The cryptocurrency market fell nearly 4% Monday, intensifying concerns over a surge in Ethereum (ETH) unstaking. On-chain data shows 1.18 million ETH are queued for withdrawal, the largest backlog in months.

The delays highlight pressure on the Ethereum network. Normally, unstaking takes three to five days. Current applicants face up to 40 days.

ETH Unstaking Surge ≠ Selling Pressure

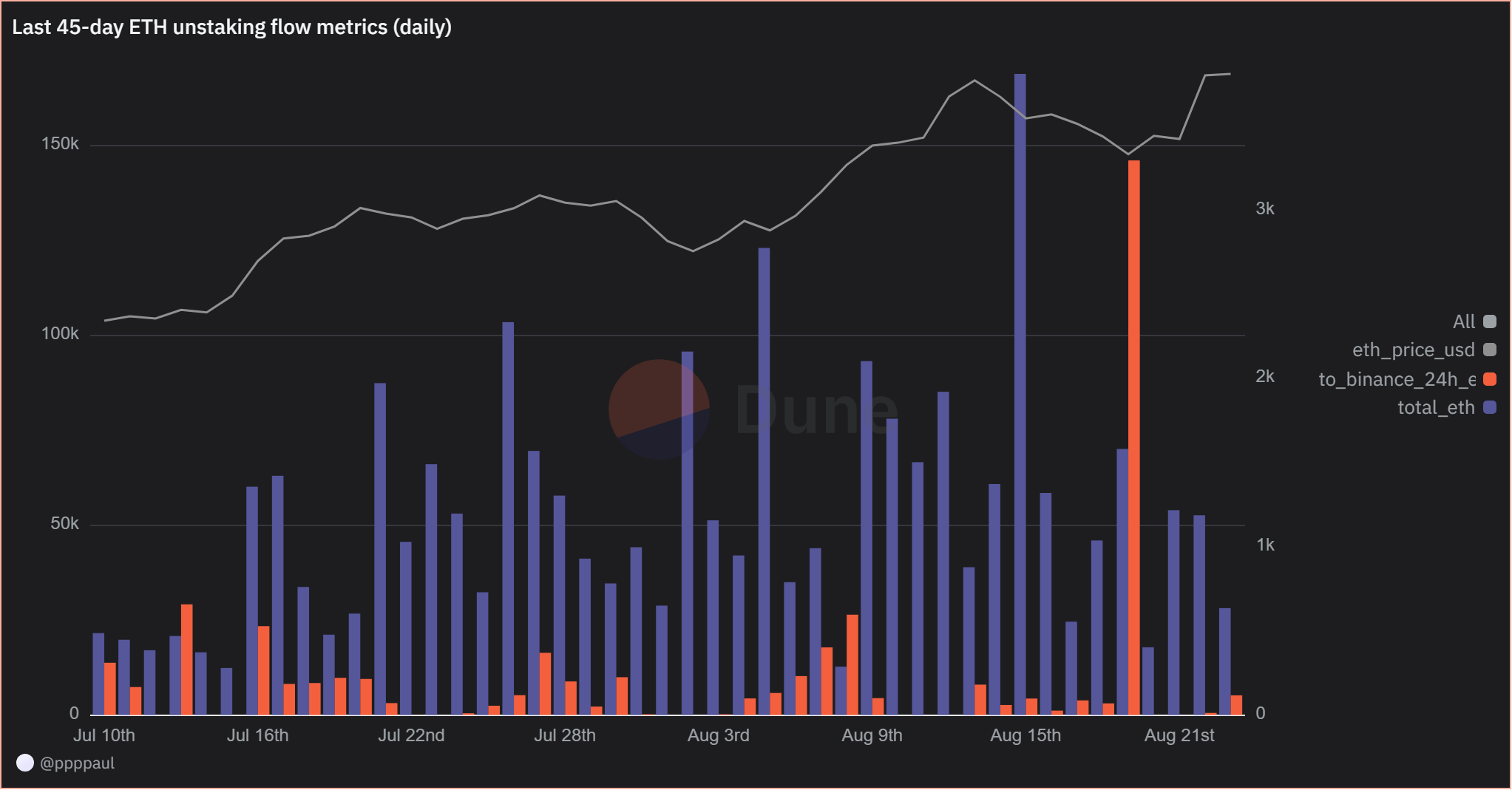

Unstaking does not automatically mean selling. Many holders may keep their ETH, waiting for higher prices or DeFi opportunities. Data from Dune Analytics indicates no strong link between unstaking volume and ETH price over the past 45 days.

