Ethereum (ETH) is likely to end December in the red, marking a fourth consecutive monthly decline. This scenario could pressure large investors who accumulated ETH throughout the year.

If ETH continues to fall, these holders must choose between exiting at breakeven or accepting losses.

How Are Ethereum Whales Caught Between Breakeven and Losses in December?

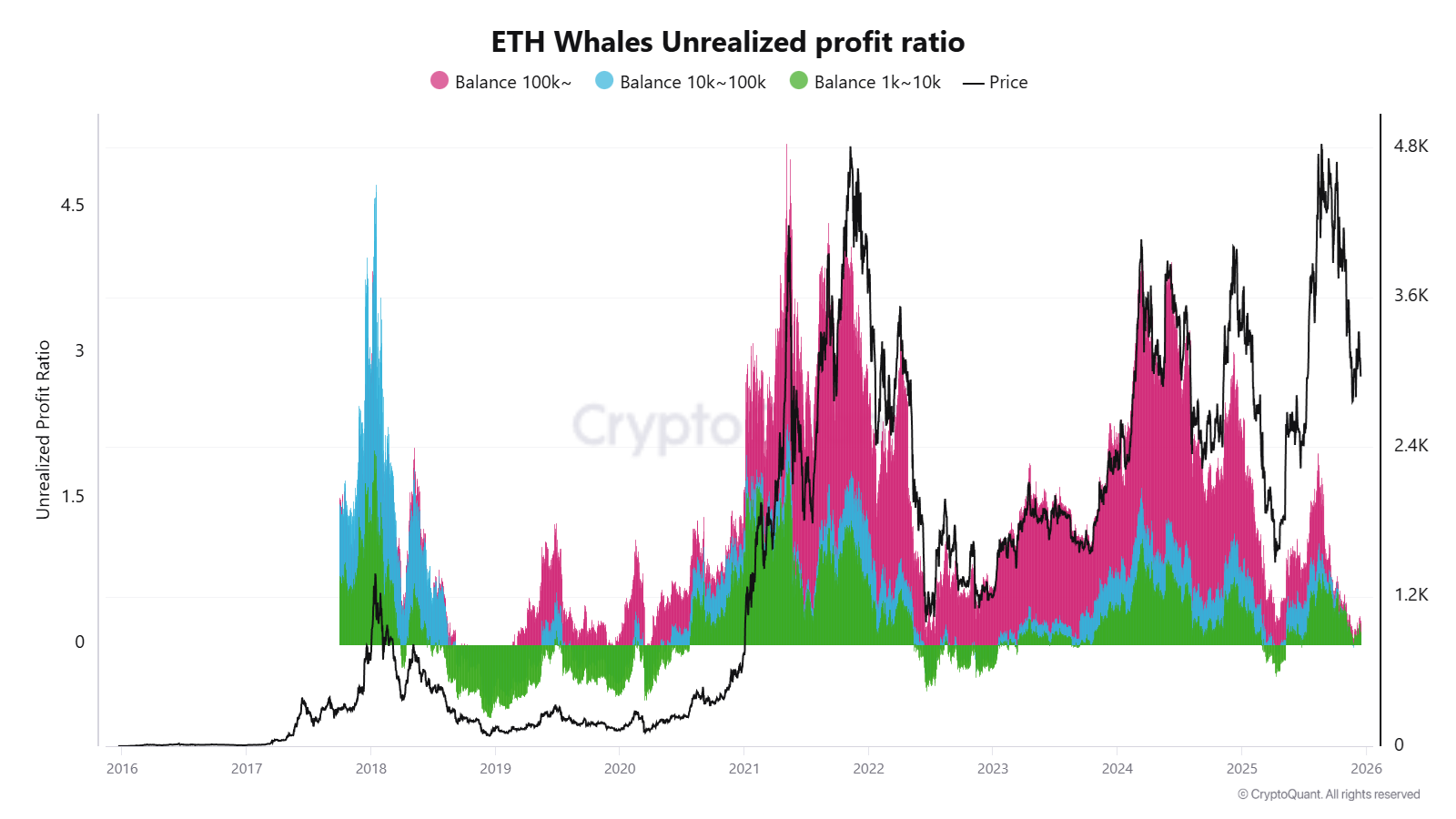

Data from the ETH Whale Unrealized Profit Ratio, which tracks addresses holding between 1,000 and over 100,000 ETH, shows a steady decline over the past four months.

