Leading meme coin Dogecoin (DOGE) has been on an upward trajectory in recent weeks. Noting a 45% gain over the past 30 days, it’s currently trading at $0.17, its highest level since May.

With bullish momentum building, DOGE is positioning itself to reclaim its year-to-date high of $0.22 before the end of 2024. This analysis explores key factors that could make this target a reality.

Dogecoin Whales and Short-Term Holders Boost Price

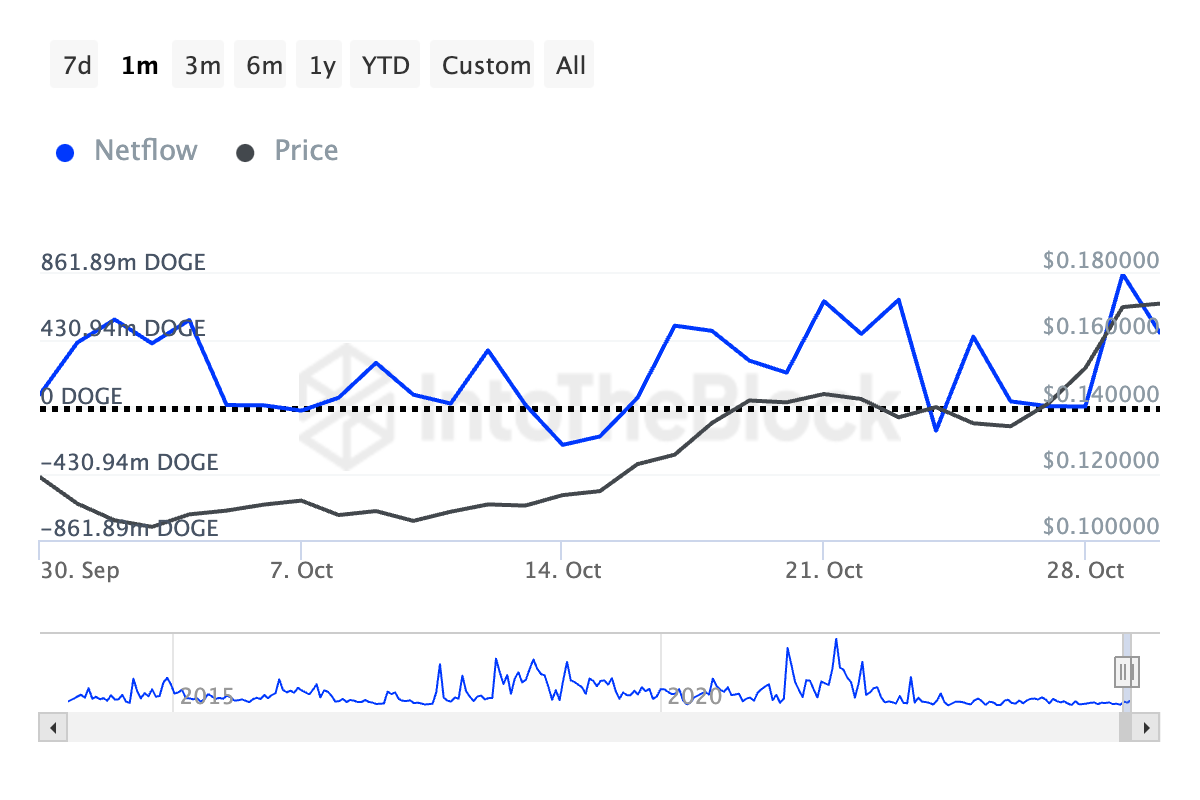

Dogecoin whale activity has increased over the past month, as reflected in its rising large holders’ netflow. IntoTheBlock’s data shows this has climbed by 15% in the past 30 days.

Large holders, defined as addresses holding over 0.1% of an asset’s circulating supply, play a pivotal role in market trends. Their “netflow” is calculated by subtracting the total amount of cryptocurrency sold from the amount purchased within a specific period, reflecting the net change in their holdings.

An increase in large holders’ netflow indicates accumulation by whales, often seen as a bullish sign and a signal of growing confidence in the asset’s future value. Additionally, retail investors tend to view heightened activity by institutional or large investors as a positive indicator, reinforcing their own confidence and driving buying interest.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

In addition to Dogecoin whale activity, short-term holders’ (STHs) behavior has been key in fueling DOGE’s recent rally. According to data from IntoTheBlock, Dogecoin’s STHs—those holding their coins for less than 30 days — have increased their average holding period by 39% over the past month.

Typically, an increase in holding time signals that these investors are choosing to hold their assets for extended periods.

This trend is bullish for Dogecoin, as STHs frequently account for a sizable portion of the asset’s circulating supply. Therefore, when these holders opt to hold onto their positions, overall selling pressure in the market is reduced.

DOGE Price Prediction: This Support Level Is Key

At press time, DOGE is trading at $0.17, aiming to establish this level as support. Sustained buying pressure could secure this position, setting the stage for the coin to test the critical resistance at $0.19. Successfully breaching this resistance would pave the way for DOGE to reclaim its year-to-date high of $0.22, last seen in March.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

However, if selling pressure increases, preventing DOGE from holding the $0.17 support level, it may trigger a downward trend. In this scenario, DOGE could seek support around $0.13, a 20% decline from its current price.