However, when withdrawn, ETH moves to exchanges, and price drops often follow.

On August 19, large inflows to Binance coincided with a 5% ETH decline. That same day, the Nasdaq fell 1.46% on fears of delayed Federal Reserve rate cuts.

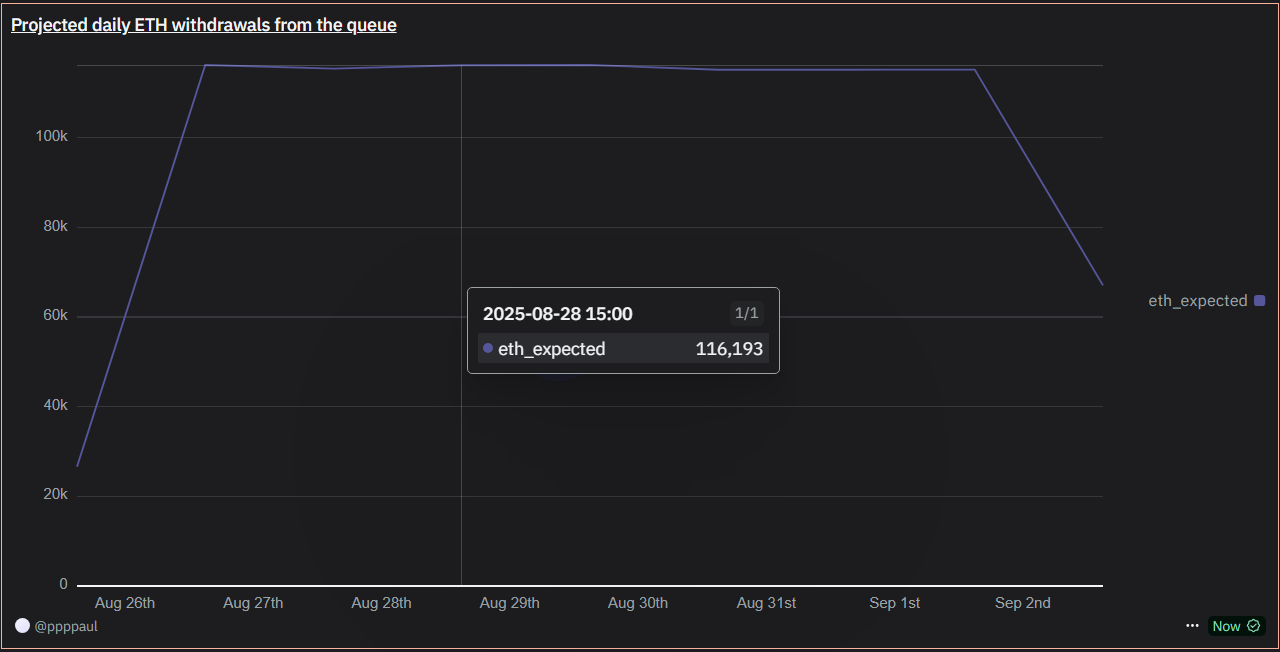

According to on-chain data, roughly 115,000 ETH will exit staking daily this week. At current prices, it is nearly $4,600, which equals $529 million in circulation each day.

The volume adds uncertainty as markets remain sensitive to macroeconomic shifts. A mix of heavy unstaking and negative news could drive sharp price swings.

. Source: Dune Analytics]

Several market voices argue that the fears are overstated. Some investors compared the situation to Solana, which faced similar fears after FTX-related unstaking.

Meanwhile, CryptoQuant data highlighted that ETH supply on centralized exchanges has fallen to record lows. Only 18.3 million ETH remain, reducing immediate sell pressure.

Unstaking flows remain large, but the impact depends on exchange transfers and broader economic conditions. Analysts caution that ETH withdrawals alone are unlikely to trigger sustained sell-offs without external market shocks.

Overall, the record Ethereum unstaking backlog underscores growing investor activity, but its market impact remains uncertain.

While billions in ETH are set for release, exchange flows and global economic trends will ultimately determine whether the surge translates into selling pressure or simply reflects a maturing network.