The ratio has approached zero. This indicates that large ETH investors now have an average cost near the current market price, leaving little to no unrealized profit.

From a positive perspective, the buying behavior of this group has a strong influence on market trends. It reinforces confidence that current prices represent an opportunity. Continued accumulation at these levels suggests a potential bottom zone for ETH accumulation.

“They did not take profits in this cycle, and they are further increasing their holdings. This means the current price range represents an opportunity to buy ETH at the lowest possible price,” CryptoQuant analyst CW8900 commented.

However, a bearish perspective raises a critical question. What happens if the market continues the four-month downtrend? In that case, whale investors would face actual losses. Two factors suggest this scenario remains plausible.

Two Factors Are Driving ETH Whales to Take Action in December.

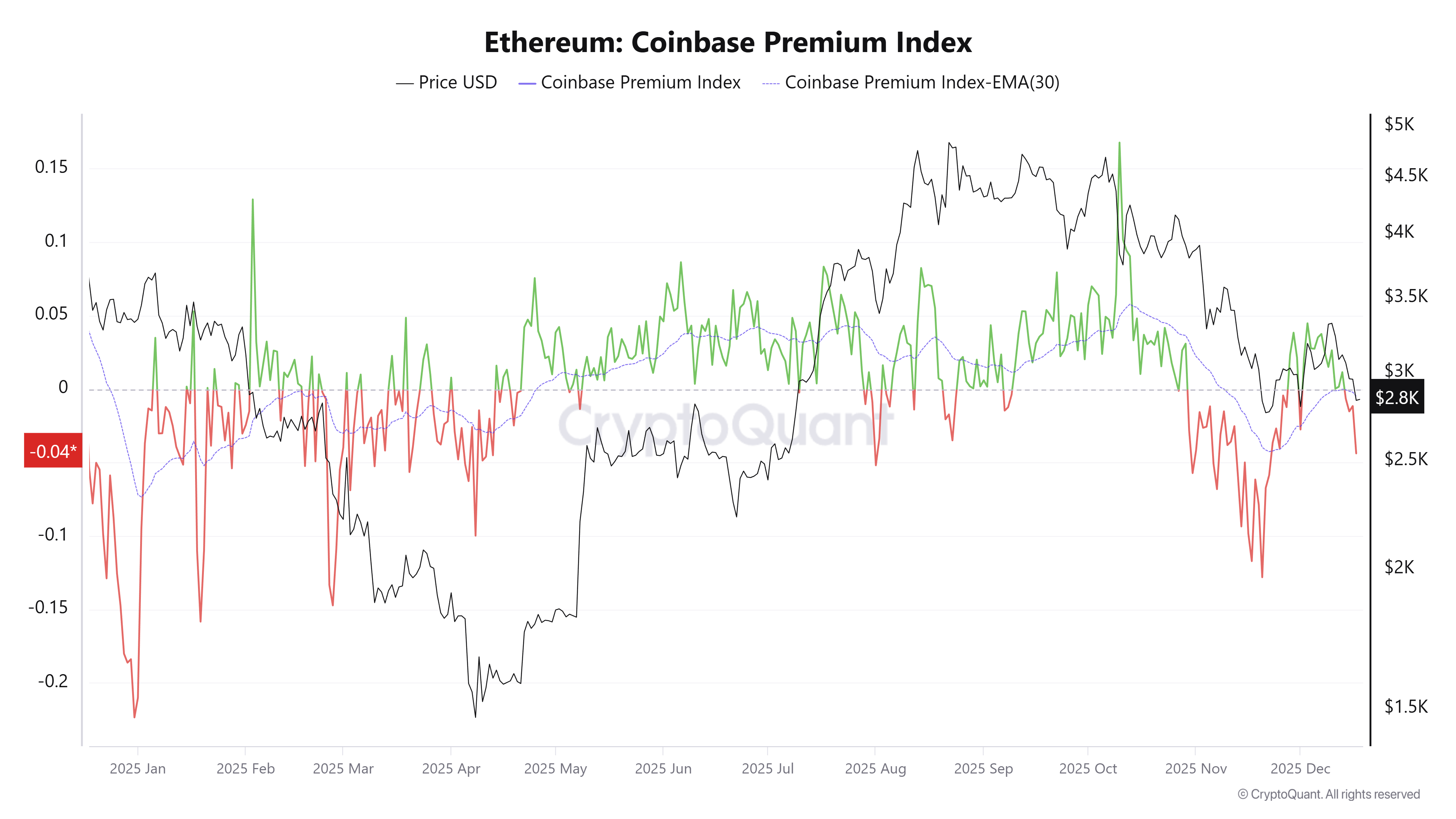

First, the Ethereum Coinbase Premium Index turned negative in the third week of December.

