Elon Musk is leading a consortium to take control of OpenAI, offering $97.4 billion to acquire the nonprofit overseeing the AI firm.

The bid aims to prevent OpenAI’s transition into a for-profit entity. Beyond sparking widespread debate, it has triggered a sharp rally in AI-related cryptocurrencies and AI-powered projects.

Musk’s Bold Move to Regain Control

Musk co-founded OpenAI in 2015 but left before it rose to prominence. However, he has long expressed dissatisfaction with the company’s evolution, criticizing its shift toward a for-profit structure. According to Elon Musk, OpenAI has deviated from its original mission of open-source AI development.

“It’s time for OpenAI to return to the open-source, safety-focused force for good it once was. We will make sure that happens,” The Information reported, citing Musk.

With this, Musk is leading a consortium to buy OpenAI for $97.4 billion. The bid is backed by Musk’s AI startup, xAI, Baron Capital Group, Emanuel Capital, and other investors. If successful, xAI could merge with OpenAI, potentially altering the playing field of AI competition.

Nevertheless, OpenAI CEO Sam Altman put out Musk’s offer, responding sarcastically on X. He wrote, “No thank you, but we will buy Twitter for $9.74 billion if you want.” The remark reflects the strained relationship between Altman and Musk.

AI Cryptos and Agents Surge in Response

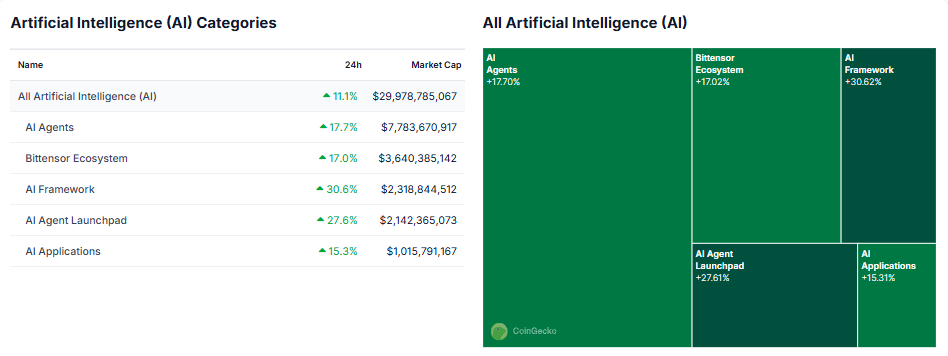

Elon Musk’s OpenAI bid has sparked a surge in AI-related cryptocurrencies, suggesting investors’ bets on the increasing importance of artificial intelligence. The AI coin sector’s market capitalization jumped 11 % to $30 billion. Meanwhile, AI-powered agents saw an even sharper rise of nearly 18%, pushing their total valuation to over $7.8 billion.

Crypto trader and developer Hodler noted the shift in investor sentiment and called for the resumption of the AI narrative.

“AI narrative should come back. In 2025-2026, we will talk a lot about the competition between AI companies and new techs,” Hodler wrote.

Experts have highlighted Bittensor (TAO) among AI sector tokens that are currently on a tear following the dTAO upgrade. With CoinGecko data showing the Bittensor Ecosystem up by 17% to $3.6 billion, one popular analyst on X indicates that TAO is the AI coin to watch.

“TAO is showing impressive strength, poised for a potential trendline breakout on the wedge. With AI coins rebounding, this presents a compelling opportunity for midterm gains. Is TAO leading the charge in a new AI season?” the analyst posed.

Meanwhile, the crypto market is undergoing a broader shift. Investors increasingly move away from meme coins and speculative assets, favoring altcoins with tangible real-world applications. A recent BeInCrypto report highlighted how utility-driven sectors like AI agents are gaining traction among serious investors.

This transition suggests a maturing market where long-term value is prioritized over short-term hype. It reinforces the significance of AI-related cryptocurrencies and blockchain-driven AI solutions.