DWS, an asset management firm owned by Deutsche Bank, is preparing to launch the first euro-denominated stablecoin regulated by Germany’s Federal Financial Supervisory Authority (BaFin).

This initiative marks a significant step for the European financial sector as DWS manages assets worth €941 billion ($1.02 billion) globally.

MiCA Framework Spurs Industry-Wide Compliance Efforts

DWS plans to introduce this stablecoin by 2025 through its newly formed company, AllUnity. This novel entity is a collaboration between DWS, Flow Traders, and Galaxy Digital. However, at the time of publishing, the firm has yet to provide further details regarding this asset.

Read more: Stablecoin Regulations Around the World

Stefan Hoops, CEO of DWS, announced that the stablecoin will cater to digital asset investors and industrial applications. Furthermore, Hoops emphasized the anticipated broad demand for regulated digital currencies.

“In the short term, we expect demand from investors in digital assets, but by the medium term we expect wider demand, for instance from industrial companies working with ‘internet of things’ continuous payments,” Hoops said.

This move aligns with the broader regulatory stage shaped by the Markets in Crypto-Assets (MiCA) framework in Europe. Since its introduction on June 30, the framework has set comprehensive standards for stablecoin issuance, including requirements for whitepaper publication, governance, reserve management, and prudential standards.

Major industry players have made necessary changes to adhere to MiCA regulations. BeInCrypto reported that Circle, the issuer of USDC and EURC stablecoins, secured an Electronic Money Institution (EMI) license on July 1. This license is a requirement for any issuer looking to offer crypto tokens with dollar and euro parity within the EU.

Additionally, prominent crypto exchanges like Binance have delisted non-compliant stablecoins for European customers to ensure compliance with these new rules.

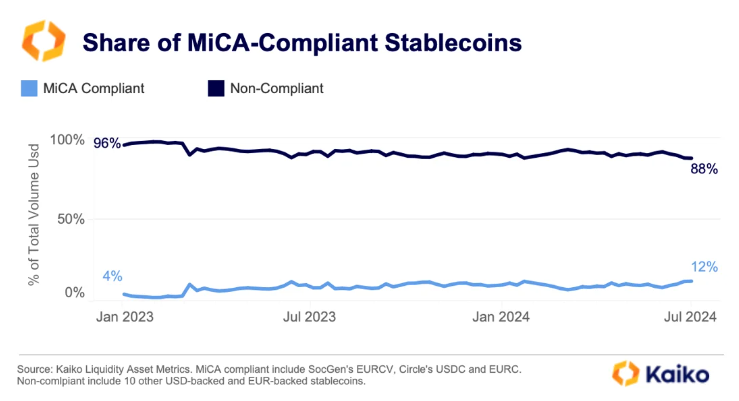

A recent report from Kaiko revealed that the share of compliant stablecoins has increased over the past year. This suggests an increased demand for transparency and regulated alternatives.

Read more: What Is Markets in Crypto-Assets (MiCA)?

Despite this development, the report also shows that non-compliant stablecoins remain dominating the market. This category accounts for 88% of the total stablecoin volume.