This indicator measures the percentage difference between ETH prices on Coinbase Pro (USD pair) and Binance (USDT pair). A negative value shows that prices on Coinbase are lower, reflecting selling pressure from US investors.

After filtering out noise using the 30-day EMA, the index has stayed negative for more than a month. If selling pressure from Coinbase intensifies, ETH prices could decline further in the coming days.

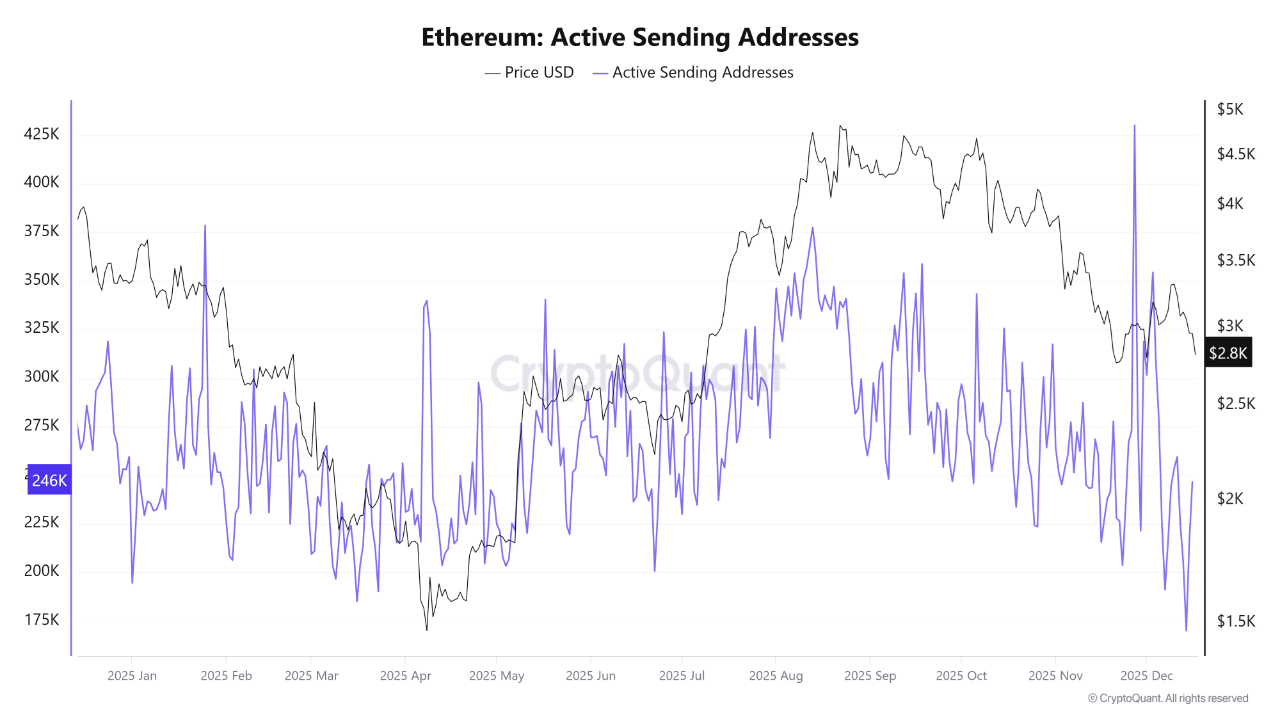

The second factor comes from declining retail interest. On-chain activity for ETH reached its lowest level of the year in December.

The ETH Active Sending Addresses chart shows a clear downtrend. Network activity has cooled significantly. Without retail buying pressure, ETH struggles to align with institutional demand to drive a breakout.

“The lack of retail participation can cap short-term upside, as retail flow typically drives momentum during early rebounds,” CryptoOnchain commented.

Additionally, the realized price for ETH accumulation addresses serves as a key support line at around $3,000. ETH currently trades near $2,800 and appears to be on the verge of breaking below this support level.

These factors put whales in a position where action may be required. Selling to recover capital or limit losses could intensify downside pressure. Such moves could even trigger panic selling on an institutional scale.

Despite these risks, a recent Bitwise report maintains an optimistic outlook for 2026. The report suggests ETH prices could reach new all-time highs sooner than expected.