The Ethereum Foundation announced a plan to sell 10,000 ETH to fund research and development. This decision has sparked debate over its potential impact on the market.

However, compared to the massive buying power from institutions and treasury companies in recent times, this sale appears to be just a “small ripple” in the flow of liquidity. The focus now lies in the $4,200–$4,500 price range, determining whether ETH continues to break new highs or enters a short-term correction.

Will DATCo Demand Absorb the Selling Pressure?

The Ethereum Foundation (EF) confirmed that “within the next few weeks of this month,” it will convert 10,000 ETH through centralized exchanges (CEX). The current ETH price of around $4,341 would equal nearly $44 million. The proceeds will fund research and development, grants, and charitable activities.

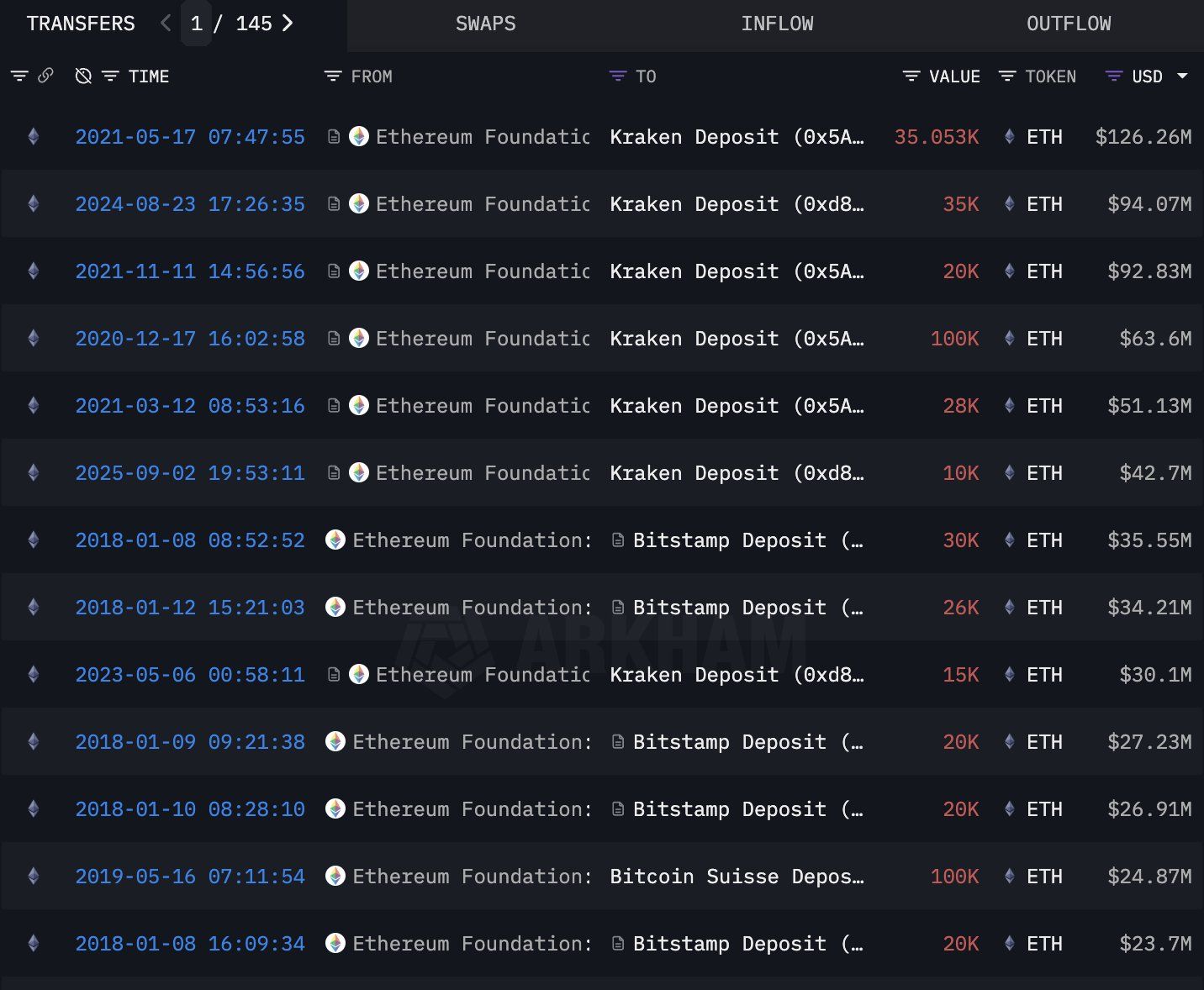

This move was made public, following previous ETH sales by EF. According to statistics from observers, EF-tagged wallets have deposited roughly $2.78 billion to CEX over the past 10 years.

One user on X also pointed out that EF sold nearly $100 million worth of assets in recent months. In the past, EF was criticized for sharing bullish messages with the community while quietly selling ETH. However, the community appreciates the transparency this time, as another X comment said, “Fortunately, they’re being honest about it this time.”

By announcing early, the “information shock” is somewhat reduced, limiting negative psychological impacts on the market. This suggests that EF’s selling activity is cyclical to fund the ecosystem rather than speculative dumping.

Even so, the community remains concerned that EF’s selling could create supply pressure, leading to price declines. Recent inflow data, fortunately, shows strong demand: 403,800 ETH was absorbed within one week. Therefore, EF’s 10,000 ETH sale looks insignificant in the bigger picture.

At the same time, the wave of ETH accumulation by DATCOs further supports this perspective. Deals from SharpLink, BitMine, and others indicate that structural demand is large enough to offset EF’s periodic sales. If this trend continues, the selling pressure from 10,000 ETH will likely be just short-term noise in an expanding liquidity landscape.

“For comparison, a single $ETH treasury company bought more $ETH in the past 3 months (90 days) than what the Ethereum Foundation has sold in the last 10 years,” an X user remarked.

Technical Outlook

From a technical perspective, the $4,200 zone has already been “swept for liquidity” and showed a rebound. Meanwhile, the $4,500 level is a crucial resistance that needs to be reclaimed to extend the bullish trend, with targets at $4,650 and $4,800.

On the broader timeframe, analyst Benjamin suggested that Ethereum may correct to the 21-week EMA before rallying to new all-time highs—a pattern often seen in strong bullish cycles. “I think Ethereum will drop to its 21W EMA within the next 4-6 weeks (regardless of what Bitcoin does). After Ethereum hits the 21W EMA, it should then rally to new All Time Highs,” Benjamin noted.

The fact that ETH touched or approached its ATH in late August makes this technical “breathing room” seem reasonable. Thus, the short-term downside risk remains real if the $4,200 level is lost. However, the medium-term outlook remains positive as long as the higher-highs and higher-lows structure is intact and institutional liquidity continues to provide support.