This 20% rise has sparked optimism among investors, but there remains some uncertainty over whether the uptrend will continue without a reversal.

Ethereum Whales Make a Comeback

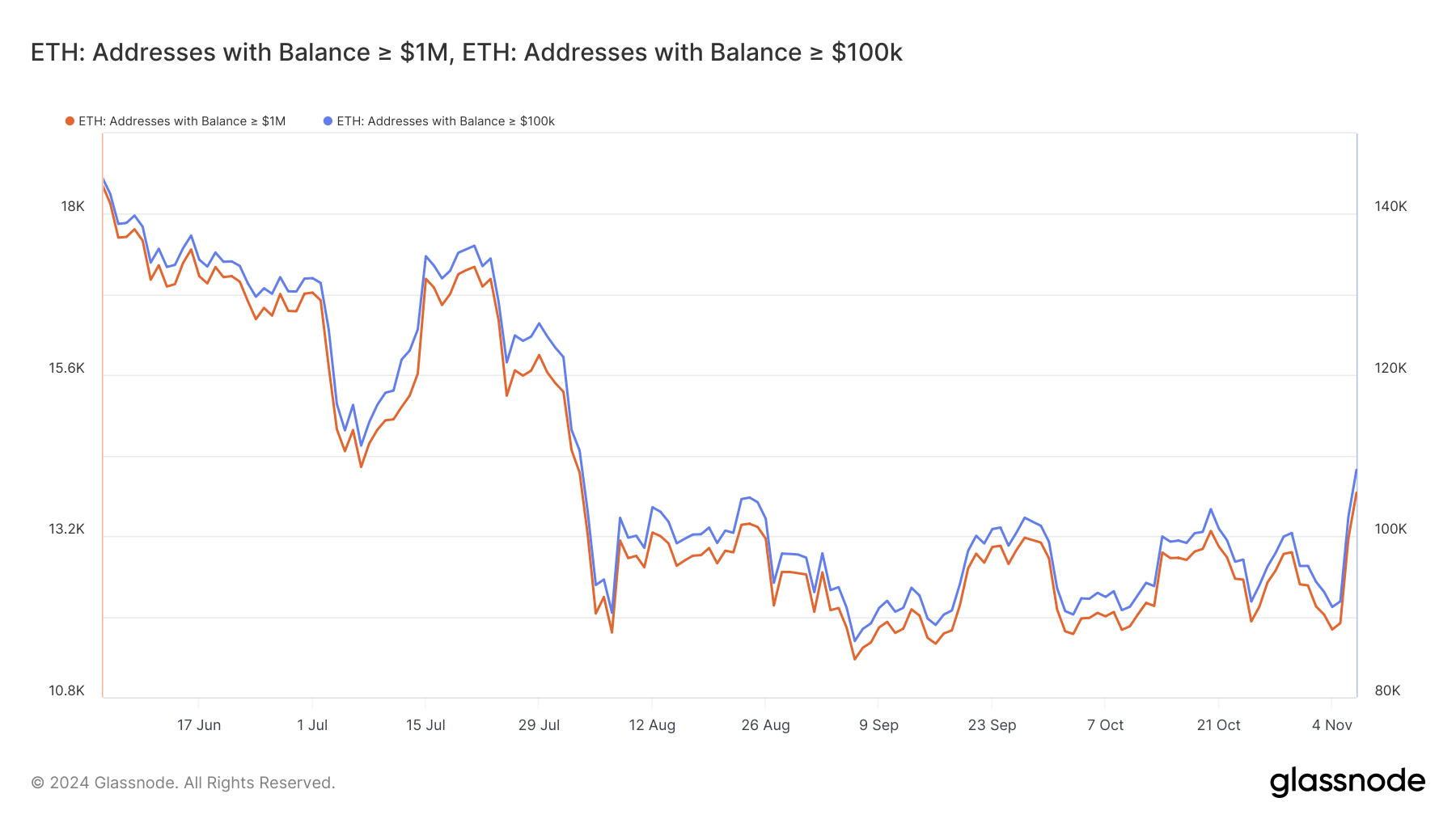

Ethereum whale activity has increased significantly, showing a resurgence of confidence among large holders. The number of addresses holding over $100,000 worth of ETH has grown by 17%, while those holding over $1 million have risen by 19%. These substantial accumulations by high-value addresses reflect growing confidence in Ethereum’s future price performance, with whales likely anticipating further gains.

Such increased whale participation is often a bullish signal, as large investors are typically seen as market stabilizers, reducing volatility by holding their assets long-term. As these significant holders consolidate their positions, Ethereum’s price stability may improve, adding resilience to the recent rally.

Ethereum’s overall momentum is reaching a crucial point, with technical indicators suggesting a potential reversal. The Relative Strength Index (RSI), a key gauge of overbought or oversold conditions, is close to entering the overbought zone.

Historically, Ethereum has experienced price reversals after brief spikes into this territory, although it has occasionally sustained prolonged stays without immediate pullbacks. Given current market conditions, a breach of the overbought zone on the RSI could lead to a price correction for Ethereum.

ETH Price Prediction: Securing Supports

Ethereum’s price has surged by 20% over the past three days, currently trading at $3,042. The cryptocurrency is attempting to establish the 61.8% Fibonacci Retracement level at $3,001 as support. Holding this support level would strengthen ETH’s upward momentum, potentially preventing a reversal.

If Ethereum can secure $3,001 as a support floor, a rise to $3,300 and beyond may be possible. This level, often seen as a bull market support, could provide the foundation needed for ETH’s price recovery. Successfully maintaining this position would enhance investor confidence and signal further bullish prospects.

However, failure to close above $3,001 could open the door for a potential pullback. Coupled with profit-taking among short-term holders, Ethereum’s price might decline to $2,828. Such a drop would invalidate the bullish thesis and indicate a potential shift toward short-term bearish sentiment among investors.