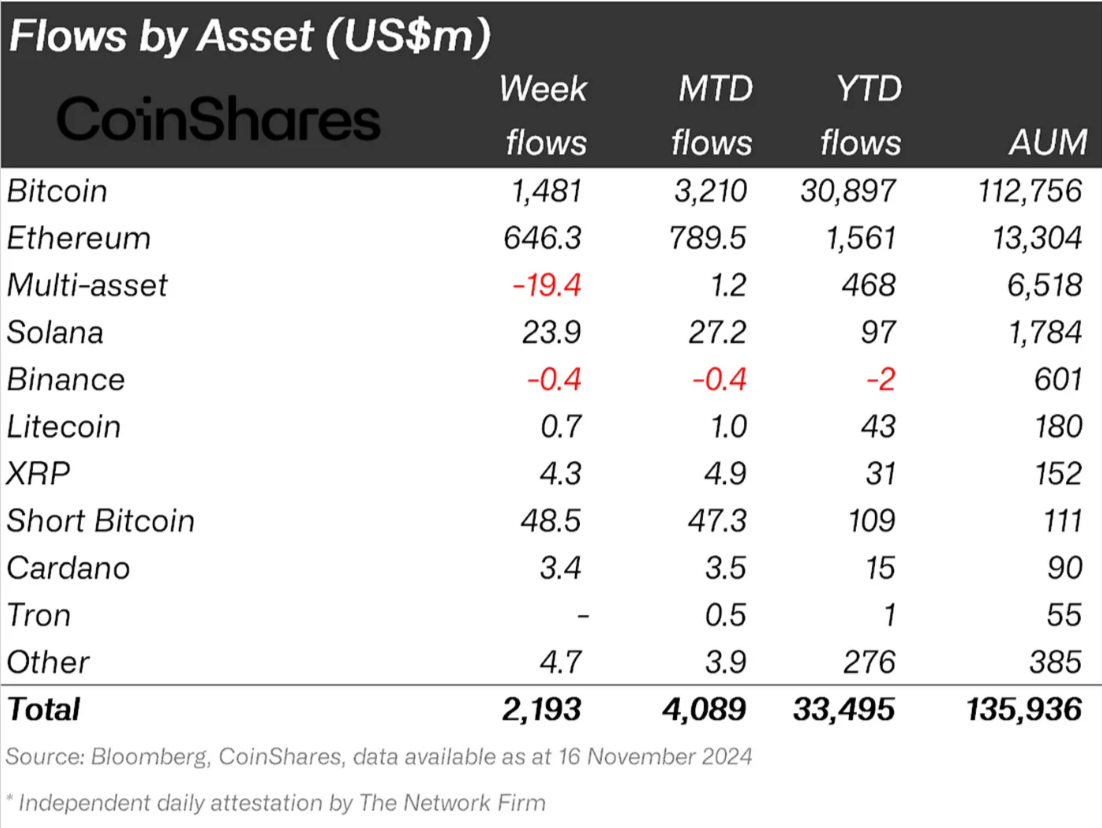

Ethereum’s institutional demand extends beyond ETFs. According to the latest CoinShares ETP netflow report, November has already seen $789 million in Ethereum inflows from institutions. These large-scale investments reflect renewed interest in Ethereum as a long-term asset.

Additionally, large wallet holders are showing heightened activity, further validating Ethereum’s strong macro momentum. Their investments could be pivotal in driving ETH’s price upward, especially as institutions amplify their exposure to the cryptocurrency. This level of interest highlights Ethereum’s growing role as a key player in institutional portfolios.

ETH Price Prediction: Looking Forward

Ethereum is currently trading at $3,108, holding steadily above its critical support at $3,001. This level aligns with the 61.8% Fibonacci Retracement line, known as the bull market support floor, providing a stable foundation for potential gains.

Should institutional activity and positive market sentiment persist, Ethereum could breach the $3,248 resistance, enabling a continued uptrend. This move would position the altcoin king for further growth, solidifying its bullish trajectory.

decline would invalidate the bullish outlook, potentially dampening investor confidence. Ethereum’s ability to maintain momentum hinges on sustaining key support levels and capitalizing on its institutional backing.