The Ethereum (ETH) price is consolidating inside a neutral pattern. A breakout from it is the most likely outlook for the next few weeks.

ETH is the native token of the Ethereum network, created by Vitalik Buterin. It specializes in smart contracts. In Jan., the token saw a considerable drop in its total supply. For the month, there was a net decrease of 10,145.72 ETH. This marks a continuation of the trend that has been ongoing since the merge. If the current rate of decline holds, the ETH token will post a -0.012% annual inflation.

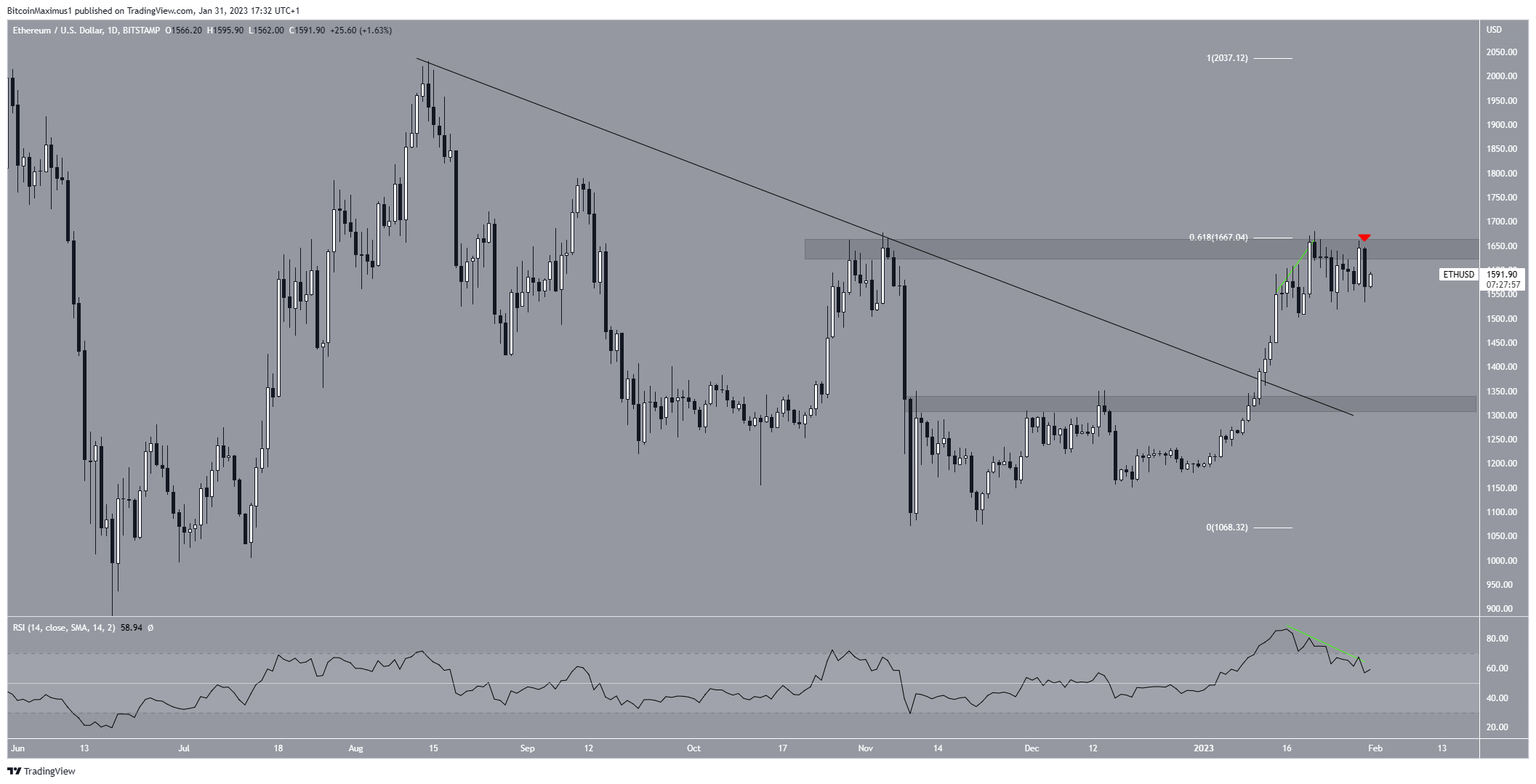

Ethereum Price Fails to Move Above Resistance

The Ethereum price has been on an upward movement since the beginning of the year. Throughout this increase, it broke out from both a descending resistance line and the $1,350 resistance area. Afterward, ETH reached a high $1,680 on Jan. 21.

However, the price failed to break out and instead was rejected by the confluence of resistances at an average price of $1,660, created by the 0.618 Fib retracement resistance level and a horizontal resistance area. Moreover, the rejection caused a bearish divergence in the daily RSI and formed a bearish engulfing candlestick on Jan. 31.

These signs indicate that the decrease is likely to continue. In this case, the $1,350 area could provide support.

On the other hand, a daily close above $1,660 would negate this bearish ETH forecast. Then, the ETH price could increase toward $2,000.

ETH Price Prediction for February: Consolidation Before Breakout

A closer look at the short-term six-hour time frame suggests that the ETH price will break out after completing its consolidation pattern.

The ETH price seems to be in wave four of a five-wave upward movement (black). The sub-wave count is given in red, showing that wave three extended.

There are two possibilities for the rest of wave four. The most likely one is that the ETH price will consolidate inside a symmetrical triangle in the next 24 hours before breaking out. Afterward, the main target would be at $1,810, created by the 2.61 extension of wave one (white).

The second possibility would be slightly more bearish. However, it still indicates that the ETH price will eventually increase toward $1,810. In it, the ETH price will fall toward the 0.382 Fib retracement support level at $1,677 before completing its increase. This would confirm a fourth-wave pullback.

If the ETH price were to decrease below the wave one high at $1,244 (red line) would completely invalidate this count. The price of ETH would be expected to fall below $1,200.

To conclude, the Ethereum price prediction for Feb. is bullish. The crypto asset is expected to consolidate in its short-term pattern before reaching at least $1,800. A decrease below $1,244 would invalidate this bullish Ethereum price forecast and likely send the price tumbling below $1,000.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.